Intro

Discover expert 5 Navy Federal Tips for managing finances, including credit score optimization, loan guidance, and investment strategies, to enhance financial stability and security.

The importance of managing personal finances cannot be overstated, especially in today's fast-paced and often unpredictable economic landscape. For members of the military, veterans, and their families, having access to reliable and tailored financial services is crucial. Navy Federal Credit Union, one of the largest credit unions in the world, offers a wide range of financial products and services designed to meet the unique needs of its members. With a rich history and a commitment to excellence, Navy Federal has become a trusted partner for those seeking to achieve financial stability and success. Whether you're looking to save for the future, finance a new home, or simply manage your day-to-day expenses, Navy Federal has the tools and expertise to help. In this article, we will delve into five key tips for making the most of Navy Federal's offerings, providing you with the insights you need to navigate your financial journey with confidence.

Financial literacy is the foundation upon which all successful financial planning is built. Understanding how to budget, save, and invest are essential skills that can make a significant difference in one's financial health. Navy Federal recognizes the importance of financial education and provides its members with a variety of resources and tools to improve their financial literacy. From webinars and workshops to online tutorials and personalized financial counseling, members have access to a wealth of information designed to help them make informed financial decisions. By taking advantage of these resources, individuals can better navigate the complexities of personal finance, avoid common pitfalls, and develop strategies tailored to their unique financial goals and circumstances.

Understanding Navy Federal's Financial Products

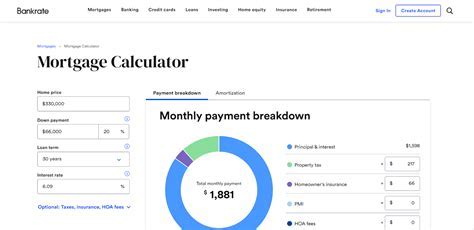

Navy Federal offers a broad spectrum of financial products, each designed to address specific financial needs. From checking and savings accounts to credit cards, personal loans, and mortgages, the credit union provides its members with a comprehensive suite of financial solutions. Understanding the features, benefits, and terms of these products is vital for making informed decisions that align with one's financial objectives. For instance, Navy Federal's credit cards often come with competitive interest rates, generous rewards programs, and exclusive benefits for military personnel, such as rebates on foreign transaction fees. Similarly, their mortgage products are tailored to meet the unique challenges faced by military families, including options for VA loans and flexible repayment terms.

Benefits of Navy Federal Membership

Navy Federal membership is not just about accessing financial products; it's also about becoming part of a community that understands and supports the military lifestyle. Members enjoy a range of benefits, from higher savings rates and lower loan rates to exclusive discounts on insurance and investment products. The credit union's commitment to its members is reflected in its competitive pricing, personalized service, and continuous innovation in financial technology. By leveraging these benefits, members can optimize their financial outcomes, reduce costs, and enhance their overall financial well-being.Managing Finances with Navy Federal Tools

Effective financial management requires more than just the right products; it also demands the right tools. Navy Federal provides its members with a suite of digital tools designed to simplify financial management, enhance transparency, and promote control. From mobile banking apps that allow for on-the-go account management to online platforms for tracking investments and credit scores, these tools empower members to take charge of their finances. Additionally, Navy Federal's budgeting and savings tools can help members set and achieve their financial goals, whether that's building an emergency fund, saving for a down payment on a home, or planning for retirement.

Security and Protection with Navy Federal

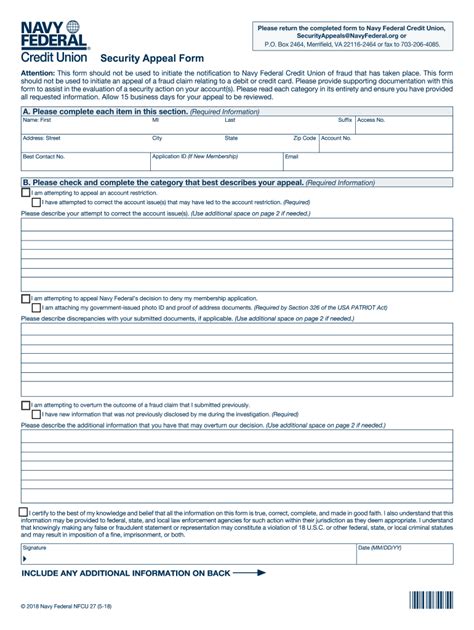

Security and protection are paramount in the digital age, especially when it comes to financial information. Navy Federal prioritizes the security of its members' data and accounts, employing state-of-the-art security measures to safeguard against fraud and unauthorized access. This includes advanced encryption, secure login protocols, and monitoring systems designed to detect and prevent suspicious activity. Furthermore, Navy Federal's commitment to protecting its members extends to education and awareness, providing resources and guidance on how to avoid financial scams and maintain personal financial security.Planning for the Future with Navy Federal

