Intro

Learn how Navy Federal overdraft protection works with 5 key methods, including overdraft transfer, courtesy pay, and debit card coverage, to help manage account overdrafts, avoid fees, and maintain financial stability.

The world of banking can be complex, and one aspect that often raises questions is overdraft protection. For members of Navy Federal Credit Union, understanding how overdraft works is crucial for managing finances effectively. Overdraft protection is a feature designed to cover transactions when there aren't enough funds in an account, helping to avoid declined transactions and associated fees from merchants. Navy Federal, being one of the largest and most reputable credit unions, offers its members various ways to manage overdrafts. Let's delve into the specifics of how Navy Federal overdraft works and explore the different options available to its members.

Overdraft protection is not just a convenience; it's a financial tool that can help members avoid the embarrassment and hassle of declined transactions. It's also a way to avoid the potential damage to one's credit score that can come from bounced checks or declined payments. Navy Federal recognizes the importance of flexible and comprehensive overdraft protection, which is why they offer multiple ways for members to manage their accounts and avoid overdraft fees.

Navy Federal's approach to overdraft protection is member-centric, focusing on providing options that fit different financial situations and preferences. Whether a member is looking for a straightforward overdraft transfer from a linked account or prefers the security of an overdraft line of credit, Navy Federal has designed its services to be adaptable and user-friendly. Understanding these options is key to leveraging them effectively and avoiding unnecessary fees.

Understanding Navy Federal Overdraft Protection Options

Navy Federal offers several overdraft protection options to its members, each designed to cater to different needs and financial strategies. These options include overdraft protection from a linked savings or checking account, an overdraft line of credit, and courtesy pay. Each of these options has its benefits and considerations, and choosing the right one depends on a member's financial habits, account balances, and personal preferences.

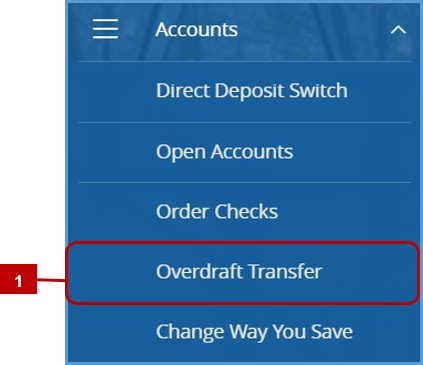

1. Overdraft Protection from Linked Accounts

One of the most common and straightforward ways to manage overdrafts with Navy Federal is by linking a savings or another checking account to serve as a backup for overdraft protection. When a transaction exceeds the available balance in the primary checking account, funds are automatically transferred from the linked account to cover the overdraft. This option is convenient and can help avoid overdraft fees, but it requires maintaining sufficient funds in the linked account to cover potential overdrafts.How Overdraft Transfers Work

Overdraft transfers from linked accounts are a preferred method for many Navy Federal members due to their simplicity and effectiveness. However, it's essential to understand the mechanics of these transfers, including any associated fees and the potential for multiple transfers if an account remains overdrawn. Members should also be aware of the order in which Navy Federal processes transactions, as this can affect when overdraft protection kicks in.

2. Overdraft Line of Credit

For members who prefer a more structured approach to managing overdrafts or who may need to cover larger overdraft amounts, Navy Federal's overdraft line of credit can be an attractive option. This is essentially a small loan that the credit union extends to the member to cover overdrafts, with the member repaying the loan, plus interest, over time. An overdraft line of credit requires a credit application and approval, but it can provide a safety net for unexpected expenses or financial shortfalls.Benefits of an Overdraft Line of Credit

The benefits of an overdraft line of credit include the ability to cover overdrafts without needing to maintain a large balance in a linked account. However, members should be aware of the interest rates associated with these lines of credit and plan to repay the borrowed amount as soon as possible to minimize interest charges.

