Intro

Explore 5 Navy Federal loan rates, including personal, auto, and home loans, with competitive APRs, flexible terms, and low-interest options for members.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular products offered by Navy Federal is its loan program, which provides competitive rates and flexible terms to help members achieve their financial goals. In this article, we will discuss the 5 Navy Federal loan rates that you should know about, including their features, benefits, and requirements.

The importance of understanding loan rates cannot be overstated. Loan rates can significantly impact the overall cost of borrowing, and choosing the right loan with the right rate can save you thousands of dollars in interest payments over the life of the loan. Whether you're looking to purchase a new car, consolidate debt, or finance a home improvement project, Navy Federal's loan program has something to offer. With its competitive rates, flexible terms, and personalized service, Navy Federal is an excellent choice for anyone looking for a loan.

Navy Federal's loan program is designed to provide members with access to affordable credit, and its loan rates are consistently lower than those offered by traditional banks and lenders. This is because credit unions are not-for-profit organizations that are owned and controlled by their members, which means that they can offer more competitive rates and better terms. Additionally, Navy Federal's loan program is designed to be flexible, with a range of repayment terms and options to choose from. This makes it easier for members to find a loan that meets their needs and budget.

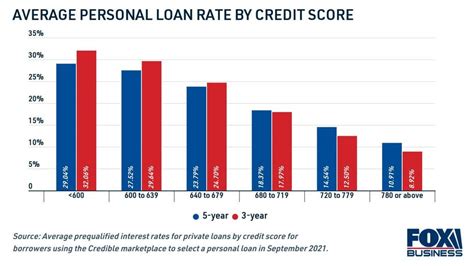

Personal Loan Rates

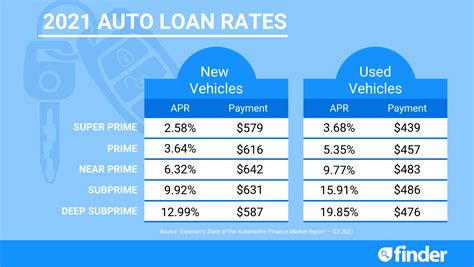

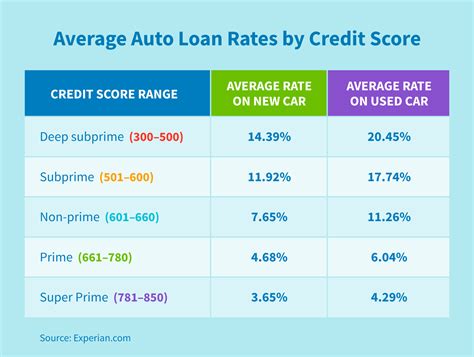

Auto Loan Rates

Home Equity Loan Rates

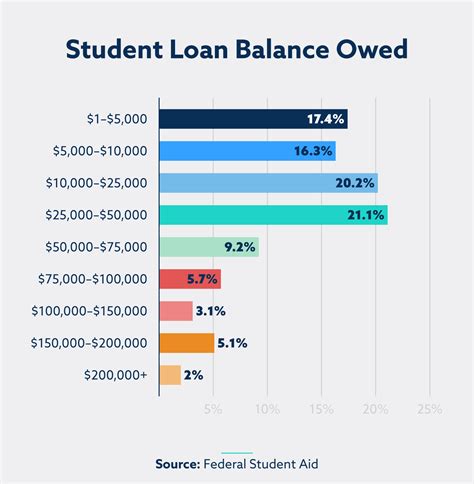

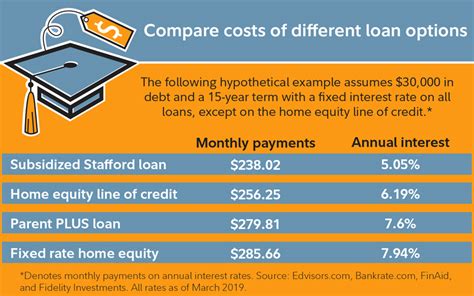

Student Loan Rates

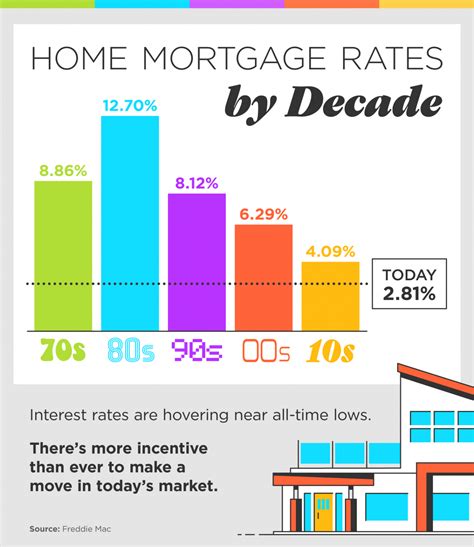

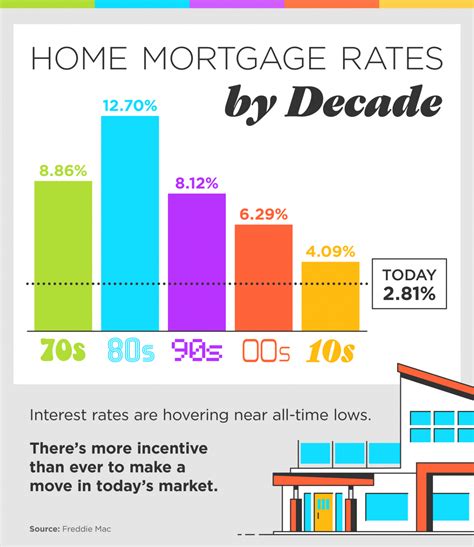

Mortgage Loan Rates

In addition to its competitive loan rates, Navy Federal also offers a range of benefits and features that can help members achieve their financial goals. These include personalized service, online banking, and mobile banking. Members can also take advantage of Navy Federal's financial education resources, which include articles, videos, and webinars on topics such as budgeting, saving, and investing.

To apply for a loan from Navy Federal, members can visit the credit union's website or visit a branch in person. The application process is quick and easy, and members can typically receive a decision within minutes. Additionally, Navy Federal offers a range of repayment options, including online payments, phone payments, and mail payments.

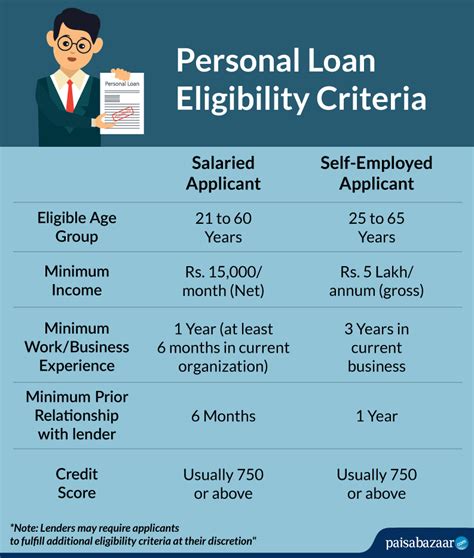

In terms of requirements, Navy Federal has a few eligibility criteria that members must meet in order to qualify for a loan. These include being a member of the credit union, having a good credit score, and meeting the credit union's income and debt requirements. Members can check their eligibility by visiting the credit union's website or by contacting a representative.

