Intro

Learn about Navy Federals Oops Overdraft Refund Policy, covering overdraft fees, refund process, and account management to avoid negative balances and overdraft protection.

The Navy Federal Credit Union is a well-established financial institution that serves the military community and their families. One of the features that sets Navy Federal apart from other banks is its overdraft refund policy, specifically designed to help members manage their accounts and avoid excessive fees. In this article, we will delve into the Navy Federal Oops Overdraft Refund Policy, exploring its benefits, how it works, and what members can expect from this unique feature.

The importance of understanding overdraft policies cannot be overstated. Overdrafts can happen to anyone, and they often come with hefty fees that can quickly add up. For individuals living on a tight budget, these fees can be particularly burdensome, leading to a cycle of debt that's hard to escape. The Navy Federal Oops Overdraft Refund Policy is designed to offer a safety net, providing members with a sense of security and flexibility in managing their finances.

Navy Federal's approach to overdrafts reflects its commitment to supporting its members' financial well-being. By offering an overdraft refund policy, the credit union demonstrates an understanding of the challenges its members might face and a willingness to help them navigate these challenges. This policy is part of a broader set of tools and services aimed at promoting financial stability and literacy among its membership.

Understanding the Navy Federal Oops Overdraft Refund Policy

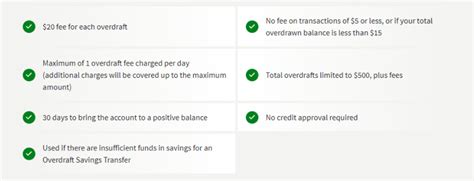

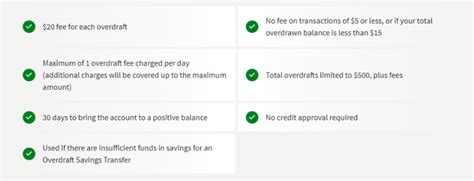

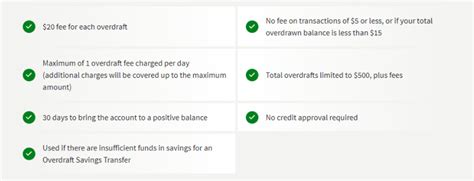

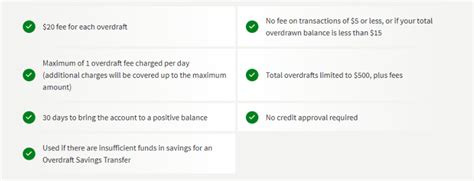

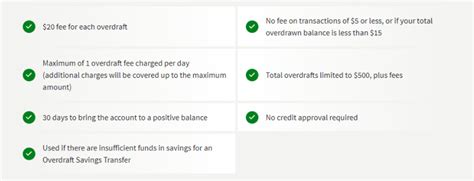

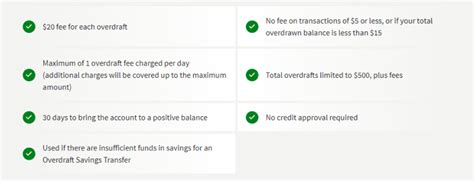

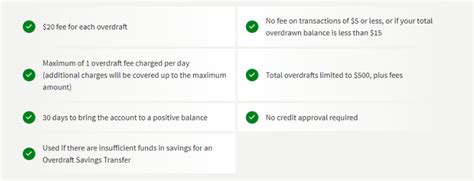

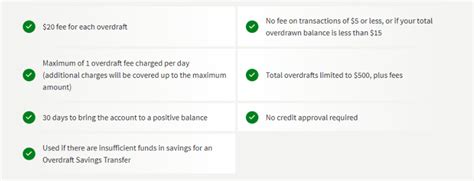

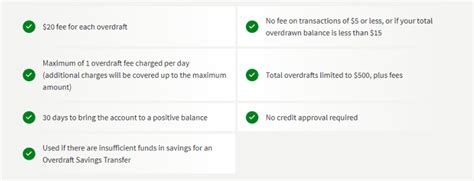

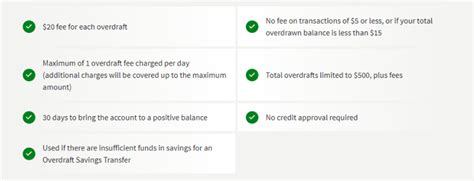

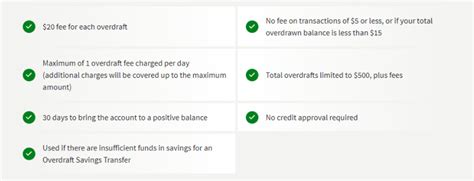

The Navy Federal Oops Overdraft Refund Policy is a consumer-friendly approach to overdrafts, focusing on refunding overdraft fees to help members avoid significant financial setbacks. This policy is automatically applied to eligible accounts, meaning members do not need to opt-in to benefit from it. The specifics of how the policy works, including the types of accounts it covers and the conditions under which fees are refunded, are crucial for members to understand.

Key aspects of the policy include the types of transactions that are covered, the maximum amount of fees that can be refunded, and any requirements members must meet to qualify for the refund. For instance, members might need to bring their account balance positive within a certain timeframe following an overdraft to be eligible for a refund. Understanding these details can help members make the most of the policy and better manage their financial obligations.

Benefits of the Navy Federal Oops Overdraft Refund Policy

