Intro

Discover 5 ways Navy Federal in Winchester, VA, offers personalized banking services, including credit union benefits, financial planning, and loan options, providing members with convenient and secure banking solutions.

Navy Federal Credit Union has been a trusted financial institution for many individuals, particularly those associated with the military and their families. With its wide range of services and benefits, it's no wonder that locations like the one in Winchester, VA, are highly regarded. If you're considering banking with Navy Federal in Winchester, here are five ways you can benefit from their services.

Firstly, Navy Federal offers competitive rates on loans and credit cards, which can be especially beneficial for those looking to finance a new vehicle, consolidate debt, or make significant purchases. Their rates are often more favorable compared to traditional banks, making it easier for members to manage their finances effectively. Moreover, the credit union's reputation for excellent customer service means that members can expect personalized advice and support throughout their financial journey.

Secondly, Navy Federal provides a comprehensive array of banking services, including checking and savings accounts, certificates, and IRAs. These accounts are designed to meet the diverse needs of their members, offering features such as low or no monthly maintenance fees, competitive dividend rates, and easy access to funds through their extensive ATM network. By managing your accounts through Navy Federal, you can streamline your financial management and make the most of your hard-earned money.

Thirdly, for those looking to invest in their future, Navy Federal offers investment services and financial planning tools. Their team of experienced financial advisors can provide guidance on retirement planning, wealth management, and insurance, helping you make informed decisions about your financial future. Whether you're just starting to build your wealth or nearing retirement, Navy Federal's investment services can help you achieve your long-term goals.

Fourthly, Navy Federal is committed to supporting the financial literacy and well-being of its members. They offer a variety of educational resources, including workshops, webinars, and online tools, designed to help members improve their financial knowledge and skills. By empowering members with the information they need to make smart financial decisions, Navy Federal contributes to the overall financial health of the community it serves.

Lastly, as a member of Navy Federal, you become part of a larger community that values service, integrity, and mutual support. The credit union's mission is rooted in serving those who serve, and this commitment is reflected in everything they do. From their charitable initiatives to their community outreach programs, Navy Federal demonstrates a genuine interest in the well-being of their members and the communities they operate in.

Benefits of Membership

Eligibility and Application Process

To become a member of Navy Federal, you must meet certain eligibility criteria, which typically includes being a member of the military, a veteran, or a family member of someone who is. The application process is straightforward and can be completed online or by visiting a local branch. Once your eligibility is verified, you can open your account with a minimal initial deposit and start enjoying the benefits of membership.Investment and Insurance Services

Financial Planning Tools and Resources

In addition to personalized advice, Navy Federal provides members with a variety of financial planning tools and resources. These include online calculators, educational articles, and workshops, all designed to empower members with the knowledge they need to manage their finances effectively. Whether you're planning for retirement, saving for a down payment on a house, or simply looking to improve your financial literacy, Navy Federal has the resources to support you.Community Involvement

Support for Military Families

Given its roots in serving the military and their families, Navy Federal has a special focus on supporting this community. The credit union offers tailored financial products and services designed to meet the unique needs of military personnel and their families. From deployment loans to military retirement planning, Navy Federal is equipped to handle the financial challenges that come with military service. This specialized support reflects the credit union's understanding of the sacrifices made by military families and its commitment to serving those who serve.Branch and ATM Network

Digital Banking Solutions

Navy Federal's digital banking solutions are designed with the user in mind, offering a seamless and secure way to bank online or through the mobile app. Members can check balances, transfer funds, pay bills, and deposit checks remotely, among other services. The credit union's commitment to innovation means that its digital platforms are constantly evolving to meet the changing needs of its members, ensuring that banking with Navy Federal remains convenient, efficient, and secure.Security and Fraud Protection

Member Education and Awareness

Educating members about potential threats and how to safeguard their financial information is a key part of Navy Federal's security strategy. Through workshops, articles, and online resources, the credit union empowers members with the knowledge they need to stay safe in an increasingly digital financial landscape. By promoting awareness and best practices, Navy Federal contributes to a more secure banking environment for all its members.Navy Federal Image Gallery

What are the benefits of joining Navy Federal Credit Union?

+Joining Navy Federal Credit Union offers numerous benefits, including competitive rates on loans and deposits, lower fees, access to a wide range of financial products and services, personalized service, and opportunities for financial education and planning.

How do I become a member of Navy Federal?

+To become a member, you must meet the eligibility criteria, which typically includes being a member of the military, a veteran, or a family member of someone who is. The application process can be completed online or by visiting a local branch.

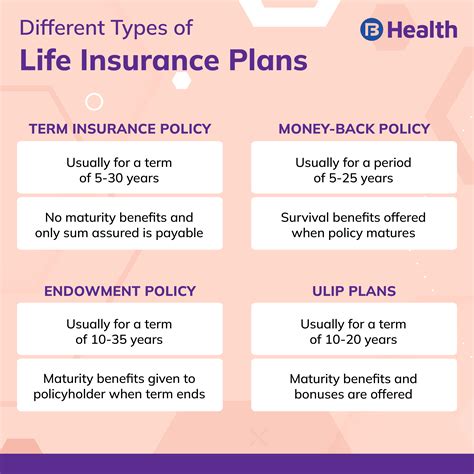

What investment and insurance services does Navy Federal offer?

+Navy Federal offers a comprehensive suite of investment and insurance services, including retirement planning, wealth management, life insurance, and more, designed to help members secure their financial future.

As you consider banking with Navy Federal in Winchester, VA, remember that you're not just choosing a financial institution - you're becoming part of a community that prioritizes your financial well-being and success. With its competitive products, personalized service, and commitment to community, Navy Federal stands out as a leader in the financial services industry. Take the first step towards a stronger financial future by exploring what Navy Federal has to offer. Share your thoughts on the benefits of banking with Navy Federal, and let's start a conversation about how you can achieve your financial goals with the right support.