Intro

Discover 5 ways Navy Federal motorcycle loan offers flexible financing, low rates, and exclusive benefits for bike enthusiasts, including new and used purchases, refinancing, and more with motorcycle insurance and warranty options.

Navy Federal Credit Union is a well-established financial institution that offers a wide range of loan products, including motorcycle loans. If you're in the market for a new motorcycle, you may be considering financing options. Here are five ways that Navy Federal motorcycle loans can benefit you:

When it comes to financing a motorcycle, it's essential to find a lender that offers competitive rates and flexible terms. Navy Federal Credit Union is a popular choice among motorcycle enthusiasts due to its reputation for providing excellent customer service and competitive loan rates. With a Navy Federal motorcycle loan, you can enjoy low monthly payments, flexible repayment terms, and a range of benefits that can help you get on the road quickly and easily.

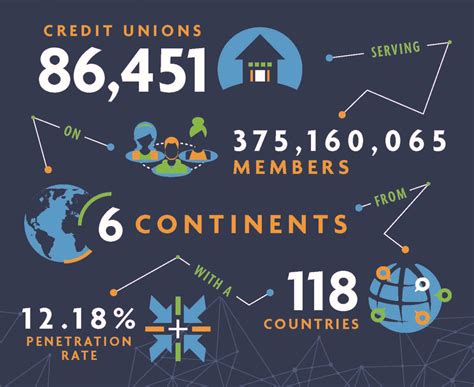

Navy Federal Credit Union has been serving its members for over 80 years, providing a range of financial products and services that cater to their unique needs. As a member-owned cooperative, Navy Federal is committed to helping its members achieve their financial goals, whether that's buying a new motorcycle or refinancing an existing loan. With a strong focus on customer service and a reputation for excellence, Navy Federal is an excellent choice for anyone looking for a reliable and trustworthy lender.

Benefits of Navy Federal Motorcycle Loans

Navy Federal motorcycle loans offer a range of benefits that can help you get on the road quickly and easily. Some of the key advantages of these loans include competitive interest rates, flexible repayment terms, and a range of loan options to suit different budgets and needs. With a Navy Federal motorcycle loan, you can enjoy low monthly payments, no origination fees, and a simple application process that can be completed online or in-person.

Competitive Interest Rates

One of the most significant benefits of Navy Federal motorcycle loans is the competitive interest rates. As a member-owned cooperative, Navy Federal is able to offer lower rates than many other lenders, which can help you save money on your loan over time. With rates starting at just 5.5% APR, you can enjoy affordable monthly payments and a lower total cost of ownership.Types of Motorcycle Loans

Navy Federal offers a range of motorcycle loan options to suit different budgets and needs. Some of the most popular types of loans include new motorcycle loans, used motorcycle loans, and refinancing loans. With a new motorcycle loan, you can finance a brand-new bike with a competitive interest rate and flexible repayment terms. Used motorcycle loans are also available, with similar rates and terms to new loans. If you're looking to refinance an existing loan, Navy Federal can help you save money on your monthly payments and reduce your total cost of ownership.

Loan Terms and Conditions

Before applying for a Navy Federal motorcycle loan, it's essential to understand the loan terms and conditions. Some of the key factors to consider include the interest rate, repayment term, and loan amount. Navy Federal offers loan terms ranging from 36 to 72 months, with loan amounts starting at $2,000 and going up to $50,000 or more. The interest rate will depend on your credit score and other factors, but with rates starting at 5.5% APR, you can enjoy affordable monthly payments and a lower total cost of ownership.How to Apply for a Navy Federal Motorcycle Loan

Applying for a Navy Federal motorcycle loan is a simple and straightforward process. You can apply online, in-person, or over the phone, and the application can be completed in just a few minutes. To apply, you'll need to provide some basic information, including your name, address, and employment details. You'll also need to provide information about the motorcycle you're looking to purchase, including the make, model, and year. Once you've submitted your application, Navy Federal will review your credit and provide a decision within a few minutes.

