Intro

Discover 5 Navy Federal Credit Options, including personal loans, credit cards, and lines of credit, with competitive rates and flexible terms, ideal for military personnel and their families, offering financial freedom and security.

The world of credit options can be overwhelming, especially for those who are new to managing their finances. With so many choices available, it's essential to find a credit option that meets your needs and helps you achieve your financial goals. For members of the Navy Federal Credit Union, there are several credit options to choose from, each with its own set of benefits and features. In this article, we'll explore five Navy Federal credit options that can help you manage your finances effectively.

When it comes to managing your finances, having access to the right credit options can make all the difference. Whether you're looking to build credit, consolidate debt, or simply have a safety net for unexpected expenses, Navy Federal Credit Union has a range of options to suit your needs. From credit cards to personal loans, we'll delve into the details of each option and explore how they can help you achieve financial stability.

With so many credit options available, it's crucial to understand the terms and conditions of each one. This includes interest rates, fees, and repayment terms, among other factors. By taking the time to research and compare different credit options, you can make informed decisions about your finances and avoid costly mistakes. In the following sections, we'll take a closer look at five Navy Federal credit options and explore their benefits, features, and requirements.

Navy Federal Credit Options Overview

Navy Federal Credit Union offers a range of credit options to its members, including credit cards, personal loans, and lines of credit. Each option has its own set of benefits and features, and some may be more suitable for your needs than others. By understanding the different credit options available, you can make informed decisions about your finances and choose the option that best meets your needs.

Credit Card Options

Navy Federal Credit Union offers a range of credit card options, each with its own set of benefits and features. Some popular options include the Navy Federal Credit Union Visa Signature Card, the Navy Federal Credit Union CashRewards Card, and the Navy Federal Credit Union Platinum Card. These cards offer benefits such as cashback rewards, travel insurance, and purchase protection, among others.

Benefits of Navy Federal Credit Cards

Some of the benefits of Navy Federal credit cards include:

- Competitive interest rates

- No foreign transaction fees

- Cashback rewards and other incentives

- Travel insurance and purchase protection

- 24/7 customer service

Personal Loan Options

Navy Federal Credit Union also offers personal loan options to its members. These loans can be used for a variety of purposes, such as consolidating debt, financing a large purchase, or covering unexpected expenses. Personal loans from Navy Federal Credit Union offer competitive interest rates and flexible repayment terms, making them a popular choice for members.

Benefits of Navy Federal Personal Loans

Some of the benefits of Navy Federal personal loans include:

- Competitive interest rates

- Flexible repayment terms

- No prepayment penalties

- Fast and easy application process

- 24/7 customer service

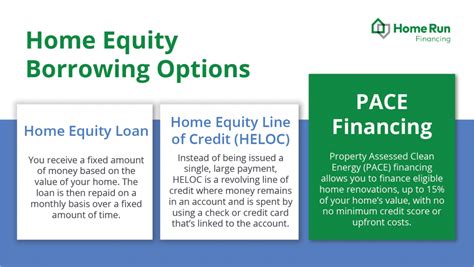

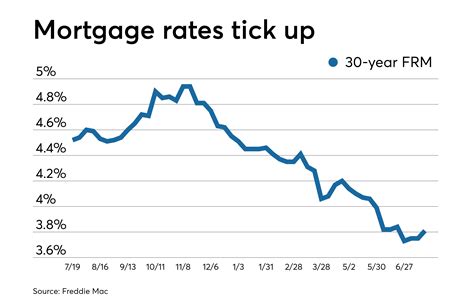

Home Equity Loan Options

For members who own a home, Navy Federal Credit Union offers home equity loan options. These loans allow members to borrow against the equity in their home, using the funds for a variety of purposes such as home improvements, debt consolidation, or financing a large purchase. Home equity loans from Navy Federal Credit Union offer competitive interest rates and flexible repayment terms, making them a popular choice for members.

