Intro

Explore Navy Federal refinance auto loan options, including lower rates, flexible terms, and debt consolidation, to simplify car financing and save money with competitive refinancing solutions.

Refinancing an auto loan can be a great way to save money on interest, lower monthly payments, or even remove a co-signer from the original loan. For members of Navy Federal Credit Union, refinancing an auto loan can be a straightforward and beneficial process. With competitive rates and flexible terms, Navy Federal offers several refinance auto loan options to suit different needs and financial situations. In this article, we will delve into the world of Navy Federal refinance auto loan options, exploring the benefits, requirements, and steps involved in the process.

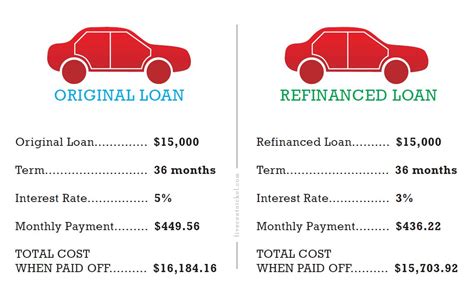

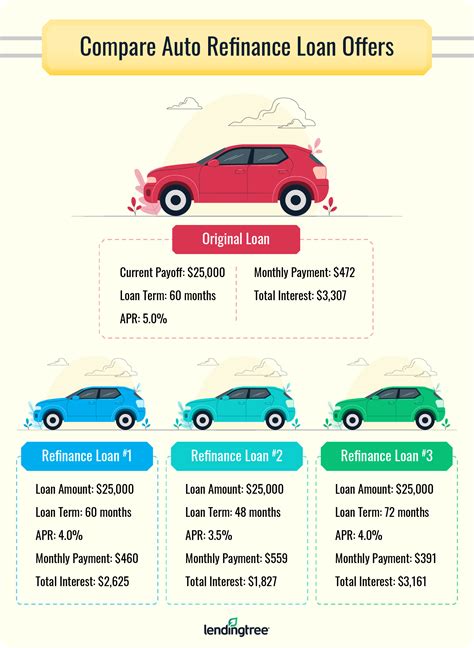

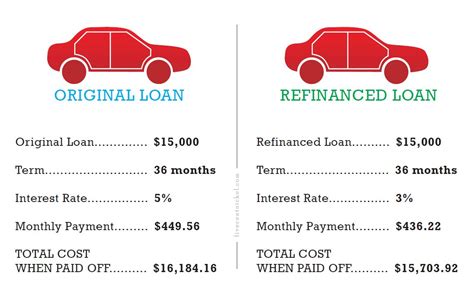

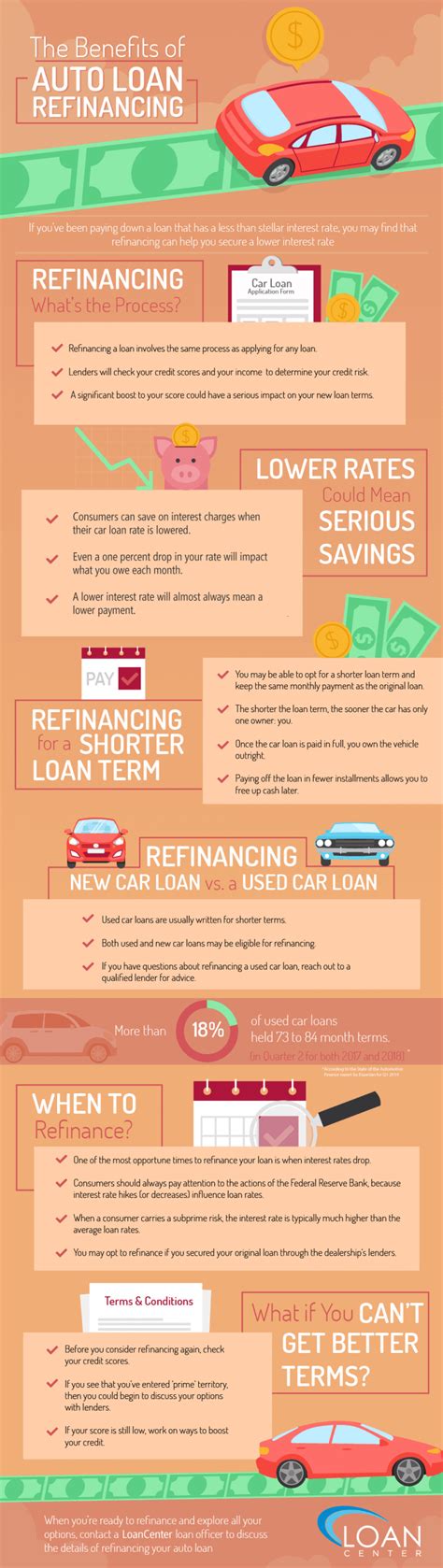

Refinancing an auto loan can be an attractive option for individuals who have improved their credit score since taking out the original loan or who are looking to take advantage of lower interest rates. By refinancing, borrowers can potentially save hundreds or even thousands of dollars over the life of the loan. Moreover, refinancing can provide an opportunity to restructure the loan terms, such as extending or shortening the repayment period, to better align with one's current financial situation. Whether you are looking to reduce your monthly payments, pay off your loan faster, or simply take advantage of a better interest rate, Navy Federal's refinance auto loan options are definitely worth considering.

For those who are unfamiliar with the concept of refinancing an auto loan, it essentially involves replacing the existing loan with a new one, typically with a lower interest rate or more favorable terms. This can be done with the same lender or a different one, such as Navy Federal Credit Union. The process typically involves applying for the new loan, providing required documentation, and paying any associated fees. Once the new loan is approved and finalized, the borrower begins making payments on the new loan, which replaces the original one. With Navy Federal, the refinance process is designed to be efficient and hassle-free, allowing members to quickly and easily take advantage of the benefits that refinancing has to offer.

Benefits of Refinancing an Auto Loan with Navy Federal

