Intro

Master 5 Navy Chit Tips for efficient financial management, including budgeting, saving, and investing strategies, with expert advice on chit fund benefits and risks.

The art of managing finances effectively is crucial for individuals from all walks of life, including those in the military. For Navy personnel, understanding how to handle their finances wisely can make a significant difference in their quality of life and long-term financial stability. One tool that has been used historically for managing small, informal loans or debts among friends, colleagues, or within close-knit communities like the military is the "chit" system. Although the term "chit" can refer to different things in various contexts, in the realm of personal finance and social interactions, it often relates to a system of tracking debts or favors. Here, we'll explore five tips related to the concept of a "Navy chit" in the context of financial management and social reciprocity.

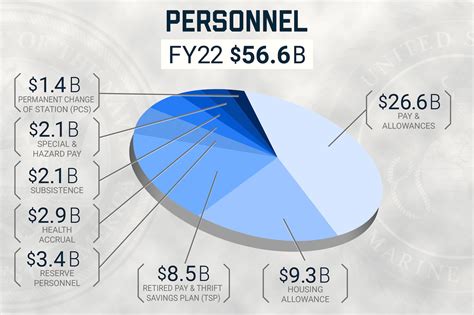

Financial discipline is the cornerstone of any successful financial plan. For Navy personnel, who may face unique financial challenges such as frequent deployments and variable income, maintaining a tight grip on finances is essential. This involves tracking every expense, no matter how small, to understand where money is going and to make informed decisions about spending and saving. In the context of a "chit" system, this means diligently recording every transaction, whether it's a loan between friends or a shared expense, to avoid misunderstandings and ensure that debts are repaid.

Effective communication is key to any successful relationship, and this is especially true when it comes to financial transactions, even those as informal as a chit system. Clear and open communication helps prevent misunderstandings and ensures that all parties are on the same page regarding debts, repayment terms, and expectations. For Navy personnel, who often rely on their comrades for support and camaraderie, maintaining transparent and respectful communication about financial matters can help preserve relationships and reduce stress.

Budgeting is a fundamental aspect of financial management. It involves creating a plan for how money will be allocated towards different expenses, savings, and debt repayment. For those using a chit system, budgeting is crucial to ensure that repayments can be made on time and that taking on debt does not compromise other financial obligations. Navy personnel, with their unique financial challenges, must be particularly adept at budgeting, taking into account irregular income, the cost of living in different deployment locations, and the need to save for long-term goals such as retirement or buying a home.

Understanding interest rates and the true cost of borrowing is vital for anyone considering taking on debt, including through informal systems like chits. Even in a system based on reciprocity and trust, it's essential to have a clear understanding of what is being borrowed and what is expected in return. For Navy personnel, who may face financial stress due to their service, avoiding high-interest debt and seeking out low-cost borrowing options when necessary can make a significant difference in their financial health.

Finally, building an emergency fund is a critical component of financial stability. This fund acts as a cushion against unexpected expenses or financial shocks, such as car repairs, medical bills, or losing income due to deployment. For Navy personnel using a chit system or any other form of informal lending, having an emergency fund in place can provide peace of mind and prevent the need for costly borrowing. It's recommended to save enough to cover at least three to six months of living expenses, though this amount can vary based on individual circumstances.

Introduction to Navy Chit Systems

Benefits of Using a Chit System

Challenges and Considerations

Best Practices for Managing a Chit System

Alternatives to Chit Systems

Conclusion and Next Steps

Navy Chit System Image Gallery

What is a chit system, and how does it work?

+A chit system is an informal method of tracking and managing small debts or favors among individuals. It works by recording transactions and relying on trust and reciprocity for repayment.

What are the benefits of using a chit system for Navy personnel?

+The benefits include fostering a sense of community, providing access to small amounts of credit, and promoting financial discipline. However, it's crucial to manage such a system carefully to avoid financial difficulties.

How can Navy personnel ensure they are managing their finances effectively while using a chit system?

+They can do so by setting clear terms and expectations, maintaining detailed records, establishing a fair repayment schedule, and avoiding excessive debt. Additionally, understanding interest rates and building an emergency fund are key to long-term financial stability.

What alternatives are available to Navy personnel who prefer not to use a chit system?

+Alternatives include traditional banking services, credit unions, peer-to-peer lending platforms, and financial assistance programs specifically designed for military personnel. The best option will depend on the individual's financial situation and needs.

How can Navy personnel seek help if they are experiencing financial difficulties?

+They can seek help through financial counseling services provided by the military, non-profit organizations that offer financial assistance to veterans and active-duty personnel, and by reaching out to their command or a financial advisor for guidance.

We hope this comprehensive guide to Navy chit systems and financial management has been informative and helpful. Whether you're a Navy personnel looking to manage your finances more effectively or simply interested in understanding the unique financial challenges and opportunities available to those in the military, we encourage you to share your thoughts and experiences in the comments below. Your insights can help others navigate their financial journeys and make more informed decisions about their financial health. Additionally, if you found this article useful, please consider sharing it with others who might benefit from this information. Together, we can work towards promoting financial literacy and stability for all.