The benefits of the Navy Federal Oops Overdraft Refund Policy are multifaceted, offering members a range of advantages that can significantly impact their financial health. One of the primary benefits is the reduction of financial stress associated with unexpected overdraft fees. When members know they have a safety net, they are more likely to feel secure in their financial decisions, which can lead to better overall financial management.Another significant benefit is the potential for cost savings. Overdraft fees can be expensive, and for individuals who frequently overdraft, these fees can add up quickly. By refunding these fees, Navy Federal helps its members save money that would otherwise be spent on penalties, money that can then be allocated towards more productive financial goals, such as saving, investing, or paying off debt.

How the Navy Federal Oops Overdraft Refund Policy Works

To understand how the Navy Federal Oops Overdraft Refund Policy works, it's essential to look at the steps involved in the refund process. First, members must have an eligible account with Navy Federal. The credit union typically communicates which accounts qualify for the overdraft refund policy through its website, mobile banking app, or customer service channels.

Once a member overdrafts, Navy Federal will charge an overdraft fee as per its standard practices. However, if the member meets the criteria for the Oops Overdraft Refund Policy, such as depositing enough funds to cover the overdraft and bring the account balance positive within a specified timeframe, Navy Federal will automatically refund the overdraft fee.

This process is designed to be as seamless as possible for members, requiring minimal action on their part beyond correcting the overdraft situation. The automation of the refund process ensures that eligible members receive the benefit without having to request it, making the policy a proactive measure to support financial stability.

Steps to Avoid Overdrafts and Make the Most of the Policy

While the Navy Federal Oops Overdraft Refund Policy provides a valuable safety net, it's also important for members to take steps to avoid overdrafts in the first place. This can include monitoring account balances closely, setting up alerts for low balances, and ensuring that there are sufficient funds in the account to cover transactions.Members can also benefit from understanding how Navy Federal's overdraft protection services work. These services can automatically transfer funds from a linked account, such as a savings account or line of credit, to cover overdrafts, thereby avoiding the overdraft fee altogether.

Additionally, taking advantage of financial education resources provided by Navy Federal can help members develop better financial habits and strategies for managing their accounts effectively. This might include budgeting advice, tips on saving, and guidance on how to build and maintain a good credit score.

Eligibility and Requirements for the Navy Federal Oops Overdraft Refund Policy

To be eligible for the Navy Federal Oops Overdraft Refund Policy, members typically need to meet certain requirements. These might include having a specific type of account, such as a checking account, and being in good standing with the credit union. Good standing might be defined by factors such as a positive account balance, regular deposits, and no history of abusive account behavior.