Benefits of Navy Federal Home Equity Loans

Some of the benefits of Navy Federal home equity loans include:

- Competitive interest rates

- Flexible repayment terms

- No prepayment penalties

- Fast and easy application process

- 24/7 customer service

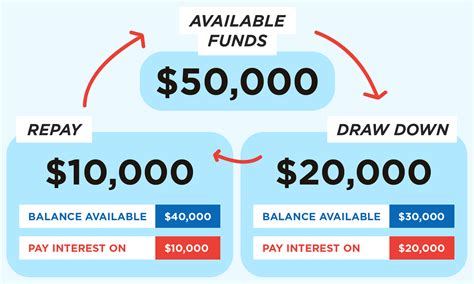

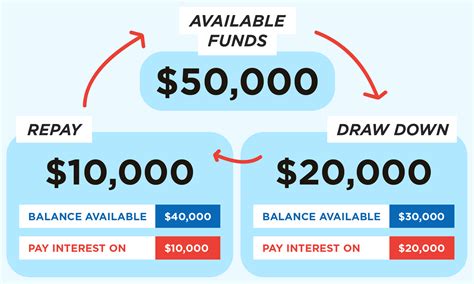

Line of Credit Options

Navy Federal Credit Union also offers line of credit options to its members. These lines of credit allow members to borrow funds as needed, using the funds for a variety of purposes such as consolidating debt, financing a large purchase, or covering unexpected expenses. Lines of credit from Navy Federal Credit Union offer competitive interest rates and flexible repayment terms, making them a popular choice for members.

Benefits of Navy Federal Lines of Credit

Some of the benefits of Navy Federal lines of credit include:

- Competitive interest rates

- Flexible repayment terms

- No prepayment penalties

- Fast and easy application process

- 24/7 customer service

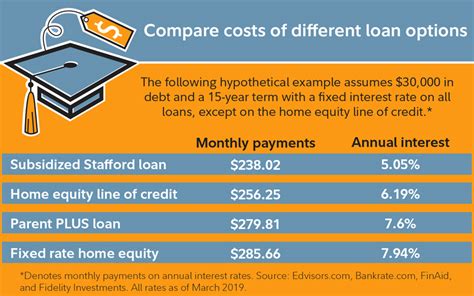

Student Loan Options

For members who are pursuing higher education, Navy Federal Credit Union offers student loan options. These loans can be used to cover the cost of tuition, fees, and other expenses related to education. Student loans from Navy Federal Credit Union offer competitive interest rates and flexible repayment terms, making them a popular choice for members.

Benefits of Navy Federal Student Loans

Some of the benefits of Navy Federal student loans include:

- Competitive interest rates

- Flexible repayment terms

- No prepayment penalties

- Fast and easy application process

- 24/7 customer service

Navy Federal Credit Options Image Gallery

What are the benefits of Navy Federal credit cards?

+The benefits of Navy Federal credit cards include competitive interest rates, no foreign transaction fees, cashback rewards, and travel insurance, among others.

How do I apply for a Navy Federal personal loan?

+To apply for a Navy Federal personal loan, you can visit the Navy Federal Credit Union website, call their customer service number, or visit a branch in person.

What are the requirements for a Navy Federal home equity loan?

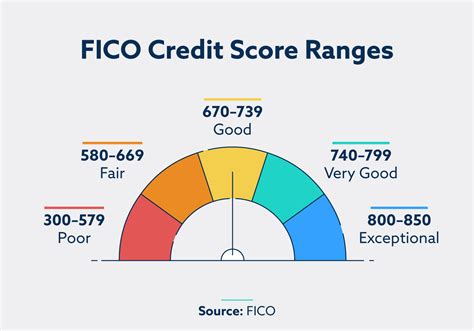

+The requirements for a Navy Federal home equity loan include being a member of the credit union, having a good credit score, and having sufficient equity in your home.

In conclusion, Navy Federal Credit Union offers a range of credit options to its members, each with its own set of benefits and features. By understanding the different credit options available, you can make informed decisions about your finances and choose the option that best meets your needs. Whether you're looking to build credit, consolidate debt, or simply have a safety net for unexpected expenses, Navy Federal Credit Union has a credit option that can help. We encourage you to share your thoughts and experiences with Navy Federal credit options in the comments below, and don't forget to share this article with anyone who may be interested in learning more about these credit options.