Intro

Explore Navy Federal refinance options, including mortgage refinancing, loan consolidation, and debt restructuring, to lower rates and monthly payments with flexible terms and competitive interest rates.

Refinancing a mortgage can be a great way to save money on interest, reduce monthly payments, or tap into home equity. For members of the Navy Federal Credit Union, there are several refinance options available. In this article, we will explore the importance of refinancing, the benefits it offers, and the various options provided by Navy Federal.

Refinancing a mortgage involves replacing an existing loan with a new one, typically with a lower interest rate or more favorable terms. This can be a smart financial move for homeowners who want to reduce their monthly payments, switch from an adjustable-rate to a fixed-rate loan, or access cash for home improvements or other expenses. With interest rates at historic lows, many homeowners are considering refinancing to take advantage of the savings.

For members of the Navy Federal Credit Union, refinancing can be a great way to save money and achieve financial goals. Navy Federal offers a range of refinance options, including conventional loans, VA loans, and FHA loans. These options cater to different needs and financial situations, ensuring that members can find a refinancing solution that works for them. Whether you're looking to reduce your monthly payments, tap into home equity, or switch to a more stable loan, Navy Federal has a refinance option that can help.

Navy Federal Refinance Options

Navy Federal offers several refinance options, each with its own benefits and eligibility requirements. These options include:

- Conventional refinance loans: These loans are not insured by the government and typically offer lower interest rates and lower mortgage insurance premiums.

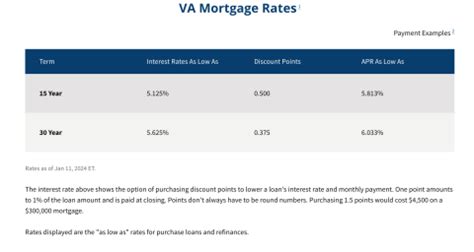

- VA refinance loans: These loans are guaranteed by the Department of Veterans Affairs and offer favorable terms, including lower interest rates and lower funding fees.

- FHA refinance loans: These loans are insured by the Federal Housing Administration and offer more lenient credit score requirements and lower down payment options.

- Cash-out refinance loans: These loans allow homeowners to tap into their home equity and receive cash at closing.

- Streamline refinance loans: These loans offer a faster and more efficient refinancing process, with reduced documentation and underwriting requirements.

Benefits of Refinancing with Navy Federal

Refinancing with Navy Federal offers several benefits, including:

- Lower interest rates: Navy Federal offers competitive interest rates, which can help reduce monthly payments and save money on interest over the life of the loan.

- Reduced monthly payments: By refinancing to a lower interest rate or extending the loan term, homeowners can reduce their monthly payments and free up more money in their budget.

- Access to cash: Cash-out refinance loans allow homeowners to tap into their home equity and receive cash at closing, which can be used for home improvements, debt consolidation, or other expenses.

- Improved loan terms: Refinancing can provide an opportunity to switch from an adjustable-rate to a fixed-rate loan, or to remove private mortgage insurance (PMI) from the loan.

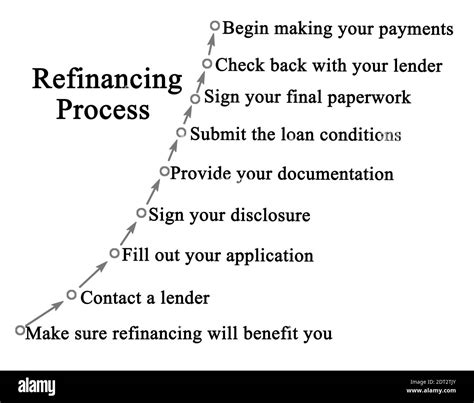

How to Refinance with Navy Federal

Refinancing with Navy Federal is a relatively straightforward process. Here are the steps to follow:

- Check eligibility: Review the eligibility requirements for the desired refinance option and ensure that you meet the criteria.

- Gather documentation: Collect the necessary documentation, including income verification, credit reports, and appraisal reports.

- Apply for the loan: Submit an application for the refinance loan, either online or through a Navy Federal loan officer.

- Review and sign the loan documents: Once the loan is approved, review the loan documents carefully and sign them to complete the refinancing process.

Refinancing FAQs

Here are some frequently asked questions about refinancing with Navy Federal:

- What are the eligibility requirements for refinancing with Navy Federal?

- How long does the refinancing process take?

- Can I refinance my loan if I have a low credit score?

- How much cash can I receive with a cash-out refinance loan?

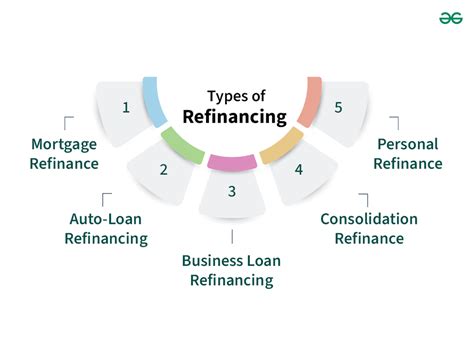

Types of Refinance Loans

Navy Federal offers several types of refinance loans, including:

- Conventional refinance loans: These loans are not insured by the government and typically offer lower interest rates and lower mortgage insurance premiums.

- VA refinance loans: These loans are guaranteed by the Department of Veterans Affairs and offer favorable terms, including lower interest rates and lower funding fees.

- FHA refinance loans: These loans are insured by the Federal Housing Administration and offer more lenient credit score requirements and lower down payment options.

- USDA refinance loans: These loans are guaranteed by the United States Department of Agriculture and offer favorable terms, including lower interest rates and lower funding fees.

Refinance Loan Options for Military Members

Navy Federal offers several refinance loan options specifically for military members, including:

- VA refinance loans: These loans are guaranteed by the Department of Veterans Affairs and offer favorable terms, including lower interest rates and lower funding fees.

- VA cash-out refinance loans: These loans allow military members to tap into their home equity and receive cash at closing.

- VA streamline refinance loans: These loans offer a faster and more efficient refinancing process, with reduced documentation and underwriting requirements.

Navy Federal Refinance Image Gallery

What are the benefits of refinancing with Navy Federal?

+The benefits of refinancing with Navy Federal include lower interest rates, reduced monthly payments, and access to cash through a cash-out refinance loan.

What are the eligibility requirements for refinancing with Navy Federal?

+The eligibility requirements for refinancing with Navy Federal vary depending on the type of loan and the individual's financial situation. Generally, borrowers must have a good credit score, a stable income, and sufficient equity in their home.

How long does the refinancing process take with Navy Federal?

+The refinancing process with Navy Federal typically takes several weeks to several months, depending on the complexity of the loan and the speed of the borrower in providing required documentation.

In conclusion, refinancing with Navy Federal can be a great way to save money, reduce monthly payments, and access cash through a cash-out refinance loan. With several refinance options available, including conventional, VA, and FHA loans, Navy Federal members can find a refinancing solution that meets their needs and financial situation. By understanding the benefits and eligibility requirements of refinancing with Navy Federal, borrowers can make an informed decision and take the first step towards achieving their financial goals. We invite you to share your thoughts and experiences with refinancing in the comments below, and to share this article with anyone who may be considering refinancing their mortgage.