Intro

Discover expert 5 Navy Federal Pledge Loan Tips, including pledge loan requirements, benefits, and repayment options, to help you navigate Navy Federal Credit Unions loan program and make informed financial decisions with pledge savings and loan solutions.

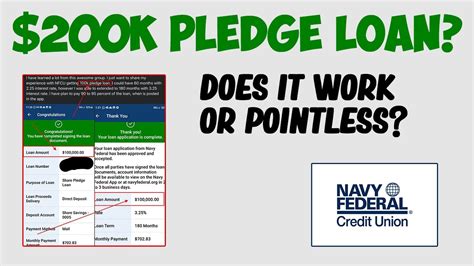

The Navy Federal Pledge Loan is a unique financial product offered by Navy Federal Credit Union, designed to help members achieve their financial goals while promoting a sense of responsibility and commitment. This loan requires borrowers to set aside a portion of the loan amount in a savings account, which can be accessed once the loan is repaid. The concept is innovative, aiming to foster a culture of saving alongside borrowing. For those considering this option, understanding the nuances and benefits is crucial. Here are several key points to consider:

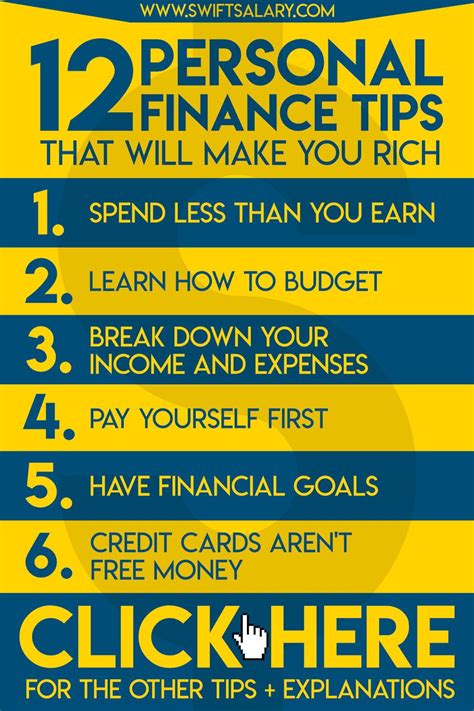

Firstly, the Navy Federal Pledge Loan encourages a savings habit. By requiring a portion of the loan to be held in a savings account, borrowers are essentially forced to save, which can be a valuable discipline, especially for those who struggle with setting aside money. This feature can help in building an emergency fund or saving for long-term goals.

Secondly, the loan terms are relatively favorable, with competitive interest rates compared to other personal loan options. This makes the Navy Federal Pledge Loan an attractive choice for credit union members looking to borrow money at a reasonable cost. The competitive rates can help keep the overall cost of the loan down, making it more manageable for borrowers.

Thirdly, the loan process is designed to be straightforward and accessible. Navy Federal Credit Union is known for its member-centric approach, offering tools and resources to help borrowers navigate the loan application and repayment process. This support can be particularly beneficial for those who are new to borrowing or have questions about managing their debt.

Fourthly, the pledge aspect of the loan serves as a motivational tool. Knowing that a portion of the borrowed amount is being saved can motivate borrowers to repay the loan diligently, as they look forward to accessing the saved funds upon completion of the loan term. This psychological aspect can be a powerful incentive for responsible financial behavior.

Lastly, it's essential to carefully review the terms and conditions of the Navy Federal Pledge Loan. Like any financial product, it's crucial to understand all the aspects, including the interest rate, repayment terms, and any fees associated with the loan. Borrowers should ensure that they can comfortably meet the repayment schedule to avoid any negative impacts on their credit score.

Understanding the Navy Federal Pledge Loan

The Navy Federal Pledge Loan is part of a broader range of financial products and services offered by Navy Federal Credit Union, aimed at supporting the financial well-being of its members. By combining borrowing with a savings component, the loan addresses a critical aspect of personal finance: the importance of saving while borrowing. This approach can help borrowers develop healthy financial habits, which are essential for long-term financial stability.

Benefits of the Navy Federal Pledge Loan

The benefits of the Navy Federal Pledge Loan are multifaceted: - **Promotes Savings Habit**: By setting aside a portion of the loan in a savings account, borrowers are encouraged to save. - **Competitive Interest Rates**: The loan offers competitive rates, making it a cost-effective borrowing option. - **Straightforward Process**: The application and repayment process is designed to be easy to understand and navigate. - **Motivational Aspect**: The pledge component can motivate borrowers to repay the loan diligently to access the saved funds.Eligibility and Application Process

To be eligible for the Navy Federal Pledge Loan, individuals must be members of Navy Federal Credit Union. Membership is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel and their families. The application process typically involves checking eligibility, choosing the loan amount and terms, and submitting the application. Navy Federal often provides online tools and resources to make this process as smooth as possible for its members.

