Intro

Discover Navy Federal Routing Transit Number for secure transactions, direct deposits, and wire transfers, with related banking codes and payment processing information.

The Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving millions of members across the globe. As a member of Navy Federal, it's essential to understand the importance of the Navy Federal routing transit number, also known as the ABA routing number or RTN. This unique nine-digit code is used to facilitate various financial transactions, including direct deposits, wire transfers, and automatic payments.

The Navy Federal routing transit number plays a crucial role in ensuring that transactions are processed correctly and efficiently. It helps to identify the financial institution and the specific branch where the account is held, enabling banks and credit unions to route transactions accurately. In the case of Navy Federal, the routing transit number is 256074974. This number is used for all types of transactions, including domestic and international wire transfers, direct deposits, and automatic payments.

Understanding the Navy Federal routing transit number is vital for members who want to take advantage of the credit union's various services and benefits. For instance, members can use the routing transit number to set up direct deposits, which allow them to receive their paychecks or government benefits directly into their Navy Federal accounts. This convenient service saves time and eliminates the need to visit a branch or ATM to deposit funds.

In addition to direct deposits, the Navy Federal routing transit number is also used for wire transfers. Members can use this number to send or receive funds domestically or internationally, making it an essential tool for those who need to transfer money frequently. The routing transit number is also required for automatic payments, such as bill payments or loan payments, which can be set up through the Navy Federal online banking platform or mobile app.

Navy Federal Routing Transit Number Uses

The Navy Federal routing transit number has several uses, including:

- Direct deposits: Members can use the routing transit number to set up direct deposits, which allow them to receive their paychecks or government benefits directly into their Navy Federal accounts.

- Wire transfers: The routing transit number is used to send or receive funds domestically or internationally.

- Automatic payments: Members can use the routing transit number to set up automatic payments, such as bill payments or loan payments.

- Online banking: The routing transit number is required to set up online banking and mobile banking services.

How to Find the Navy Federal Routing Transit Number

Finding the Navy Federal routing transit number is relatively easy. Members can locate this number in several ways:

- Check the Navy Federal website: The routing transit number is listed on the Navy Federal website, along with other important account information.

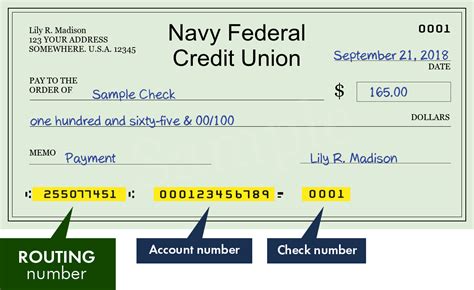

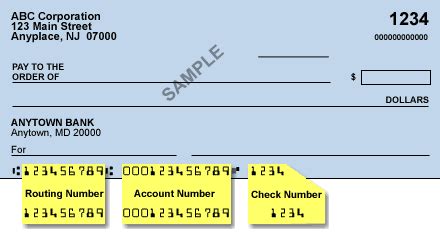

- Review account documents: The routing transit number is printed on Navy Federal account documents, such as checks and deposit slips.

- Contact Navy Federal customer service: Members can contact Navy Federal customer service to obtain the routing transit number.

- Check online banking: The routing transit number is also available through the Navy Federal online banking platform.

Navy Federal Routing Transit Number Format

The Navy Federal routing transit number is a nine-digit code that follows a specific format. The format is as follows:

- The first four digits represent the Federal Reserve Bank routing symbol.

- The next four digits represent the American Bankers Association (ABA) institution identifier.

- The last digit is the check digit, which is calculated using a formula to ensure the accuracy of the routing transit number.

Benefits of Using the Navy Federal Routing Transit Number

Using the Navy Federal routing transit number offers several benefits, including:

- Convenience: The routing transit number allows members to set up direct deposits, wire transfers, and automatic payments, making it easy to manage their finances.

- Efficiency: The routing transit number ensures that transactions are processed quickly and accurately, reducing the risk of errors or delays.

- Security: The routing transit number helps to protect members' accounts by verifying the identity of the financial institution and the account holder.

Common Issues with the Navy Federal Routing Transit Number

While the Navy Federal routing transit number is generally reliable, members may encounter issues from time to time. Some common problems include:

- Incorrect routing transit number: Using an incorrect routing transit number can result in delayed or rejected transactions.

- Routing transit number changes: Navy Federal may change its routing transit number from time to time, which can affect members who have set up automatic payments or direct deposits.

- Technical issues: Technical problems with the Navy Federal online banking platform or mobile app can prevent members from accessing their accounts or using the routing transit number.

Gallery of Navy Federal Routing Transit Number

Navy Federal Routing Transit Number Image Gallery

What is the Navy Federal routing transit number?

+The Navy Federal routing transit number is 256074974. This number is used for all types of transactions, including domestic and international wire transfers, direct deposits, and automatic payments.

How do I find the Navy Federal routing transit number?

+Members can find the Navy Federal routing transit number on the Navy Federal website, on account documents, or by contacting Navy Federal customer service.

What are the benefits of using the Navy Federal routing transit number?

+Using the Navy Federal routing transit number offers several benefits, including convenience, efficiency, and security. It allows members to set up direct deposits, wire transfers, and automatic payments, making it easy to manage their finances.

What are some common issues with the Navy Federal routing transit number?

+Common issues with the Navy Federal routing transit number include using an incorrect routing transit number, routing transit number changes, and technical issues with the Navy Federal online banking platform or mobile app.

How do I resolve issues with the Navy Federal routing transit number?

+Members can resolve issues with the Navy Federal routing transit number by contacting Navy Federal customer service or visiting a branch. They can also use the Navy Federal online banking platform or mobile app to troubleshoot issues and find solutions.

In summary, the Navy Federal routing transit number is a crucial piece of information that members need to manage their finances effectively. By understanding the importance of this number and how to use it, members can take advantage of the various services and benefits offered by Navy Federal. Whether it's setting up direct deposits, wire transfers, or automatic payments, the Navy Federal routing transit number is an essential tool for managing finances and achieving financial goals. We invite you to share your thoughts and experiences with the Navy Federal routing transit number in the comments below. If you found this article helpful, please share it with others who may benefit from this information.