Intro

Master 5 Navy Federal payment tips, including online banking, mobile pay, and bill pay, to streamline your financial management and avoid late fees with efficient payment methods.

Making payments on time is crucial for maintaining a good credit score and avoiding late fees. For Navy Federal Credit Union members, understanding the various payment options and tips can help simplify the process. In this article, we will delve into the world of Navy Federal payments, exploring the benefits, mechanisms, and best practices for making timely payments.

The importance of timely payments cannot be overstated. Not only does it help build a positive credit history, but it also prevents unnecessary fees and charges. Navy Federal, as a member-owned credit union, offers a range of payment options designed to make managing finances easier and more convenient. From online banking to mobile apps, members have numerous ways to make payments, check balances, and monitor their accounts.

Whether you're a seasoned member or new to Navy Federal, navigating the payment system can seem daunting at first. However, with the right guidance, you can master the art of making payments efficiently. This article aims to provide comprehensive insights into the Navy Federal payment system, including tips, tricks, and best practices for managing your finances effectively.

Understanding Navy Federal Payment Options

Benefits of Each Payment Method

- **Online Banking:** Provides 24/7 access to your accounts, allowing for quick and easy payments from the comfort of your home. - **Mobile App:** Offers the flexibility to manage your finances on the go, with features like payment scheduling and account monitoring. - **Phone Payments:** Useful for those who prefer speaking directly with a representative or need assistance with the payment process. - **Mail Payments:** Suitable for members who prefer traditional methods or need to make payments from locations without easy access to digital services. - **In-Person Payments:** Ideal for those who prefer face-to-face interactions or need to conduct other banking activities simultaneously.Setting Up Payments with Navy Federal

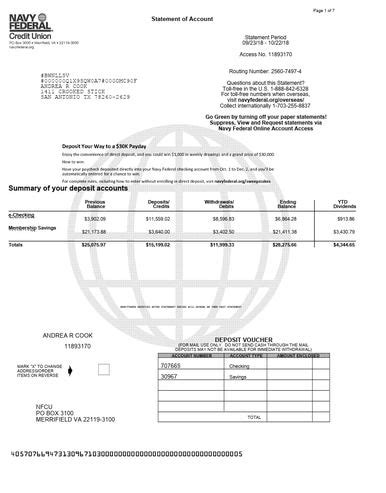

For first-time users, it's essential to have your account information and the payee's details handy. This includes the payee's name, address, and account number, as well as your own login credentials. Navy Federal also offers a payment calendar that helps members keep track of upcoming payments and due dates.

Step-by-Step Guide to Setting Up Payments

1. **Log In:** Access your Navy Federal account through the website or mobile app. 2. **Navigate to Payments:** Find the payments or bill pay section. 3. **Add Payee:** Enter the payee's information as required. 4. **Schedule Payment:** Choose the payment date and amount. 5. **Confirm:** Review the payment details and confirm.Navy Federal Payment Tips for Efficiency

Practical Tips for Members

- **Automate Payments:** Set up automatic payments for recurring bills to ensure timely payments. - **Monitor Accounts:** Regularly check your account balances and transaction history to detect any discrepancies. - **Use Payment Reminders:** Enable reminders through the mobile app or email to stay informed about upcoming payments. - **Keep Information Updated:** Ensure that your contact and payment information is current to avoid any issues with payments.Security Measures for Navy Federal Payments

Security Features

- **Encryption:** Uses advanced encryption technology to secure data transmitted over the internet. - **Two-Factor Authentication:** Requires an additional verification step to ensure that only authorized individuals can access accounts. - **Monitoring:** Continuously monitors accounts for suspicious activity and alerts members to potential threats.Common Issues with Navy Federal Payments

Troubleshooting Tips

- **Check Account Status:** Ensure that your account is active and not under any restrictions. - **Verify Payment Details:** Double-check the payee's information and the payment amount. - **Contact Support:** Reach out to Navy Federal's customer service for assistance with resolving any issues.Gallery of Navy Federal Payment Solutions

Navy Federal Payment Solutions Image Gallery

Frequently Asked Questions

What are the benefits of using Navy Federal's online banking for payments?

+The benefits include 24/7 access, ease of use, and the ability to manage multiple accounts from one platform.

How do I set up automatic payments through Navy Federal?

+Log in to your account, navigate to the payments section, select the account you wish to pay from, choose the payee, and set the payment amount and frequency.

What should I do if I encounter an issue with a payment?

+Contact Navy Federal's customer service immediately. They can assist with troubleshooting and resolving the issue.

In conclusion, managing payments efficiently is a crucial aspect of personal finance, and Navy Federal offers a comprehensive suite of tools and services to help its members achieve this goal. By understanding the available payment options, setting up payments correctly, and following best practices for efficiency and security, members can ensure that their financial obligations are met on time. Whether you're looking to simplify your payment process, reduce the risk of late fees, or just want to stay on top of your finances, Navy Federal's payment solutions are designed to meet your needs. We invite you to share your experiences with Navy Federal's payment system, ask questions, or provide tips that have worked for you in the comments below. Your insights can help others navigate the world of payments with ease and confidence.