Intro

Discover Navy Federal personal loan options, including unsecured loans, debt consolidation, and home improvement loans with competitive rates and flexible terms.

The importance of having access to affordable and flexible loan options cannot be overstated, especially for individuals who are seeking to manage their finances effectively. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a range of personal loan options that cater to the diverse needs of its members. With a strong commitment to providing excellent service and competitive rates, Navy Federal has established itself as a trusted financial partner for millions of people. In this article, we will delve into the various personal loan options available through Navy Federal, exploring their features, benefits, and how they can help individuals achieve their financial goals.

For those who are unfamiliar with Navy Federal, it is essential to understand the credit union's history and mission. Founded in 1933, Navy Federal has grown to become one of the largest credit unions in the United States, serving over 10 million members worldwide. With a focus on providing exceptional service and support to its members, Navy Federal has developed a comprehensive range of financial products and services, including personal loans, credit cards, mortgages, and investment solutions. By joining Navy Federal, individuals can gain access to a wide range of benefits, including competitive rates, flexible terms, and personalized support from experienced financial professionals.

Navy Federal Personal Loan Options

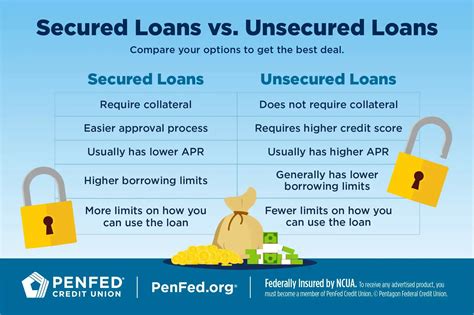

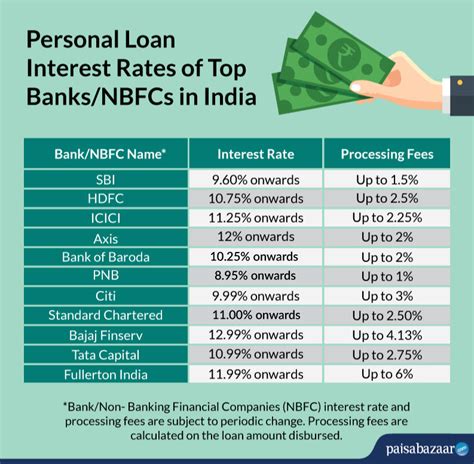

Navy Federal offers several personal loan options, each designed to meet specific needs and financial goals. These options include unsecured personal loans, secured personal loans, and personal lines of credit. Unsecured personal loans are ideal for individuals who need to borrow a fixed amount of money for a specific purpose, such as consolidating debt, financing a wedding, or covering unexpected expenses. Secured personal loans, on the other hand, require collateral, such as a vehicle or savings account, and often offer lower interest rates and more favorable terms. Personal lines of credit provide individuals with a revolving credit limit, allowing them to borrow and repay funds as needed.

Unsecured Personal Loans

Unsecured personal loans from Navy Federal offer several benefits, including competitive interest rates, flexible repayment terms, and no collateral requirements. These loans can be used for a variety of purposes, such as debt consolidation, home improvements, or major purchases. With loan amounts ranging from $2,500 to $50,000, individuals can choose the amount that best suits their needs. Additionally, Navy Federal's unsecured personal loans often feature no origination fees, no prepayment penalties, and a quick application process.Secured Personal Loans

Secured personal loans from Navy Federal offer several advantages, including lower interest rates, larger loan amounts, and more flexible repayment terms. By using collateral, such as a vehicle or savings account, individuals can secure a loan with a lower interest rate and more favorable terms. Secured personal loans can be used for a variety of purposes, such as financing a major purchase, consolidating debt, or covering unexpected expenses. With loan amounts ranging from $2,500 to $100,000, individuals can choose the amount that best suits their needs.

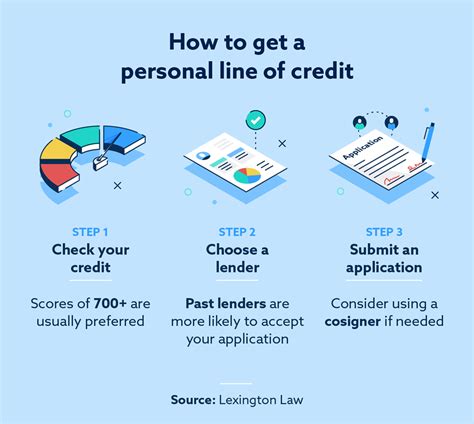

Personal Lines of Credit

Personal lines of credit from Navy Federal provide individuals with a revolving credit limit, allowing them to borrow and repay funds as needed. These lines of credit offer several benefits, including competitive interest rates, flexible repayment terms, and no collateral requirements. With credit limits ranging from $2,500 to $50,000, individuals can choose the amount that best suits their needs. Additionally, Navy Federal's personal lines of credit often feature no origination fees, no prepayment penalties, and a quick application process.Benefits of Navy Federal Personal Loans

