Intro

Explore Navy Federal refinance car loan options, including auto loan refinancing, car loan consolidation, and low-rate refinancing, to lower payments and save on interest rates with flexible terms.

The process of refinancing a car loan can be complex and overwhelming, especially for those who are new to the world of auto financing. However, with the right guidance and support, refinancing a car loan can be a great way to save money, lower monthly payments, and improve overall financial stability. For members of the Navy Federal Credit Union, refinancing a car loan can be a particularly attractive option, thanks to the organization's competitive rates and flexible terms. In this article, we will explore the Navy Federal refinance car loan options, including the benefits, eligibility requirements, and application process.

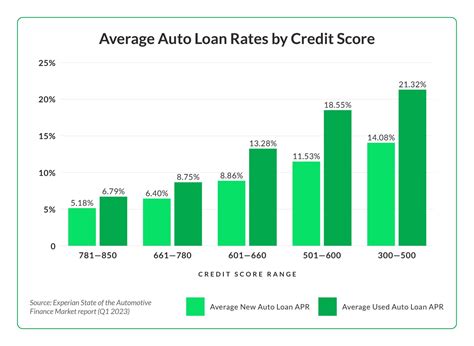

Refinancing a car loan involves replacing an existing loan with a new one, typically with a lower interest rate or more favorable terms. This can be a great way to reduce monthly payments, save money on interest, and improve cash flow. For example, let's say you currently have a car loan with an interest rate of 6% and a monthly payment of $500. By refinancing your loan with a new interest rate of 4%, you may be able to reduce your monthly payment to $450, saving you $50 per month. Over the life of the loan, this can add up to significant savings.

Navy Federal Credit Union is a popular choice for car loan refinancing, thanks to its competitive rates and flexible terms. As a member-owned organization, Navy Federal is able to offer more favorable rates and terms than traditional banks and lenders. Additionally, Navy Federal offers a range of refinancing options, including fixed-rate loans, variable-rate loans, and loans with flexible repayment terms.

Navy Federal Refinance Car Loan Benefits

Some of the key benefits of refinancing a car loan with Navy Federal include:

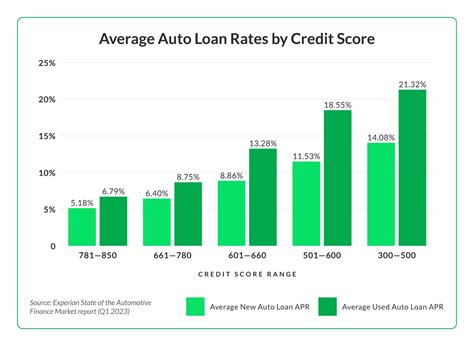

- Competitive interest rates: Navy Federal offers some of the lowest interest rates in the industry, which can help to reduce monthly payments and save money on interest.

- Flexible repayment terms: Members can choose from a range of repayment terms, including the option to extend or shorten the loan term.

- Improved credit scores: Refinancing a car loan with Navy Federal can help to improve credit scores, as the new loan will be reported to the credit bureaus and can help to demonstrate responsible credit behavior.

- No prepayment penalties: Navy Federal does not charge prepayment penalties, which means that members can pay off their loan early without incurring additional fees.

- Easy application process: The application process for refinancing a car loan with Navy Federal is quick and easy, and can be completed online or in-person at a local branch.

Navy Federal Refinance Car Loan Eligibility Requirements

Navy Federal Refinance Car Loan Application Process

Once the application is submitted, Navy Federal will review the information and make a decision. If approved, the new loan will be disbursed and the existing loan will be paid off. Members can then begin making payments on the new loan, which will be reported to the credit bureaus and can help to improve credit scores.

Navy Federal Refinance Car Loan Types

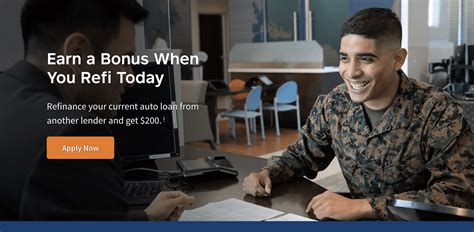

Navy Federal offers a range of refinance car loan options, including: * Fixed-rate loans: These loans have a fixed interest rate, which means that the monthly payment will remain the same over the life of the loan. * Variable-rate loans: These loans have a variable interest rate, which means that the monthly payment may change over the life of the loan. * Loans with flexible repayment terms: These loans offer flexible repayment terms, including the option to extend or shorten the loan term.Navy Federal Refinance Car Loan Rates and Terms

It's worth noting that Navy Federal offers a range of discounts and promotions, which can help to reduce the interest rate and save money on the loan. For example, members who set up automatic payments may be eligible for a 0.25% discount on the interest rate. Additionally, members who have a good credit history may be eligible for a lower interest rate.

Navy Federal Refinance Car Loan Fees and Charges

However, members may be required to pay certain fees, such as title and registration fees, which will vary depending on the state and local regulations. Additionally, members may be required to pay late payment fees, which will vary depending on the individual circumstances.

Navy Federal Refinance Car Loan Image Gallery

What are the benefits of refinancing a car loan with Navy Federal?

+The benefits of refinancing a car loan with Navy Federal include competitive interest rates, flexible repayment terms, and improved credit scores. Members can also take advantage of discounts and promotions, such as a 0.25% discount on the interest rate for setting up automatic payments.

What are the eligibility requirements for a Navy Federal refinance car loan?

+To be eligible for a Navy Federal refinance car loan, members must meet certain requirements, including membership in the credit union, an existing car loan, good credit, and income and debt requirements. The vehicle being refinanced must also meet certain requirements, including age and mileage limits.

How do I apply for a Navy Federal refinance car loan?

+The application process for a Navy Federal refinance car loan is quick and easy. Members can apply online or in-person at a local branch, and will need to provide certain documentation, including proof of income, proof of employment, vehicle information, and loan information.

What are the rates and terms for a Navy Federal refinance car loan?

+The rates and terms for a Navy Federal refinance car loan will vary depending on the individual circumstances. However, the credit union typically offers competitive interest rates, ranging from 4.5% to 7.5% APR, and flexible repayment terms, including 36, 48, 60, and 72 months.

Are there any fees or charges associated with a Navy Federal refinance car loan?

+The fees and charges for a Navy Federal refinance car loan are typically minimal. The credit union does not charge prepayment penalties, and members may be eligible for discounts and promotions. However, members may be required to pay certain fees, such as title and registration fees, which will vary depending on the state and local regulations.

In summary, refinancing a car loan with Navy Federal can be a great way to save money, lower monthly payments, and improve overall financial stability. With competitive interest rates, flexible repayment terms, and minimal fees, Navy Federal offers a range of refinance car loan options that can help members achieve their financial goals. Whether you're looking to reduce your monthly payments, save money on interest, or improve your credit scores, Navy Federal has a refinance car loan option that can help. So why wait? Apply today and start taking advantage of the benefits of refinancing your car loan with Navy Federal. We encourage you to share your thoughts and experiences with refinancing a car loan in the comments below. Have you refinanced a car loan with Navy Federal or another lender? What were your experiences? Let us know and help others make informed decisions about their financial options.