Navy Federal may also consider the member's overall relationship with the credit union, including other accounts held and the member's creditworthiness. The specifics of eligibility can vary, so it's crucial for members to review the terms and conditions of the policy as outlined by Navy Federal.

Common Misconceptions About the Navy Federal Oops Overdraft Refund Policy

There are several common misconceptions about the Navy Federal Oops Overdraft Refund Policy that it's essential to address. One misconception is that the policy encourages reckless spending or neglect of financial responsibilities. In reality, the policy is designed to help members recover from occasional mistakes or unexpected expenses, not to facilitate habitual overdrafting.Another misconception is that all overdraft fees are automatically refunded. While Navy Federal does offer a generous refund policy, there are conditions that must be met for a refund to be issued. Members must understand these conditions to avoid disappointment and to make the most of the policy.

Comparing the Navy Federal Oops Overdraft Refund Policy to Other Banks

The Navy Federal Oops Overdraft Refund Policy stands out in the banking industry for its consumer-friendly approach. Compared to other banks, Navy Federal's policy is more generous in terms of the conditions under which overdraft fees are refunded and the amount of fees that can be refunded.

Other banks may offer overdraft protection services, but these often come with their own set of fees or requirements. For example, transferring funds from a linked account to cover an overdraft might incur a transfer fee, albeit typically less than the overdraft fee itself. The Navy Federal policy, by automatically refunding eligible overdraft fees without additional cost to the member, provides a unique benefit that can significantly reduce the financial burden of overdrafts.

Future Developments and Potential Enhancements to the Policy

As the financial landscape continues to evolve, it's likely that Navy Federal will review and potentially enhance its Oops Overdraft Refund Policy. Members can expect the credit union to stay abreast of regulatory changes, technological advancements, and shifts in consumer needs, adapting the policy to better serve its membership.Enhancements might include expanding the types of accounts eligible for the policy, increasing the amount of fees that can be refunded, or introducing new tools and services to help members avoid overdrafts altogether. Navy Federal's commitment to its members' financial well-being suggests that any future developments will be aimed at providing even greater support and flexibility.

Gallery of Navy Federal Oops Overdraft Refund Policy Images

Frequently Asked Questions About the Navy Federal Oops Overdraft Refund Policy

What is the Navy Federal Oops Overdraft Refund Policy?

+The Navy Federal Oops Overdraft Refund Policy is a feature that refunds overdraft fees to eligible members under certain conditions.

How do I qualify for the Navy Federal Oops Overdraft Refund Policy?

+To qualify, members typically need to have an eligible account, meet specific balance requirements, and correct the overdraft within a designated timeframe.

Can I opt-out of the Navy Federal Oops Overdraft Refund Policy?

+Generally, the policy is automatically applied to eligible accounts, but members should contact Navy Federal directly for specific details on opting out or modifying their account settings.

How long does it take for the overdraft fee to be refunded?

+The refund process typically occurs automatically and promptly after the member corrects the overdraft and meets the eligibility criteria.

Are there any limits to how many times I can receive an overdraft fee refund?

+Navy Federal may have specific limits or conditions under which repeated overdrafts are refunded, so it's essential to review the policy's terms and conditions for the most accurate information.

As we explore the intricacies of the Navy Federal Oops Overdraft Refund Policy, it becomes clear that this feature is a valuable tool for members looking to manage their finances more effectively. By understanding the benefits, requirements, and process of the policy, members can better navigate their financial obligations and make the most of the support offered by Navy Federal.

We invite you to share your thoughts and experiences with the Navy Federal Oops Overdraft Refund Policy in the comments below. Whether you're a current member of Navy Federal or simply looking for more information on consumer-friendly banking practices, your insights can help others make informed decisions about their financial services. Additionally, if you found this article helpful, please consider sharing it with others who might benefit from learning more about the Navy Federal Oops Overdraft Refund Policy and its potential to positively impact their financial well-being.