Intro

Discover 5 ways order checks boost business efficiency, preventing errors and enhancing customer satisfaction through automated inventory management, payment verification, and shipping confirmation, ensuring seamless transactions and reduced returns.

Ordering checks can be a straightforward process, but it's essential to understand the different methods available to ensure you get the best value for your money. With the rise of digital banking, many people are opting for online check ordering, but traditional methods are still widely used. In this article, we will explore the various ways to order checks, highlighting their benefits, drawbacks, and key considerations.

The importance of ordering checks cannot be overstated, as they provide a secure and reliable way to make payments. Whether you're an individual or a business, having a steady supply of checks is crucial for managing your finances effectively. Moreover, with the increasing threat of identity theft and online fraud, it's more important than ever to choose a secure and reputable check ordering method.

Before we dive into the different ways to order checks, it's worth noting that the process has become more streamlined and efficient over the years. With the advent of online banking and digital payment systems, ordering checks has become faster, cheaper, and more convenient. However, it's still important to be aware of the potential risks and pitfalls associated with each method, such as security concerns, hidden fees, and quality issues.

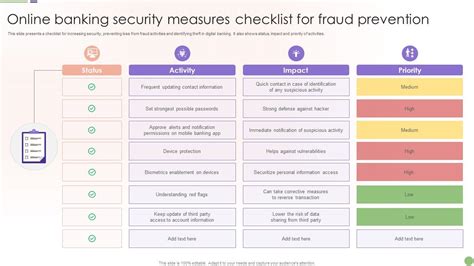

Understanding the Importance of Secure Check Ordering

When it comes to ordering checks, security is a top priority. With identity theft and check fraud on the rise, it's essential to choose a method that provides robust security features, such as encryption, secure servers, and tamper-evident packaging. Additionally, it's crucial to verify the authenticity of the check ordering company and ensure that they comply with industry standards and regulations.

5 Ways to Order Checks

Now that we've discussed the importance of secure check ordering, let's explore the different methods available. Here are five ways to order checks, each with its own advantages and disadvantages:

1. Online Check Ordering

Online check ordering is a popular method that offers convenience, speed, and cost-effectiveness. Many banks and financial institutions provide online check ordering services, allowing you to design and order checks from the comfort of your own home. This method is ideal for those who are tech-savvy and want to avoid the hassle of visiting a physical bank branch.2. Bank Branch Check Ordering

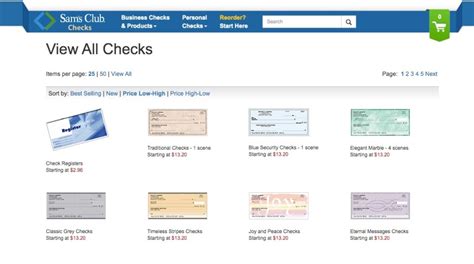

Visiting a bank branch is a traditional method of ordering checks that provides a personal touch and face-to-face interaction. This method is suitable for those who prefer to deal with a bank representative and want to ensure that their checks are ordered correctly. Additionally, bank branches often offer a wider range of check designs and styles.3. Check Ordering Companies

Check ordering companies specialize in providing high-quality checks at competitive prices. These companies often offer a wide range of check designs, fonts, and security features, making them a popular choice for individuals and businesses. However, it's essential to research and verify the credibility of the company before placing an order.4. Credit Union Check Ordering

Credit unions are member-owned financial cooperatives that offer a range of financial services, including check ordering. This method is ideal for those who are members of a credit union and want to take advantage of competitive pricing and personalized service.5. Mail-Order Check Ordering

Mail-order check ordering is a traditional method that involves filling out a form and mailing it to the check ordering company. This method is suitable for those who prefer a more traditional approach and don't have access to online banking or a bank branch.Benefits and Drawbacks of Each Method

Each method of ordering checks has its own benefits and drawbacks. Here are some key considerations to keep in mind:

- Online check ordering: fast, convenient, and cost-effective, but may lack personal touch and security features.

- Bank branch check ordering: personal touch, face-to-face interaction, and wide range of check designs, but may be time-consuming and expensive.

- Check ordering companies: high-quality checks, competitive prices, and wide range of designs, but may lack credibility and security features.

- Credit union check ordering: competitive pricing, personalized service, and member benefits, but may be limited to credit union members.

- Mail-order check ordering: traditional approach, no need for online banking or bank branch, but may be slow and lack security features.

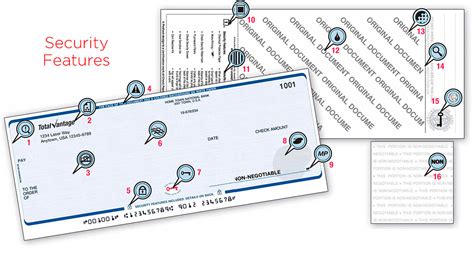

Security Features to Consider

When ordering checks, it's essential to consider the security features that are in place to protect your identity and financial information. Here are some key security features to look out for:

- Encryption: ensures that your personal and financial information is protected from unauthorized access.

- Secure servers: provides a secure environment for storing and processing your check orders.

- Tamper-evident packaging: prevents checks from being tampered with during shipping and handling.

- Check verification: ensures that checks are genuine and not counterfeit.

Quality and Design Options

The quality and design of your checks are crucial in making a positive impression and ensuring that your payments are processed efficiently. Here are some key considerations to keep in mind:

- Paper quality: ensures that checks are durable and resistant to wear and tear.

- Ink quality: ensures that checks are printed clearly and accurately.

- Design options: provides a range of check designs, fonts, and colors to suit your personal or business needs.

- Customization: allows you to add your name, address, and other personal details to your checks.

Cost and Pricing

The cost of ordering checks can vary significantly depending on the method and provider you choose. Here are some key considerations to keep in mind:

- Pricing: compare prices from different providers to ensure you're getting the best value for your money.

- Discounts: look for discounts and promotions that can help reduce the cost of your check order.

- Shipping: consider the cost of shipping and handling, as well as the estimated delivery time.

Check Ordering Image Gallery

What is the best way to order checks?

+The best way to order checks depends on your personal preferences and needs. Online check ordering is a popular method that offers convenience and speed, while bank branch check ordering provides a personal touch and face-to-face interaction.

How do I ensure the security of my check order?

+To ensure the security of your check order, look for providers that offer encryption, secure servers, and tamper-evident packaging. Additionally, verify the authenticity of the provider and check for any reviews or testimonials from previous customers.

What are the benefits of using a check ordering company?

+Check ordering companies offer high-quality checks at competitive prices, as well as a wide range of design options and security features. Additionally, they often provide fast and efficient shipping, making them a popular choice for individuals and businesses.

How do I choose the right check design for my business?

+When choosing a check design for your business, consider your brand identity and the image you want to project. Look for designs that reflect your company's values and personality, and ensure that the checks are printed clearly and accurately.

What are the costs associated with ordering checks?

+The costs associated with ordering checks vary depending on the provider and the type of checks you order. Look for providers that offer competitive pricing and discounts, and consider the cost of shipping and handling.

In conclusion, ordering checks is a crucial aspect of managing your finances, and there are various methods available to suit your needs. By understanding the benefits and drawbacks of each method, considering security features, quality, and design options, and comparing prices, you can make an informed decision and ensure that your check ordering experience is efficient, secure, and cost-effective. Whether you're an individual or a business, taking the time to research and choose the right check ordering method can save you time, money, and hassle in the long run. So why not start exploring your options today and discover the convenience and security of ordering checks online? Share your thoughts and experiences with us, and don't forget to like and comment on this article if you found it helpful!