3. Courtesy Pay

Courtesy pay is another option Navy Federal offers to help members manage overdrafts. This service allows the credit union to pay overdrafts up to a certain limit, even if the member doesn't have sufficient funds in their account or a linked account. Courtesy pay can cover checks, electronic transactions, and debit card transactions, but it typically comes with a fee per transaction. Members must opt-in for courtesy pay on debit card and ATM transactions, as these are not automatically covered under regulatory guidelines.Courtesy Pay Fees and Limits

Understanding the fees and limits associated with courtesy pay is crucial for managing finances effectively. Members should be aware of the potential for multiple fees if an account remains overdrawn and should plan to bring their account back into positive balance as soon as possible to avoid continued fees.

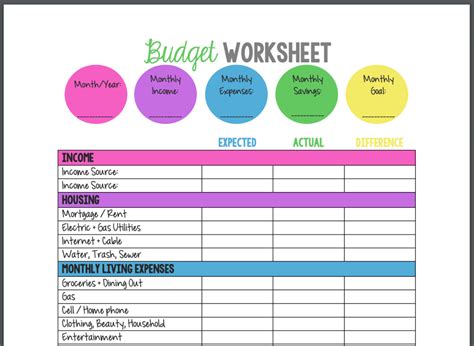

4. Managing Overdrafts through Budgeting and Alerts

While Navy Federal's overdraft protection options can provide a safety net, preventing overdrafts in the first place is often the best strategy. Members can use budgeting tools and set up account alerts to monitor their balances closely and avoid overdrafts. By keeping track of transactions and balances in real-time, members can make informed financial decisions and transfer funds or adjust spending to prevent overdrafts.Using Technology to Prevent Overdrafts

Technology plays a significant role in managing finances and preventing overdrafts. Navy Federal's digital banking tools allow members to check balances, transfer funds, and set up alerts from their mobile devices. Leveraging these tools can help members stay on top of their finances and make timely decisions to avoid overdrafts.

5. Educational Resources and Financial Counseling

Lastly, Navy Federal recognizes that managing overdrafts and maintaining good financial health is not just about the tools and services provided but also about education and planning. The credit union offers various educational resources and financial counseling services to help members understand their financial options, create budgets, and develop strategies for avoiding overdrafts and improving their overall financial well-being.Empowering Financial Literacy

Empowering members with the knowledge and skills to manage their finances effectively is a core part of Navy Federal's mission. By providing access to educational resources and financial counseling, the credit union helps its members make informed decisions about their financial lives, including how to best use overdraft protection options and avoid unnecessary fees.

Navy Federal Overdraft Image Gallery

What is overdraft protection, and how does it work?

+Overdraft protection is a service that covers transactions when there aren't enough funds in an account, helping to avoid declined transactions and associated fees. It works by automatically transferring funds from a linked account or using a line of credit to cover overdrafts.

How do I choose the right overdraft protection option for my needs?

+Choosing the right overdraft protection option depends on your financial habits, account balances, and personal preferences. Consider factors such as the fees associated with each option, the ease of use, and whether you need a structured repayment plan like an overdraft line of credit.

Can I avoid overdraft fees by using budgeting tools and account alerts?

+Yes, using budgeting tools and setting up account alerts can help you monitor your balances closely and make informed financial decisions to avoid overdrafts. By staying on top of your finances, you can transfer funds or adjust spending to prevent overdrafts and associated fees.

In conclusion, managing overdrafts effectively is a critical aspect of financial health, and Navy Federal offers its members a range of options to do so. From overdraft protection from linked accounts to an overdraft line of credit, courtesy pay, and educational resources, members have the tools they need to prevent overdrafts and avoid unnecessary fees. By understanding these options and leveraging them appropriately, Navy Federal members can better manage their finances, avoid the stress of overdrafts, and work towards long-term financial stability. We invite you to share your experiences with Navy Federal's overdraft protection options and how they have helped you manage your finances. Your insights can help others make informed decisions about their financial health.