Intro

Discover 5 essential Navy insurance tips, including military coverage, veteran benefits, and naval service protection, to ensure financial security for servicemembers and families through informed insurance decisions.

Being a part of the navy comes with its own set of unique challenges and risks. As a member of the naval forces, it's essential to have the right insurance coverage to protect yourself and your loved ones from unforeseen circumstances. In this article, we'll delve into the world of navy insurance, exploring the top tips to help you make informed decisions about your coverage.

As a navy personnel, you're entitled to various insurance benefits, but navigating the complex world of insurance can be overwhelming. With so many options available, it's crucial to understand what you need and how to get the most out of your insurance policy. Whether you're a seasoned veteran or just starting your naval career, having the right insurance coverage can provide peace of mind and financial security.

From understanding the different types of insurance available to navigating the claims process, we'll cover it all. Our goal is to empower you with the knowledge you need to make informed decisions about your insurance coverage, ensuring that you and your loved ones are protected in the event of an unexpected incident. With that said, let's dive into the top 5 navy insurance tips to help you get started.

Understanding Navy Insurance Options

Some of the most common types of navy insurance include:

- Servicemembers' Group Life Insurance (SGLI)

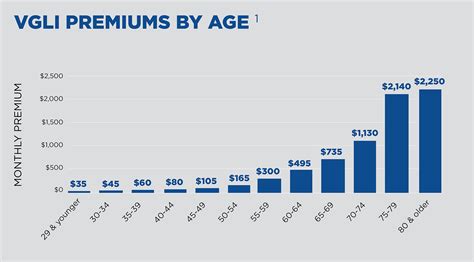

- Veterans' Group Life Insurance (VGLI)

- Family Servicemembers' Group Life Insurance (FSGLI)

- Traumatic Injury Protection (TSGLI)

- Service-Disabled Veterans' Insurance (RH Insurance)

Benefits of Navy Insurance

Each type of insurance offers unique benefits and advantages. For example, SGLI provides low-cost life insurance coverage to personnel, while VGLI offers lifetime renewable term insurance to veterans. FSGLI, on the other hand, provides life insurance coverage to spouses and children of personnel. Understanding the benefits of each type of insurance can help you make informed decisions about your coverage.Choosing the Right Insurance Policy

By considering these factors, you can narrow down your options and choose a policy that meets your unique needs and circumstances.

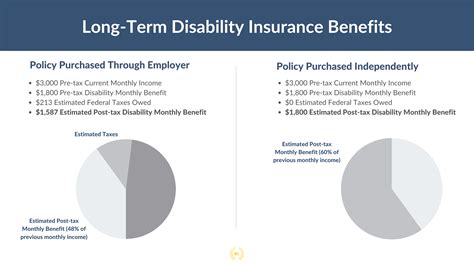

Understanding Insurance Premiums

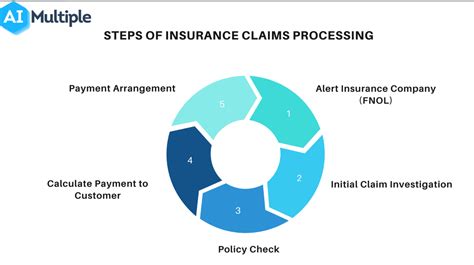

Insurance premiums can vary significantly depending on the type of policy, your age, and other factors. It's essential to understand how premiums work and how they can impact your coverage. For example, some policies may offer lower premiums but higher deductibles, while others may offer more comprehensive coverage but higher premiums.Navigating the Claims Process

To navigate the claims process successfully, be sure to:

- Keep detailed records and documentation

- Follow the insurance company's procedures and guidelines

- Be patient and persistent

- Seek help and support if needed

Common Mistakes to Avoid

When it comes to navy insurance, there are several common mistakes to avoid. These include: * Not understanding the terms and conditions of your policy * Not keeping accurate records and documentation * Not reviewing and updating your policy regularly * Not seeking help and support when neededBy avoiding these common mistakes, you can ensure that you have the right coverage and support when you need it most.

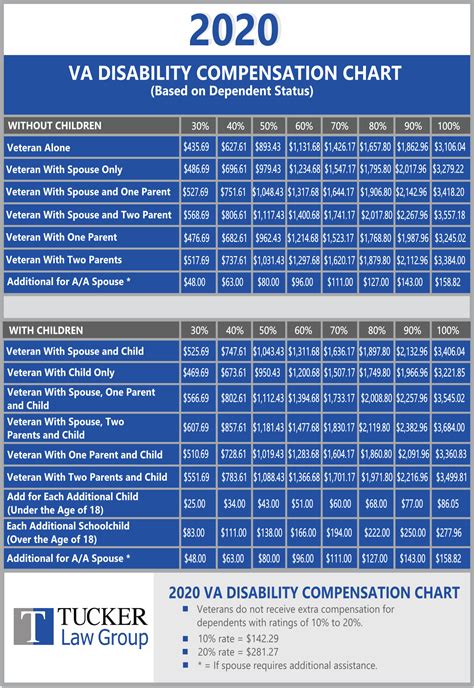

Maximizing Your Insurance Benefits

By maximizing your benefits, you can ensure that you and your loved ones are protected and supported in the event of an unexpected incident.

Additional Resources and Support

If you're struggling to understand your navy insurance options or need additional support, there are several resources available to help. These include: * Military insurance websites and portals * Insurance company customer service * Military support groups and organizations * Financial advisors and plannersBy taking advantage of these resources, you can get the help and support you need to make informed decisions about your insurance coverage.

Staying Informed and Up-to-Date

By staying informed, you can ensure that you have the latest information and resources to make informed decisions about your insurance coverage.

Navy Insurance Image Gallery

What is the purpose of navy insurance?

+The purpose of navy insurance is to provide financial protection and support to personnel and their families in the event of an unexpected incident or injury.

What types of insurance are available to navy personnel?

+There are several types of insurance available to navy personnel, including life insurance, health insurance, disability insurance, and more.

How do I choose the right insurance policy for my needs?

+To choose the right insurance policy, consider your age, health, financial situation, dependents, and military career, and review and compare different policies to find the best fit for your needs.

What is the claims process for navy insurance?

+The claims process for navy insurance typically involves providing documentation and evidence to support your claim, and the insurance company will review and process your claim accordingly.

Where can I find additional resources and support for navy insurance?

+Additional resources and support for navy insurance can be found through military insurance websites and portals, insurance company customer service, military support groups and organizations, and financial advisors and planners.

In conclusion, navy insurance is a vital aspect of protecting yourself and your loved ones from unforeseen circumstances. By understanding your options, choosing the right policy, navigating the claims process, maximizing your benefits, and staying informed, you can ensure that you have the right coverage and support when you need it most. We hope that this article has provided you with the knowledge and resources you need to make informed decisions about your navy insurance. If you have any further questions or concerns, please don't hesitate to reach out. Share this article with your fellow navy personnel and let's work together to ensure that we're all protected and supported.