Intro

Maximize your naval career with 5 Navy Retirement Tips, including pension planning, veterans benefits, and transition strategies for a smooth military-to-civilian shift.

Transitioning from a military career to civilian life can be a significant challenge, especially when it comes to planning for retirement. For those serving in the Navy, understanding the specifics of Navy retirement and how to maximize its benefits is crucial for a secure and comfortable post-service life. The process involves not only navigating the complexities of military retirement pay and benefits but also making informed decisions about career transition, education, and personal finance.

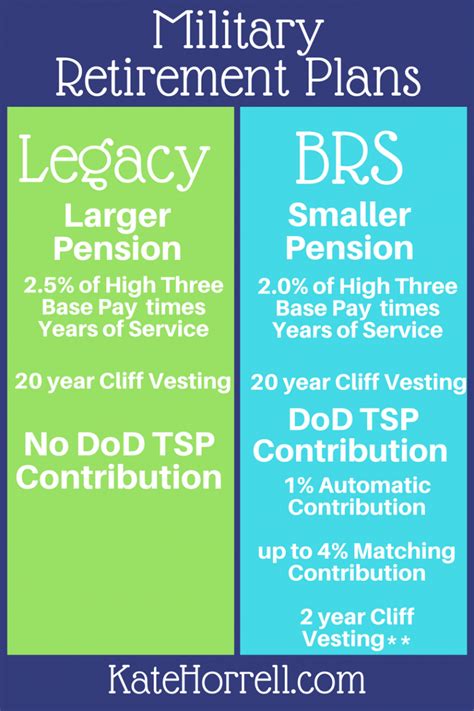

Navy personnel have access to a unique set of benefits designed to reward their service and facilitate a successful transition to civilian life. From the moment of enlistment, servicemembers should be thinking about their long-term financial goals and how their military service can contribute to achieving them. This includes understanding the Thrift Savings Plan (TSP), a retirement savings plan that offers a match to servicemembers' contributions, similar to a 401(k) in the civilian sector.

The Navy's retirement system is structured to provide a pension after 20 years of service, but there are many factors to consider when deciding whether to stay in for 20 years or to separate earlier. For those who choose to retire from the Navy, careful planning is necessary to ensure a smooth transition. This planning involves not just financial considerations but also career development, as many skills learned in the Navy are highly transferable to the civilian job market.

Navy Retirement Overview

Understanding the basics of Navy retirement is the first step in planning for the future. The Navy offers a defined benefit plan, where retirement pay is based on the servicemember's final pay grade and years of service. The formula for calculating retirement pay is 2.5% times the number of years served times the final base pay. This means that for every year of service, a servicemember earns 2.5% of their final base pay in retirement benefits, up to a maximum of 100% after 40 years of service.

Maximizing Retirement Benefits

To maximize retirement benefits, Navy personnel should focus on advancing in rank and staying in the service for as long as possible. Each increase in rank significantly raises the final base pay used in the retirement calculation, thereby increasing the monthly retirement pay. Additionally, servicemembers should contribute to the Thrift Savings Plan (TSP), taking advantage of any matching contributions offered by the military. This not only provides an additional source of retirement income but also allows for tax-deferred growth of the investment.

Key Considerations for Maximizing Benefits

- **Promotions:** Focus on career advancement to increase the final pay grade. - **Length of Service:** Stay in the Navy for at least 20 years to be eligible for retirement benefits. - **Thrift Savings Plan (TSP):** Contribute to the TSP and take advantage of any employer matching contributions. - **Education and Training:** Utilize Navy education benefits to enhance skills and increase career opportunities.Transitioning to Civilian Life

Transitioning from the Navy to civilian life involves more than just leaving the military; it requires a strategic plan for the next phase of life. This includes career planning, where skills learned in the Navy are translated into civilian job opportunities. The Navy offers transition assistance programs to help servicemembers prepare for this change, including resume building, interview skills, and education counseling.

Transition Assistance Programs

- **Transition Assistance Program (TAP):** Mandatory for all separating servicemembers, TAP provides assistance with career transition. - **Disabled Transition Assistance Program (DTAP):** For servicemembers with disabilities, offering specialized assistance. - **Career Readiness Standards:** Ensures servicemembers are prepared for transition by meeting specific career readiness standards.Financial Planning for Retirement

Financial planning is a critical component of Navy retirement planning. This involves not just saving for retirement through the TSP but also managing debt, creating a budget, and planning for healthcare costs. The military offers various resources to help servicemembers manage their finances effectively, including financial counseling services and online planning tools.

Financial Planning Strategies

- **Budgeting:** Create a budget that accounts for reduced income in retirement. - **Debt Management:** Pay off high-interest debt before retirement. - **Healthcare Planning:** Understand healthcare options in retirement, including TRICARE and Medicare. - **Investment Planning:** Consider other investment vehicles in addition to the TSP for retirement savings.Navy Retirement Benefits

Navy retirement benefits extend beyond pension pay and include access to base facilities, commissary and exchange privileges, and healthcare through TRICARE. Additionally, retired servicemembers are eligible for veterans' benefits, including home loan guarantees, education assistance, and employment preference. Understanding these benefits and how to access them is essential for maximizing the value of Navy retirement.

Comprehensive Benefits Package

- **Base Privileges:** Access to base facilities, including gyms, libraries, and recreational facilities. - **Commissary and Exchange:** Shopping privileges at reduced prices. - **TRICARE:** Healthcare coverage for retirees and their families. - **Veterans' Benefits:** Eligibility for VA loans, education benefits, and job preference.Final Preparations for Retirement

As the retirement date approaches, there are several final preparations to make. This includes applying for retirement, which involves submitting paperwork and attending a final physical exam. Retirees should also update their contact information with the Defense Finance and Accounting Service (DFAS) to ensure timely receipt of retirement pay and other benefits.

Retirement Application Process

- **Submit Retirement Request:** Formal request for retirement through the appropriate channels. - **Final Physical Exam:** Required for all retirees to assess health status. - **Update Contact Information:** Ensure DFAS has current contact information for benefit payments.Navy Retirement Image Gallery

What are the eligibility requirements for Navy retirement?

+To be eligible for Navy retirement, servicemembers must have completed at least 20 years of active duty service. The years of service can include time spent in other branches of the military, provided the servicemember is currently serving in the Navy.

How is Navy retirement pay calculated?

+Navy retirement pay is calculated based on 2.5% times the number of years served times the final base pay. For example, a servicemember who retires after 20 years of service with a final base pay of $60,000 per year would receive 50% of their final base pay, or $30,000 per year, in retirement benefits.

What benefits are available to Navy retirees?

+Navy retirees are eligible for a range of benefits, including retirement pay, access to base facilities, commissary and exchange privileges, healthcare through TRICARE, and veterans' benefits such as home loan guarantees and education assistance.

In conclusion, planning for Navy retirement requires careful consideration of a range of factors, from maximizing retirement benefits through career advancement and savings, to transitioning smoothly into civilian life. By understanding the Navy's retirement system, taking advantage of available benefits, and planning strategically, servicemembers can set themselves up for a secure and fulfilling post-military life. Whether you're just starting your Navy career or approaching retirement, it's never too early or too late to start planning for your future. Consider sharing your experiences or tips for successful Navy retirement planning in the comments below, and don't forget to share this article with anyone who might benefit from the insights and advice provided here.