Refinancing an auto loan with Navy Federal can offer several benefits, including lower interest rates, reduced monthly payments, and the potential to remove a co-signer from the original loan. By taking advantage of a lower interest rate, borrowers can save money over the life of the loan and reduce the overall cost of owning their vehicle. Additionally, refinancing can provide an opportunity to restructure the loan terms, such as extending or shortening the repayment period, to better align with one's current financial situation. For example, if you have improved your credit score since taking out the original loan, you may be eligible for a lower interest rate, which can result in significant savings over the life of the loan.

Some of the key benefits of refinancing an auto loan with Navy Federal include:

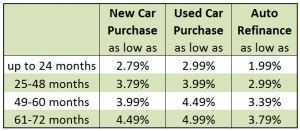

- Lower interest rates: Navy Federal offers competitive interest rates, which can help reduce the overall cost of the loan.

- Reduced monthly payments: By refinancing, borrowers can potentially lower their monthly payments, making it easier to manage their finances.

- Flexibility: Navy Federal offers flexible loan terms, allowing borrowers to choose the repayment period that best suits their needs.

- No prepayment penalties: Navy Federal does not charge prepayment penalties, giving borrowers the freedom to pay off their loan at any time without incurring additional fees.

Types of Refinance Auto Loans Offered by Navy Federal

Navy Federal offers several types of refinance auto loans to suit different needs and financial situations. These include:

- Traditional refinance loans: These loans involve replacing the existing loan with a new one, typically with a lower interest rate or more favorable terms.

- Cash-out refinance loans: These loans allow borrowers to tap into the equity of their vehicle, providing access to cash for other expenses or financial needs.

- Lease buyout loans: These loans enable borrowers to purchase their leased vehicle, often with a lower interest rate and more favorable terms than the original lease.

Each type of refinance auto loan has its own set of benefits and requirements, and Navy Federal's experienced loan officers can help members determine which option is best for their individual circumstances. By understanding the different types of refinance auto loans available, borrowers can make informed decisions and choose the loan that best aligns with their financial goals.

Requirements and Eligibility for Refinancing an Auto Loan with Navy Federal

To be eligible for refinancing an auto loan with Navy Federal, borrowers must meet certain requirements, including:

- Membership: Borrowers must be members of Navy Federal Credit Union, which is open to active-duty and retired military personnel, as well as their families.

- Credit score: A good credit score is typically required, although Navy Federal considers a range of factors when evaluating loan applications.