Here are some key benefits of Navy Federal's loan program:

- Competitive interest rates: Navy Federal's loan rates are consistently lower than those offered by traditional banks and lenders.

- Flexible repayment terms: Members can choose from a range of repayment terms, including short-term and long-term options.

- Personalized service: Navy Federal's loan program is designed to provide members with personalized service and support.

- Financial education resources: Members can take advantage of Navy Federal's financial education resources, which include articles, videos, and webinars on topics such as budgeting, saving, and investing.

Overall, Navy Federal's loan program is an excellent choice for anyone looking for a competitive loan with flexible terms and personalized service. With its range of loan options, competitive interest rates, and financial education resources, Navy Federal is an excellent choice for members who want to achieve their financial goals.

Navy Federal Loan Image Gallery

What are the benefits of Navy Federal's loan program?

+Navy Federal's loan program offers competitive interest rates, flexible repayment terms, and personalized service. Members can also take advantage of financial education resources and online banking.

How do I apply for a loan from Navy Federal?

+Members can apply for a loan from Navy Federal by visiting the credit union's website or by visiting a branch in person. The application process is quick and easy, and members can typically receive a decision within minutes.

What are the eligibility criteria for Navy Federal's loan program?

+Navy Federal has a few eligibility criteria that members must meet in order to qualify for a loan. These include being a member of the credit union, having a good credit score, and meeting the credit union's income and debt requirements.

How do I repay my loan from Navy Federal?

+Members can repay their loan from Navy Federal by making online payments, phone payments, or mail payments. Members can also set up automatic payments to make repayment easier and more convenient.

What types of loans does Navy Federal offer?

+Navy Federal offers a range of loan options, including personal loans, auto loans, home equity loans, student loans, and mortgage loans. Members can choose the loan that best meets their needs and financial goals.

In conclusion, Navy Federal's loan program is an excellent choice for anyone looking for a competitive loan with flexible terms and personalized service. With its range of loan options, competitive interest rates, and financial education resources, Navy Federal is an excellent choice for members who want to achieve their financial goals. We encourage you to share this article with others who may be interested in learning more about Navy Federal's loan program, and to comment below with any questions or feedback you may have. By working together, we can help each other achieve financial success and security.