Planning for the future is a critical aspect of financial management, and Navy Federal offers a range of products and services designed to help members achieve their long-term financial goals. Whether it's saving for retirement, funding a child's education, or leaving a legacy, the credit union provides the tools and expertise necessary to create a personalized financial plan. This includes investment products, such as mutual funds and IRAs, as well as insurance options to protect one's assets and ensure financial stability for loved ones. By working with Navy Federal, members can develop a comprehensive financial strategy that addresses their unique needs and aspirations.

Access to Exclusive Benefits

One of the significant advantages of Navy Federal membership is access to exclusive benefits that can enhance one's financial situation and overall quality of life. These benefits can range from special discounts on financial products to unique rewards and perks designed specifically for military personnel and their families. For example, Navy Federal often partners with other organizations to offer members exclusive deals on everything from home appliances to vacation packages. By taking advantage of these benefits, members can enjoy savings, upgrades, and privileges that might not be available to the general public.Navigating Financial Challenges with Navy Federal

Despite the best planning, financial challenges can arise, and it's how one navigates these challenges that can make all the difference. Navy Federal is committed to supporting its members through difficult financial times, offering resources and solutions designed to help mitigate financial stress. This includes financial counseling, debt management tools, and temporary hardship programs that can provide relief during periods of financial strain. By reaching out to Navy Federal, members can access the guidance and support they need to overcome financial obstacles and get back on track towards achieving their financial goals.

Community Involvement and Support

Navy Federal's commitment to its members extends beyond financial services to community involvement and support. The credit union is actively engaged in philanthropic efforts, supporting initiatives that benefit military families, veterans, and the communities they serve. This not only reflects Navy Federal's values of service and compassion but also underscores its role as a responsible corporate citizen. By being part of the Navy Federal community, members are connected to a network of individuals and families who share a common bond and a commitment to supporting one another.Conclusion and Next Steps

In conclusion, Navy Federal Credit Union offers its members a powerful combination of financial products, educational resources, and community support designed to help them achieve financial success and stability. By understanding and leveraging the benefits of Navy Federal membership, individuals can take significant steps towards securing their financial future. Whether you're just starting out or nearing retirement, Navy Federal has the tools, expertise, and commitment to help you navigate your financial journey with confidence. As you consider your next steps, remember that financial planning is a continuous process, and staying informed and proactive is key to achieving your goals.

Navy Federal Image Gallery

What are the benefits of Navy Federal membership?

+Navy Federal membership offers a range of benefits, including competitive financial products, exclusive discounts, and personalized service tailored to the unique needs of military personnel and their families.

How can I manage my finances effectively with Navy Federal?

+Navy Federal provides its members with a variety of tools and resources to manage their finances effectively, including digital banking platforms, budgeting tools, and financial education resources.

What kinds of financial products does Navy Federal offer?

+Navy Federal offers a comprehensive suite of financial products, including checking and savings accounts, credit cards, personal loans, mortgages, and investment products, all designed to meet the unique financial needs of its members.

How does Navy Federal support financial education and literacy?

+Navy Federal supports financial education and literacy through a variety of resources, including webinars, workshops, online tutorials, and personalized financial counseling, all aimed at empowering members to make informed financial decisions.

What security measures does Navy Federal have in place to protect member accounts?

+Navy Federal employs advanced security measures, including encryption, secure login protocols, and monitoring systems, to protect member accounts and data from unauthorized access and fraud.

As you embark on your financial journey with Navy Federal, remember that the path to financial success is unique to each individual. By leveraging the resources, tools, and expertise provided by Navy Federal, you can navigate the complexities of personal finance with confidence and achieve your long-term financial goals. We invite you to share your experiences, ask questions, and seek advice from the Navy Federal community, and to explore the many resources available to help you make the most of your membership. Together, let's work towards a brighter financial future.