Intro

Maximize your Navy Federal payday with expert tips on budgeting, saving, and managing finances, including direct deposit, overdraft protection, and credit score optimization.

Managing finances effectively is crucial for achieving financial stability, and for members of the Navy Federal Credit Union, understanding how to navigate payday can be particularly important. Navy Federal Credit Union is one of the largest credit unions in the world, serving all branches of the US military, veterans, and their families. Its mission is to provide its members with exceptional financial services. Here are some key tips to help you make the most out of your Navy Federal payday:

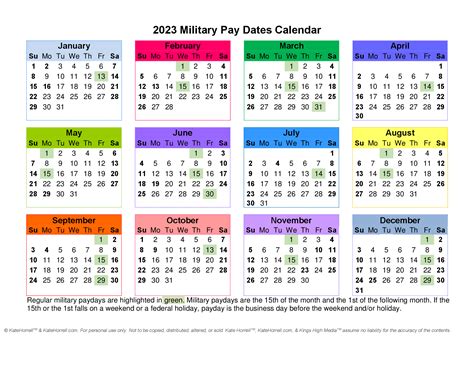

Firstly, it's essential to understand the payday schedule. Navy Federal typically follows the military pay schedule, which is usually every 1st and 15th of the month. However, it's crucial to note that these dates can sometimes be adjusted due to weekends or federal holidays. Being aware of these dates can help you plan your finances more effectively.

Secondly, having a budget is vital. Before payday arrives, take some time to review your expenses and create a budget that accounts for all your necessary expenditures, savings, and any debt repayments. Navy Federal offers various tools and resources to help its members manage their finances, including budgeting apps and financial counseling services.

Thirdly, consider setting up automatic transfers. Navy Federal allows you to set up automatic transfers from your checking account to your savings, investment accounts, or even to pay bills. This can help ensure that you save a portion of your income regularly and pay your bills on time, reducing the risk of late payments and associated fees.

Fourthly, take advantage of Navy Federal's financial products and services. The credit union offers a range of products, including low-interest loans, high-yield savings accounts, and investment services. By using these products wisely, you can make your money work harder for you. For example, consolidating high-interest debt into a lower-interest loan can save you money on interest payments.

Lastly, keep an eye on your credit score. Your credit score plays a significant role in determining the interest rates you qualify for on loans and credit cards. Navy Federal offers free credit score monitoring and reporting tools to its members. By regularly checking your credit report and score, you can identify areas for improvement and work on building a stronger credit profile.

Understanding Navy Federal Payday Loans

Navy Federal payday loans are designed to provide members with short-term financial assistance. These loans are typically offered at more favorable terms than traditional payday loans, with lower interest rates and more flexible repayment terms. However, it's essential to use these loans responsibly and only when necessary, as they can still lead to debt if not managed properly.

Benefits of Navy Federal Payday Loans

- Lower interest rates compared to traditional payday lenders

- Flexible repayment terms

- Quick access to cash when needed

- No hidden fees or charges

Managing Your Finances with Navy Federal

Effective financial management is key to achieving long-term financial stability. Navy Federal offers a range of tools and resources to help its members manage their finances, including:

- Budgeting apps and software

- Financial counseling services

- Investment advice and products

- Insurance services

By taking advantage of these resources, you can gain a better understanding of your financial situation and make informed decisions about your money.

Steps to Improve Your Financial Literacy

- Educate yourself: Learn about personal finance, investing, and money management.

- Set financial goals: Determine what you want to achieve, whether it's saving for a house, paying off debt, or building an emergency fund.

- Create a budget: Track your income and expenses to understand where your money is going.

- Avoid debt: Try to minimize your use of credit and work on paying off high-interest debt.

- Save and invest: Make saving and investing a priority to build wealth over time.

Navy Federal Credit Union Services

Navy Federal Credit Union offers a wide range of services designed to meet the financial needs of its members. These services include:

- Checking and savings accounts

- Loans and credit cards

- Investment and insurance services

- Financial counseling and planning

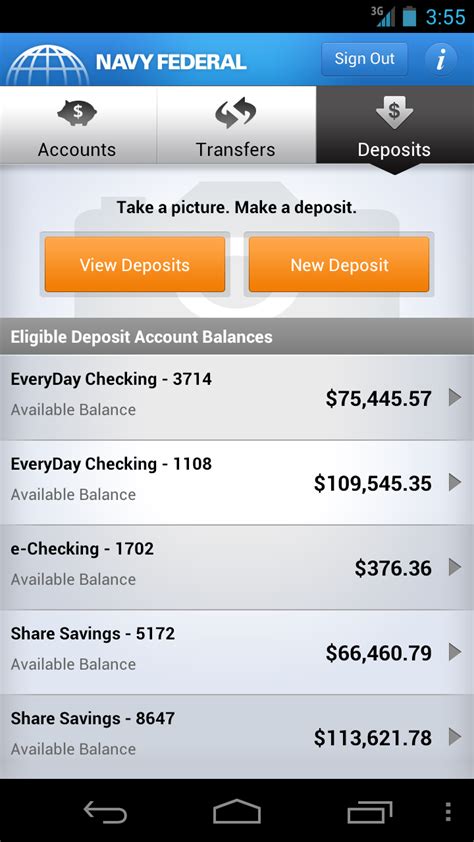

- Online and mobile banking

By taking advantage of these services, you can manage your finances more effectively and achieve your long-term financial goals.

Benefits of Using Navy Federal Services

- Competitive interest rates on loans and deposits

- Low or no fees on many services

- Personalized service and support

- Access to financial education and resources

- Convenience through online and mobile banking

Gallery of Navy Federal Financial Products

Navy Federal Financial Products Image Gallery

Frequently Asked Questions

What are the benefits of using Navy Federal Credit Union services?

+The benefits include competitive interest rates, low or no fees, personalized service, access to financial education, and convenience through online and mobile banking.

How can I manage my finances effectively with Navy Federal?

+You can manage your finances effectively by using Navy Federal's budgeting tools, setting financial goals, creating a budget, avoiding debt, and saving and investing for the future.

What types of loans does Navy Federal offer?

+Navy Federal offers a variety of loans, including personal loans, auto loans, home loans, and credit card loans, all designed to meet the different financial needs of its members.

In conclusion, making the most of your Navy Federal payday requires a combination of understanding the payday schedule, managing your finances effectively, taking advantage of Navy Federal's financial products and services, and maintaining a good credit score. By following these tips and utilizing the resources available to you, you can achieve financial stability and secure a brighter financial future. We invite you to share your thoughts and experiences with managing your finances and using Navy Federal services. Your insights can help others navigate their financial journeys more successfully.