Navy Federal personal loans offer several benefits, including competitive interest rates, flexible repayment terms, and no origination fees. These loans can be used for a variety of purposes, such as debt consolidation, home improvements, or major purchases. With a quick application process and personalized support from experienced financial professionals, individuals can easily apply for and manage their personal loans. Additionally, Navy Federal's personal loans often feature no prepayment penalties, allowing individuals to repay their loans early without incurring additional fees.

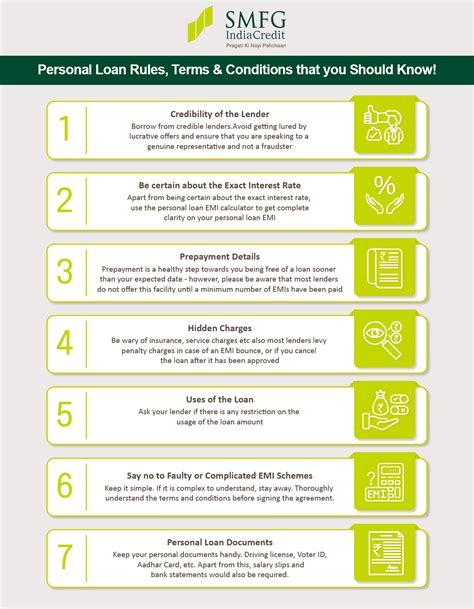

Eligibility Requirements

To be eligible for a Navy Federal personal loan, individuals must meet certain requirements, such as being a member of the credit union, having a good credit score, and providing required documentation. Membership in Navy Federal is open to active-duty military personnel, veterans, and their families, as well as Department of Defense civilians and contractors. With a simple and straightforward application process, individuals can easily apply for and become members of Navy Federal.How to Apply for a Navy Federal Personal Loan

Applying for a Navy Federal personal loan is a simple and straightforward process. Individuals can apply online, by phone, or in person at a Navy Federal branch. To apply, individuals will need to provide required documentation, such as proof of income, identification, and credit information. With a quick application process and personalized support from experienced financial professionals, individuals can easily apply for and manage their personal loans.

Managing Your Loan

Once approved, individuals can manage their Navy Federal personal loan through the credit union's online banking platform or mobile app. With features such as automatic payments, payment reminders, and loan tracking, individuals can easily stay on top of their loan payments and manage their finances effectively. Additionally, Navy Federal's experienced financial professionals are available to provide personalized support and guidance throughout the loan process.Conclusion and Next Steps

In conclusion, Navy Federal personal loan options offer several benefits, including competitive interest rates, flexible repayment terms, and no origination fees. With a range of loan options to choose from, including unsecured personal loans, secured personal loans, and personal lines of credit, individuals can find the perfect loan to meet their financial needs. By applying for a Navy Federal personal loan, individuals can take control of their finances, achieve their financial goals, and enjoy the benefits of membership in one of the largest and most reputable credit unions in the world.

Navy Federal Personal Loan Image Gallery

What are the benefits of a Navy Federal personal loan?

+Navy Federal personal loans offer several benefits, including competitive interest rates, flexible repayment terms, and no origination fees.

How do I apply for a Navy Federal personal loan?

+Individuals can apply for a Navy Federal personal loan online, by phone, or in person at a Navy Federal branch.

What are the eligibility requirements for a Navy Federal personal loan?

+To be eligible for a Navy Federal personal loan, individuals must meet certain requirements, such as being a member of the credit union, having a good credit score, and providing required documentation.

Can I use a Navy Federal personal loan for any purpose?

+Navy Federal personal loans can be used for a variety of purposes, such as debt consolidation, home improvements, or major purchases.

How do I manage my Navy Federal personal loan?

+Individuals can manage their Navy Federal personal loan through the credit union's online banking platform or mobile app, with features such as automatic payments, payment reminders, and loan tracking.

We hope this article has provided you with a comprehensive understanding of Navy Federal personal loan options and how they can help you achieve your financial goals. If you have any further questions or would like to share your experiences with Navy Federal personal loans, please don't hesitate to comment below. Additionally, if you found this article informative and helpful, please share it with your friends and family who may be interested in learning more about personal loan options. By working together, we can help each other make informed financial decisions and achieve our goals.