Intro

Navy Federal faces $95 million fine for violating consumer protection laws, impacting credit union members with unfair banking practices, overdraft fees, and regulatory noncompliance issues.

The financial industry has witnessed numerous regulatory actions in recent years, with institutions facing penalties for non-compliance with various laws and regulations. One such incident involves Navy Federal, a prominent credit union in the United States. The National Credit Union Administration (NCUA) imposed a significant fine on Navy Federal, totaling $95 million, for violating certain regulations. This development has sparked interest among financial experts, consumers, and regulatory bodies, highlighting the importance of adherence to financial laws and regulations.

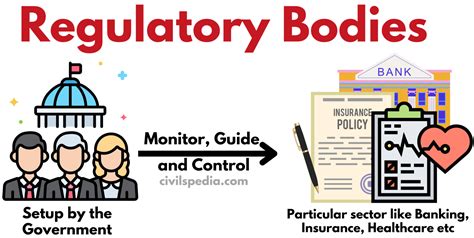

The fine imposed on Navy Federal serves as a reminder of the consequences of non-compliance in the financial sector. Regulatory bodies, such as the NCUA, play a crucial role in ensuring that financial institutions operate within the bounds of the law, protecting consumers and maintaining the stability of the financial system. The $95 million fine is a substantial penalty, demonstrating the severity with which regulatory bodies view violations of financial regulations. This incident underscores the need for financial institutions to prioritize compliance, invest in robust regulatory frameworks, and foster a culture of adherence to laws and regulations.

The Navy Federal fine has significant implications for the financial industry as a whole. It emphasizes the importance of regulatory compliance, highlighting the potential consequences of failing to adhere to laws and regulations. Financial institutions must take proactive steps to ensure compliance, investing in training, technology, and personnel to maintain the highest standards of regulatory adherence. Furthermore, this incident demonstrates the role of regulatory bodies in enforcing compliance, protecting consumers, and maintaining the integrity of the financial system. As the financial industry continues to evolve, the importance of regulatory compliance will only continue to grow, making it essential for institutions to prioritize adherence to laws and regulations.

Background of the Fine

Regulatory Compliance in the Financial Industry

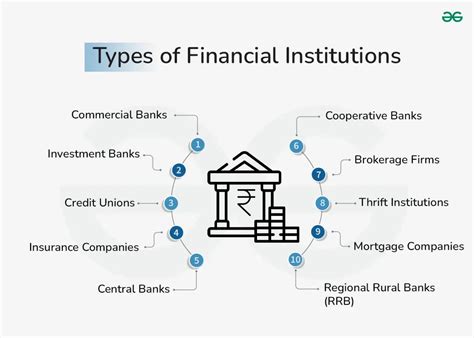

Regulatory compliance is a critical aspect of the financial industry, with institutions facing numerous laws and regulations that govern their operations. The NCUA, the Consumer Financial Protection Bureau (CFPB), and the Federal Reserve are among the regulatory bodies that oversee financial institutions, ensuring compliance with relevant laws and regulations. Financial institutions must invest in robust compliance frameworks, providing training to personnel, implementing effective policies and procedures, and maintaining accurate records to demonstrate compliance. The Navy Federal fine serves as a reminder of the importance of regulatory compliance, highlighting the potential consequences of failing to adhere to laws and regulations.Implications of the Fine

Best Practices for Regulatory Compliance

Financial institutions can take several steps to ensure regulatory compliance, minimizing the risk of fines and penalties. These include: * Investing in robust compliance frameworks, providing training to personnel, and implementing effective policies and procedures * Maintaining accurate records to demonstrate compliance with relevant laws and regulations * Conducting regular audits and risk assessments to identify potential compliance risks * Implementing technology solutions to streamline compliance processes and improve efficiency * Fostering a culture of compliance, emphasizing the importance of adherence to laws and regulations throughout the organizationConsumer Protection

Role of Regulatory Bodies

Regulatory bodies, such as the NCUA, the CFPB, and the Federal Reserve, play a critical role in enforcing compliance and protecting consumers in the financial industry. These bodies oversee financial institutions, ensuring adherence to relevant laws and regulations, and imposing penalties for non-compliance. The Navy Federal fine demonstrates the effectiveness of regulatory bodies in enforcing compliance, highlighting the importance of their role in maintaining the integrity of the financial system. As the financial industry continues to evolve, the role of regulatory bodies will only continue to grow, making it essential for institutions to prioritize adherence to laws and regulations.Future of Regulatory Compliance

Emerging Trends in Regulatory Compliance

Several emerging trends are likely to shape the future of regulatory compliance in the financial industry, including: * Increased use of technology, such as artificial intelligence and machine learning, to streamline compliance processes and improve efficiency * Growing importance of data analytics, enabling financial institutions to identify potential compliance risks and implement effective mitigation strategies * Evolving regulatory requirements, such as the implementation of new laws and regulations, and updates to existing ones * Changing consumer behaviors, such as increased demand for digital banking services, and growing expectations for transparency and fairnessFinancial Regulation Image Gallery

What is the significance of the $95 million fine imposed on Navy Federal?

+The $95 million fine imposed on Navy Federal highlights the importance of regulatory compliance in the financial industry, demonstrating the potential consequences of failing to adhere to laws and regulations.

What are the implications of the fine for the financial industry?

+The fine imposed on Navy Federal emphasizes the importance of regulatory compliance, highlighting the potential consequences of failing to adhere to laws and regulations. It also demonstrates the role of regulatory bodies in enforcing compliance and protecting consumers.

How can financial institutions ensure regulatory compliance?

+Financial institutions can ensure regulatory compliance by investing in robust compliance frameworks, implementing effective policies and procedures, and maintaining accurate records to demonstrate adherence to relevant laws and regulations.

What is the role of regulatory bodies in enforcing compliance?

+Regulatory bodies, such as the NCUA and the CFPB, play a critical role in enforcing compliance, protecting consumers, and maintaining the integrity of the financial system. They oversee financial institutions, ensuring adherence to relevant laws and regulations, and imposing penalties for non-compliance.

What are the emerging trends in regulatory compliance?

+Several emerging trends are likely to shape the future of regulatory compliance, including increased use of technology, growing importance of data analytics, evolving regulatory requirements, and changing consumer behaviors.

In conclusion, the $95 million fine imposed on Navy Federal serves as a reminder of the importance of regulatory compliance in the financial industry. Financial institutions must prioritize adherence to laws and regulations, investing in robust compliance frameworks and implementing effective policies and procedures to minimize the risk of fines and penalties. As the financial industry continues to evolve, the importance of regulatory compliance will only continue to grow, making it essential for institutions to prioritize adherence to laws and regulations. We invite readers to share their thoughts on the significance of regulatory compliance, and how financial institutions can ensure adherence to laws and regulations. By working together, we can promote a culture of compliance, protecting consumers and maintaining the integrity of the financial system.