Required Documents

To complete your loan application, you'll need to provide some additional documentation. This may include proof of income, proof of insurance, and a copy of your driver's license. You'll also need to provide information about the motorcycle, including the vehicle identification number (VIN) and a copy of the sales contract. Once you've provided all the required documentation, Navy Federal will finalize your loan and provide you with the funds to purchase your new motorcycle.Navy Federal Motorcycle Loan Calculator

Before applying for a Navy Federal motorcycle loan, it's a good idea to use a loan calculator to determine how much you can afford to borrow. A loan calculator can help you estimate your monthly payments and total cost of ownership, based on the loan amount, interest rate, and repayment term. Navy Federal offers a range of loan calculators on its website, including a motorcycle loan calculator that can help you determine how much you can afford to borrow.

Repayment Options

Navy Federal offers a range of repayment options to suit different budgets and needs. You can choose to repay your loan over a period of 36, 48, or 72 months, with monthly payments that are tailored to your budget. You can also choose to make bi-weekly payments, which can help you pay off your loan faster and reduce your total cost of ownership. With flexible repayment options and competitive interest rates, Navy Federal motorcycle loans can help you get on the road quickly and easily.Navy Federal Credit Union Membership

To apply for a Navy Federal motorcycle loan, you'll need to be a member of the credit union. Membership is open to active and retired members of the military, as well as their families and household members. You can join Navy Federal by visiting its website or visiting a branch in person. Once you've joined, you can apply for a motorcycle loan and enjoy the many benefits of membership, including competitive loan rates, flexible repayment terms, and excellent customer service.

Member Benefits

As a member of Navy Federal Credit Union, you can enjoy a range of benefits that can help you achieve your financial goals. Some of the most significant benefits include competitive loan rates, flexible repayment terms, and excellent customer service. You'll also have access to a range of financial products and services, including checking and savings accounts, credit cards, and investment products. With Navy Federal, you can enjoy the convenience and flexibility of online banking, as well as the support of a dedicated team of financial experts.Motorcycle Loan Image Gallery

What are the benefits of a Navy Federal motorcycle loan?

+Navy Federal motorcycle loans offer competitive interest rates, flexible repayment terms, and a range of loan options to suit different budgets and needs.

How do I apply for a Navy Federal motorcycle loan?

+You can apply for a Navy Federal motorcycle loan online, in-person, or over the phone. You'll need to provide some basic information, including your name, address, and employment details, as well as information about the motorcycle you're looking to purchase.

What are the repayment options for a Navy Federal motorcycle loan?

+Navy Federal offers a range of repayment options to suit different budgets and needs. You can choose to repay your loan over a period of 36, 48, or 72 months, with monthly payments that are tailored to your budget.

Do I need to be a member of Navy Federal Credit Union to apply for a motorcycle loan?

+Yes, you need to be a member of Navy Federal Credit Union to apply for a motorcycle loan. Membership is open to active and retired members of the military, as well as their families and household members.

What are the interest rates for Navy Federal motorcycle loans?

+Navy Federal motorcycle loans offer competitive interest rates starting at 5.5% APR. The interest rate will depend on your credit score and other factors, but with rates starting at 5.5% APR, you can enjoy affordable monthly payments and a lower total cost of ownership.

If you're in the market for a new motorcycle, a Navy Federal motorcycle loan can be an excellent option. With competitive interest rates, flexible repayment terms, and a range of loan options to suit different budgets and needs, Navy Federal can help you get on the road quickly and easily. Whether you're a seasoned motorcycle enthusiast or just starting out, Navy Federal has the expertise and resources to help you achieve your financial goals. So why not apply for a Navy Federal motorcycle loan today and start enjoying the freedom and excitement of motorcycle ownership? Share your thoughts and experiences with Navy Federal motorcycle loans in the comments below, and don't forget to share this article with your friends and family who may be in the market for a new motorcycle.