Intro

Discover 5 ways Navy Federal Direct Deposit simplifies finances with instant access, early pay, and secure transactions, using digital banking, mobile deposit, and online services for effortless money management and financial flexibility.

The importance of managing finances efficiently cannot be overstated, especially in today's fast-paced world where financial stability is key to achieving peace of mind. One of the most effective ways to streamline your financial management is through the use of direct deposit. For members of Navy Federal Credit Union, utilizing Navy Federal direct deposit can significantly simplify the process of receiving and managing your funds. Whether you're a service member, a veteran, or a family member of someone in the military, taking advantage of this feature can make a substantial difference in how you handle your finances.

Navy Federal Credit Union, known for its commitment to serving the financial needs of the military community, offers a range of services and tools designed to make financial management easier and more accessible. Among these services, direct deposit stands out as a particularly useful feature, allowing users to have their paychecks, government benefits, or other regular payments deposited directly into their accounts. This eliminates the need to physically visit a branch or ATM to deposit funds, reducing the risk of lost or stolen checks and providing quicker access to your money.

The benefits of using Navy Federal direct deposit extend beyond mere convenience. It also plays a crucial role in financial planning and budgeting. By having a steady and predictable income stream, individuals can better plan their expenses, savings, and investments. Moreover, direct deposit can help in avoiding late payment fees and penalties by ensuring that bills are paid on time. For those looking to build or repair their credit, timely payments facilitated by direct deposit can contribute positively to their credit score over time.

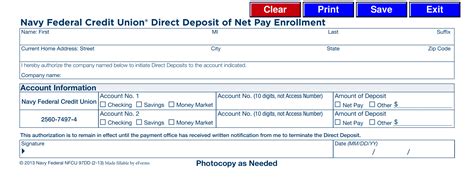

Setting Up Navy Federal Direct Deposit

Setting up Navy Federal direct deposit is a straightforward process that can be completed in a few steps. First, you'll need to ensure you have an active checking or savings account with Navy Federal Credit Union. If you haven't already, you can apply for an account online or by visiting a local branch. Once your account is set up, you can proceed to enroll in direct deposit. This typically involves providing your employer or the relevant government agency with Navy Federal's routing number and your account number. You can find this information on a check or by logging into your online banking account.

Benefits of Direct Deposit

The benefits of direct deposit are numerous and can significantly impact your financial stability and peace of mind. Some of the key advantages include: - **Convenience:** Direct deposit eliminates the need to physically deposit checks, saving you time and effort. - **Security:** It reduces the risk of checks being lost, stolen, or forged. - **Timeliness:** Funds are available sooner, as you don't have to wait for checks to clear. - **Budgeting:** Direct deposit helps in budgeting by providing a predictable income stream. - **Credit Building:** Timely payments facilitated by direct deposit can help in building or repairing credit.Managing Your Finances with Navy Federal

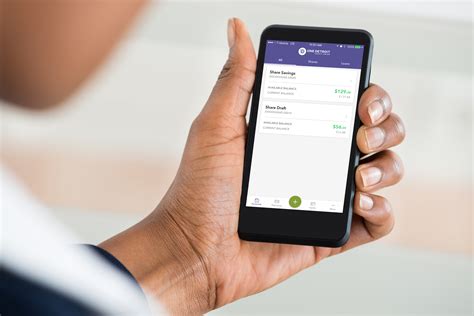

Navy Federal Credit Union offers a variety of tools and services to help members manage their finances effectively. From online banking and mobile banking apps to financial counseling and investment services, Navy Federal is committed to providing its members with the resources they need to achieve their financial goals. Whether you're looking to save for a big purchase, pay off debt, or plan for retirement, Navy Federal has solutions tailored to your needs.

Online Banking and Mobile Apps

Navy Federal's online banking and mobile banking apps provide members with 24/7 access to their accounts, allowing them to check balances, transfer funds, pay bills, and deposit checks remotely. These digital tools are designed to be user-friendly and secure, ensuring that managing your finances is both convenient and safe.Security Measures for Direct Deposit

The security of your financial information is of utmost importance when using direct deposit. Navy Federal Credit Union employs robust security measures to protect its members' accounts and personal data. These measures include encryption, secure login processes, and monitoring for suspicious activity. Additionally, members are advised to use strong passwords, keep their contact information up to date, and regularly review their account activity to detect any potential issues early.

Protecting Your Account

To further protect your account, it's essential to be vigilant about phishing scams, never share your login credentials, and use two-factor authentication when available. Regularly updating your browser and operating system can also help safeguard against newer threats.Direct Deposit for Government Benefits

For individuals receiving government benefits, such as Social Security or veteran benefits, direct deposit is a convenient and secure way to receive these payments. The process for setting up direct deposit for government benefits is similar to that for payroll, involving the provision of your account and routing numbers to the relevant government agency.

Benefits for Veterans and Retirees

Direct deposit can be particularly beneficial for veterans and retirees, providing them with a reliable means of receiving their benefits. It ensures that they have consistent access to their funds, which is crucial for planning and budgeting, especially on a fixed income.Common Issues with Direct Deposit

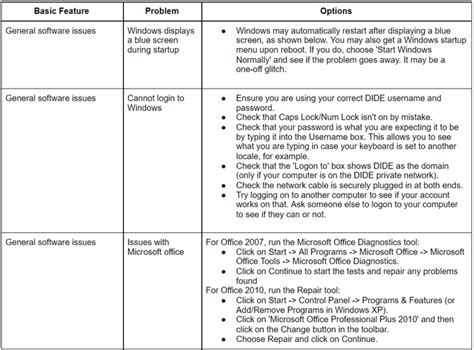

While direct deposit is a reliable service, issues can sometimes arise. These may include delayed payments, incorrect account information, or technical glitches. If you encounter any problems with your direct deposit, it's essential to contact Navy Federal's customer service promptly. They can help resolve the issue and ensure that your funds are deposited correctly and on time.

Troubleshooting Tips

- **Verify Account Information:** Ensure that your account and routing numbers are correct. - **Check Payment Schedules:** Confirm the scheduled payment dates with your employer or the government agency. - **Contact Support:** Reach out to Navy Federal's support team for assistance with any issues.Navy Federal Direct Deposit Image Gallery

How do I set up direct deposit with Navy Federal?

+To set up direct deposit, you'll need to provide your employer or the relevant government agency with Navy Federal's routing number and your account number. You can find this information on a check or by logging into your online banking account.

What are the benefits of using direct deposit?

+The benefits of direct deposit include convenience, security, timeliness, and it helps in budgeting. It also reduces the risk of lost or stolen checks and provides quicker access to your money.

How secure is direct deposit with Navy Federal?

+Navy Federal employs robust security measures to protect its members' accounts and personal data. These measures include encryption, secure login processes, and monitoring for suspicious activity.

In conclusion, Navy Federal direct deposit offers a convenient, secure, and reliable way to manage your finances. By taking advantage of this feature, you can streamline your financial transactions, reduce the risk of fraud, and enjoy quicker access to your funds. Whether you're receiving payroll, government benefits, or other regular payments, direct deposit with Navy Federal can play a significant role in achieving your financial goals. We invite you to share your experiences with Navy Federal direct deposit, ask questions, or explore more about how this service can benefit your financial management. Together, let's make managing finances easier and more accessible for everyone.