Key Considerations

Before applying for the Navy Federal Pledge Loan, consider the following: - **Loan Amount**: Determine how much you need to borrow and ensure it aligns with your financial goals. - **Repayment Terms**: Understand the repayment schedule and ensure it fits your budget. - **Interest Rate**: Compare the interest rate with other borrowing options to ensure you're getting the best deal. - **Savings Component**: Consider how the savings aspect of the loan will impact your overall financial plan.Managing Your Navy Federal Pledge Loan

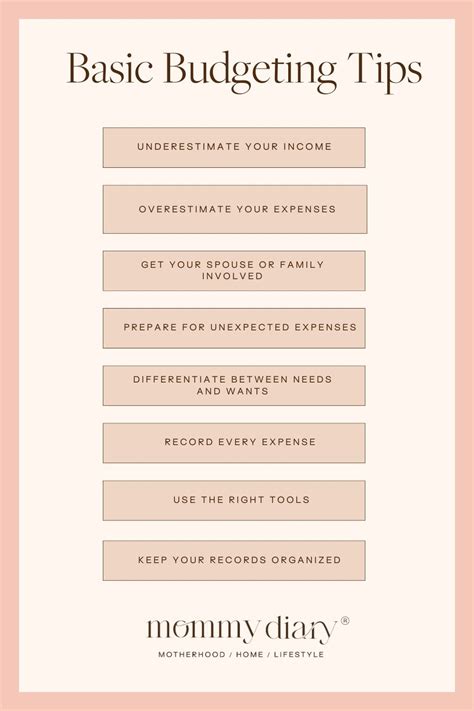

Effective management of your Navy Federal Pledge Loan is crucial for maximizing its benefits. This includes making timely payments, monitoring your savings progress, and adjusting your budget as necessary to accommodate loan repayments. Navy Federal Credit Union may offer tools and advice to help members manage their loans and achieve their financial objectives.

Repayment Strategies

Consider the following repayment strategies: - **Automate Payments**: Set up automatic payments to ensure timely repayments. - **Budgeting**: Adjust your budget to accommodate loan repayments and savings. - **Extra Payments**: Make extra payments when possible to pay off the loan sooner and reduce interest.Navy Federal Pledge Loan vs. Other Options

When deciding on a borrowing option, it's essential to compare the Navy Federal Pledge Loan with other personal loans and financial products. Consider factors such as interest rates, repayment terms, fees, and the savings component. For members of Navy Federal Credit Union, the pledge loan may offer unique benefits that outweigh other options, especially for those looking to build a savings habit.

Comparison Points

Key points to compare: - **Interest Rates**: How do the rates compare across different loan options? - **Fees**: Are there any origination fees, late payment fees, or other charges? - **Repayment Flexibility**: Can you adjust repayment terms if needed? - **Savings Component**: Is there a built-in savings aspect, and if so, how does it work?Conclusion and Next Steps

In conclusion, the Navy Federal Pledge Loan offers a unique approach to borrowing, combining loan financing with a savings component. This product can be particularly beneficial for individuals looking to develop a savings habit while addressing their borrowing needs. By understanding the loan's terms, benefits, and how it compares to other options, borrowers can make informed decisions about their financial futures.

Final Considerations

- **Review Terms**: Ensure you understand all aspects of the loan. - **Budget Carefully**: Plan your repayments and savings. - **Seek Advice**: If needed, consult with a financial advisor.Navy Federal Pledge Loan Image Gallery

What is the Navy Federal Pledge Loan?

+The Navy Federal Pledge Loan is a loan product that requires borrowers to set aside a portion of the loan amount in a savings account, accessible upon loan repayment.

How do I apply for the Navy Federal Pledge Loan?

+To apply, you must be a member of Navy Federal Credit Union. You can then check your eligibility, choose your loan amount and terms, and submit your application through Navy Federal's online platform or by visiting a branch.

What are the benefits of the Navy Federal Pledge Loan?

+The loan promotes a savings habit, offers competitive interest rates, and provides a straightforward application and repayment process. It also serves as a motivational tool to repay the loan diligently to access the saved funds.

We invite you to share your thoughts and experiences with the Navy Federal Pledge Loan in the comments below. Whether you're considering this loan option or have already utilized it, your insights can help others make informed decisions about their financial futures. Additionally, if you found this information helpful, please consider sharing it with others who might benefit from learning more about this unique financial product.