Intro

Boost savings with Navy Federals expert tips, including budgeting, credit scores, and loan management, to achieve financial stability and security.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. As a member of Navy Federal, you have access to a wide range of financial products and services designed to help you manage your money effectively. In this article, we will discuss five Navy Federal savings tips that can help you make the most of your membership and achieve your financial goals.

The importance of saving money cannot be overstated. Having a cushion of savings can provide peace of mind, help you weather financial storms, and enable you to achieve your long-term goals, such as buying a home, funding your retirement, or financing your children's education. By following these Navy Federal savings tips, you can develop healthy financial habits, reduce your debt, and build a brighter financial future.

Navy Federal offers a variety of savings accounts and programs that can help you save money, including traditional savings accounts, money market accounts, certificates, and individual retirement accounts (IRAs). By taking advantage of these products and services, you can earn competitive interest rates, minimize fees, and maximize your savings. In the following sections, we will explore five Navy Federal savings tips that can help you get started on the path to financial success.

Understanding Navy Federal Savings Accounts

Benefits of Navy Federal Savings Accounts

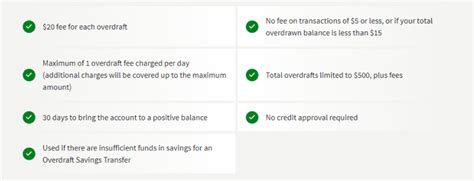

The benefits of Navy Federal savings accounts include competitive interest rates, low fees, and easy access to your money. With a Navy Federal savings account, you can earn a higher interest rate than a traditional savings account at a bank, which can help your savings grow over time. Additionally, Navy Federal savings accounts have low or no fees, which can help you save money on maintenance charges, overdraft fees, and other expenses. You can also access your money easily through online banking, mobile banking, or at one of Navy Federal's many branches or ATMs.Setting Financial Goals with Navy Federal

Creating a Budget with Navy Federal

Creating a budget is a critical step in achieving your financial goals. A budget helps you track your income and expenses, identify areas for improvement, and make informed decisions about how to allocate your resources. Navy Federal provides a range of budgeting tools and resources, including budgeting worksheets, spending trackers, and financial counseling. By creating a budget, you can prioritize your spending, reduce waste, and allocate more money towards savings and debt repayment. For example, you may want to allocate 50% of your income towards necessary expenses, such as housing, food, and transportation, 30% towards discretionary spending, and 20% towards saving and debt repayment.Using Navy Federal Savings Tools and Resources

Benefits of Navy Federal Savings Tools and Resources

The benefits of Navy Federal savings tools and resources include personalized savings plans, tracking and monitoring, and motivation and support. By using these tools and resources, you can create a tailored savings plan that meets your unique needs and goals, track your progress and stay on track, and receive motivation and support from Navy Federal's financial experts. Additionally, Navy Federal's savings tools and resources are free or low-cost, which can help you save money on financial planning and advice.Maximizing Navy Federal Savings Rates

Benefits of Navy Federal Savings Rates

The benefits of Navy Federal savings rates include competitive interest rates, low risk, and liquidity. By earning a competitive interest rate, you can grow your savings over time and achieve your financial goals. Additionally, Navy Federal savings accounts are low-risk, which means you can enjoy peace of mind and avoid the volatility of the stock market. You can also access your money easily, which provides liquidity and flexibility in case of an emergency or unexpected expense.Avoiding Fees with Navy Federal

Benefits of Avoiding Fees with Navy Federal

The benefits of avoiding fees with Navy Federal include saving money, reducing stress, and improving financial health. By avoiding fees, you can save money on unnecessary expenses and allocate more resources towards savings and debt repayment. Additionally, avoiding fees can reduce stress and anxiety, which can improve your overall well-being and financial health. You can also enjoy the convenience and flexibility of Navy Federal's fee-free services, which can make managing your finances easier and more efficient.Navy Federal Savings Image Gallery

What is the minimum deposit required to open a Navy Federal savings account?

+The minimum deposit required to open a Navy Federal savings account is $5.

What is the difference between a Navy Federal Share Savings Account and a Money Market Savings Account?

+A Navy Federal Share Savings Account is a basic savings account that earns a competitive interest rate, while a Money Market Savings Account earns a higher interest rate and requires a minimum deposit of $1,000.

How can I avoid fees with Navy Federal?

+You can avoid fees with Navy Federal by maintaining a minimum balance, using online banking or mobile banking, and avoiding overdrafts.

What are the benefits of using Navy Federal savings tools and resources?

+The benefits of using Navy Federal savings tools and resources include personalized savings plans, tracking and monitoring, and motivation and support.

How can I maximize my Navy Federal savings rates?

+You can maximize your Navy Federal savings rates by opening a Certificate or a Money Market Savings Account, and taking advantage of Navy Federal's savings promotions and bonuses.

In conclusion, Navy Federal offers a range of savings accounts and programs that can help you achieve your financial goals. By following these five Navy Federal savings tips, you can develop healthy financial habits, reduce your debt, and build a brighter financial future. Remember to take advantage of Navy Federal's savings tools and resources, avoid fees, and maximize your savings rates to get the most out of your membership. If you have any questions or need further guidance, don't hesitate to reach out to Navy Federal's financial experts. Share this article with your friends and family to help them achieve their financial goals, and start building a stronger financial future today!