- Income: Borrowers must have a stable income and be able to demonstrate their ability to repay the loan.

- Vehicle eligibility: The vehicle being refinanced must meet certain criteria, such as age and mileage limits.

In addition to these requirements, borrowers will need to provide various documents, including:

- Proof of income

- Proof of insurance

- Vehicle title or registration

- Current loan information

By understanding the requirements and eligibility criteria, borrowers can prepare themselves for the refinance process and ensure a smooth and efficient experience.

Steps Involved in Refinancing an Auto Loan with Navy Federal

The steps involved in refinancing an auto loan with Navy Federal are relatively straightforward and can be completed quickly and easily. These steps include:

- Checking eligibility: Borrowers can check their eligibility for refinancing by contacting Navy Federal or using the credit union's online tools.

- Gathering documents: Borrowers will need to gather the required documents, including proof of income, proof of insurance, and vehicle title or registration.

- Applying for the loan: Borrowers can apply for the refinance loan online, by phone, or in person at a Navy Federal branch.

- Reviewing and signing the loan agreement: Once the loan is approved, borrowers will review and sign the loan agreement, which outlines the terms and conditions of the loan.

- Paying any associated fees: Borrowers may need to pay fees associated with the refinance, such as title and registration fees.

By following these steps, borrowers can refinance their auto loan with Navy Federal and start enjoying the benefits of a lower interest rate, reduced monthly payments, or more favorable loan terms.

Common Mistakes to Avoid When Refinancing an Auto Loan

When refinancing an auto loan, there are several common mistakes to avoid, including:

- Not shopping around: Failing to compare rates and terms from different lenders can result in missing out on the best deal.

- Not reading the fine print: Borrowers should carefully review the loan agreement to ensure they understand the terms and conditions.

- Not considering the total cost: Borrowers should consider the total cost of the loan, including interest rates, fees, and other expenses.

- Not checking credit reports: Borrowers should check their credit reports to ensure they are accurate and up-to-date.

By avoiding these common mistakes, borrowers can ensure a successful and beneficial refinance experience.

Conclusion and Next Steps

In conclusion, refinancing an auto loan with Navy Federal can be a great way to save money, reduce monthly payments, or take advantage of more favorable loan terms. By understanding the benefits, requirements, and steps involved in the process, borrowers can make informed decisions and choose the loan that best aligns with their financial goals. Whether you are looking to refinance your current loan or simply want to explore your options, Navy Federal's experienced loan officers are available to help.

Before proceeding with the refinance process, it's essential to weigh the pros and cons, consider your financial situation, and determine whether refinancing is right for you. With Navy Federal's competitive rates, flexible terms, and personalized service, refinancing an auto loan can be a straightforward and beneficial experience.

Navy Federal Refinance Auto Loan Image Gallery

What are the benefits of refinancing an auto loan with Navy Federal?

+The benefits of refinancing an auto loan with Navy Federal include lower interest rates, reduced monthly payments, and the potential to remove a co-signer from the original loan.

What are the requirements for refinancing an auto loan with Navy Federal?

+To be eligible for refinancing an auto loan with Navy Federal, borrowers must meet certain requirements, including membership, a good credit score, stable income, and vehicle eligibility.

How do I apply for a refinance auto loan with Navy Federal?

+Borrowers can apply for a refinance auto loan with Navy Federal online, by phone, or in person at a Navy Federal branch.

What are the common mistakes to avoid when refinancing an auto loan?

+Common mistakes to avoid when refinancing an auto loan include not shopping around, not reading the fine print, not considering the total cost, and not checking credit reports.

How long does the refinance process typically take?

+The refinance process typically takes a few days to a few weeks, depending on the complexity of the loan and the speed of the borrower in providing required documentation.

If you're considering refinancing your auto loan, we encourage you to share your thoughts and experiences in the comments below. Have you refinanced an auto loan with Navy Federal or another lender? What were your experiences, and what benefits did you enjoy? By sharing your stories and asking questions, you can help others make informed decisions and navigate the refinance process with confidence. Additionally, if you found this article helpful, please share it with others who may be interested in refinancing their auto loan. Together, we can create a community of informed and empowered borrowers who are equipped to make the best financial decisions for their unique situations.