Intro

Discover expert 5 Navy Federal Tips for managing finances, including credit score optimization, loan guidance, and investment strategies, to enhance financial stability and security.

The world of personal finance can be overwhelming, especially for those who are just starting to navigate the complexities of banking and credit. However, with the right guidance and tools, managing one's finances can become a much more manageable task. For members of the military and their families, Navy Federal Credit Union stands out as a premier financial institution, offering a wide range of services and benefits tailored to their unique needs. In this article, we will delve into five Navy Federal tips that can help individuals make the most of their membership and improve their financial well-being.

Understanding the importance of financial literacy and the specific challenges faced by military personnel and their families is crucial. Navy Federal Credit Union, with its long history of serving this community, has developed a comprehensive suite of products and services designed to address these challenges. From competitive loan rates to innovative banking technologies, Navy Federal is committed to helping its members achieve their financial goals. Whether you're looking to save for a big purchase, pay off debt, or simply manage your day-to-day expenses more effectively, Navy Federal has the tools and expertise to support you every step of the way.

The benefits of being a Navy Federal member are numerous, ranging from higher savings rates and lower loan rates to exclusive discounts and rewards programs. Moreover, the credit union's commitment to community and its focus on serving the military and their families create a sense of belonging and trust among its members. This unique approach to banking not only sets Navy Federal apart from other financial institutions but also underscores its dedication to the well-being of its members. By leveraging the resources and services provided by Navy Federal, individuals can take significant steps towards securing their financial future and achieving peace of mind.

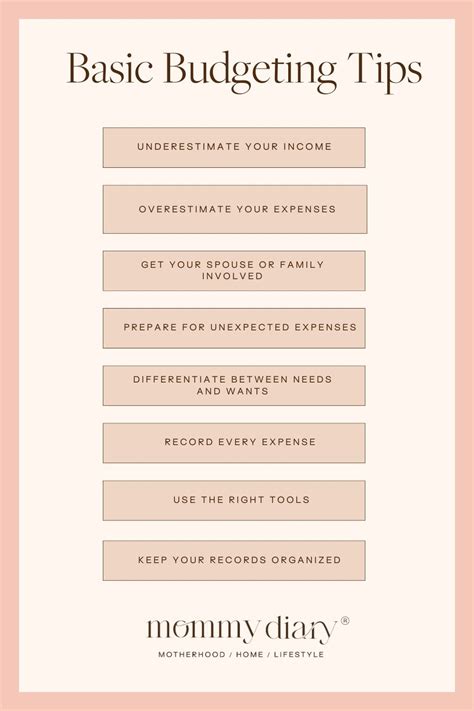

Maximizing Your Savings

To maximize your savings with Navy Federal, consider the following strategies:

- Set clear financial goals: Whether you're saving for a short-term goal, like a vacation, or a long-term goal, like a down payment on a house, having specific objectives can help guide your savings strategy.

- Automate your savings: Setting up automatic transfers from your checking account to your savings or investment accounts can make saving easier and less prone to being neglected.

- Take advantage of higher-yield savings options: Products like money market accounts or certificates can offer higher interest rates than traditional savings accounts, especially if you're willing to keep your money locked in the account for a specified period.

Managing Debt Effectively

Effective debt management involves:

- Understanding your debt: Make a list of all your debts, including the balance, interest rate, and minimum payment for each. This will give you a clear picture of your debt landscape.

- Prioritizing your debts: You can choose to pay off debts with the highest interest rates first (to save the most money in interest over time) or focus on eliminating smaller debts to build momentum.

- Consolidating debt: If you have multiple debts with high interest rates, consider consolidating them into a single loan with a lower interest rate and a manageable repayment plan.

Building Credit

To build credit effectively:

- Make on-time payments: Payment history is a significant factor in determining your credit score, so making all your payments on time is crucial.

- Keep credit utilization low: Try to keep your credit card balances low compared to your credit limits. High utilization can negatively affect your credit score.

- Monitor your credit report: Ensure there are no errors on your credit report that could be affecting your score. You can request a free credit report from each of the three major credit reporting bureaus once a year.

Investing for the Future

When investing:

- Start early: The sooner you start investing, the more time your money has to grow.

- Diversify your portfolio: Spreading your investments across different asset classes can help reduce risk and increase potential returns.

- Be patient: Investing is a long-term game. Avoid making emotional decisions based on short-term market fluctuations.

Protecting Your Finances

To protect your finances:

- Monitor your accounts regularly: Keep an eye on your account activity to quickly identify and report any suspicious transactions.

- Use strong security measures: This includes using strong, unique passwords, enabling two-factor authentication when available, and being cautious with links and attachments from unknown sources.

- Consider insurance: Depending on your situation, insurance products such as life insurance or disability insurance can provide financial protection for you and your loved ones.

Navy Federal Tips Image Gallery

What are the benefits of being a Navy Federal member?

+Being a Navy Federal member offers numerous benefits, including competitive loan rates, higher savings rates, exclusive discounts, and a sense of community. Members also have access to financial counseling, investment services, and robust security measures to protect their finances.

How can I build my credit with Navy Federal?

+Navy Federal offers several options to help build credit, including secured credit cards and credit-builder loans. Making on-time payments and keeping credit utilization low are also crucial for building a strong credit score.

What investment options are available through Navy Federal?

+Navy Federal Investment Services provides a range of investment products, including stocks, bonds, mutual funds, and retirement accounts. Members can also receive professional investment advice to help them create a personalized investment strategy.

In conclusion, Navy Federal Credit Union offers its members a comprehensive suite of financial products and services designed to support their unique needs and goals. By understanding and leveraging these resources, individuals can take significant steps towards achieving financial stability, security, and success. Whether you're focusing on saving, managing debt, building credit, investing for the future, or protecting your finances, Navy Federal is committed to helping you every step of the way. We invite you to explore the benefits of Navy Federal membership further and to share your own tips and experiences in managing your finances effectively. Together, we can work towards a brighter financial future for all.