Intro

Discover the NYC ASP Calendar Guide, featuring after-school programs, activities, and events for kids, including sports, arts, and enrichment classes, in New York Citys public schools.

The NYC ASP calendar is a crucial tool for individuals and organizations involved in the New York City real estate market. Understanding the intricacies of this calendar can help investors, developers, and homeowners navigate the complex world of property taxes and assessments. In this article, we will delve into the world of the NYC ASP calendar, exploring its importance, benefits, and key features.

The NYC ASP calendar is published annually by the New York City Department of Finance, providing a comprehensive guide to the city's property tax assessment and collection process. This calendar outlines important deadlines, procedures, and requirements for property owners, including the filing of tax returns, payment of taxes, and resolution of disputes. By familiarizing themselves with the NYC ASP calendar, property owners can avoid penalties, fines, and other complications that may arise from non-compliance.

The importance of the NYC ASP calendar cannot be overstated. With millions of dollars in property taxes at stake, it is essential for property owners to stay informed about the assessment and collection process. The calendar provides a roadmap for navigating the complex world of property taxes, helping owners to plan and budget accordingly. Whether you are a seasoned investor or a first-time homeowner, understanding the NYC ASP calendar is crucial for making informed decisions about your property.

NYC ASP Calendar Overview

The NYC ASP calendar is divided into several key sections, each outlining a specific aspect of the property tax assessment and collection process. These sections include the tax year, assessment dates, filing deadlines, and payment schedules. By reviewing these sections, property owners can gain a deeper understanding of the NYC ASP calendar and its relevance to their specific situation.

One of the most critical components of the NYC ASP calendar is the tax year, which runs from July 1 to June 30. During this period, property owners are required to file their tax returns and pay any outstanding taxes. The calendar also outlines the assessment dates, which are used to determine the value of properties for tax purposes. These dates are typically set in January and July, with property owners receiving notices of their assessed values shortly thereafter.

Key Features of the NYC ASP Calendar

The NYC ASP calendar includes several key features that are essential for property owners to understand. These features include: * Tax year: The period from July 1 to June 30 during which property taxes are assessed and collected. * Assessment dates: The dates used to determine the value of properties for tax purposes, typically set in January and July. * Filing deadlines: The dates by which property owners must file their tax returns and pay any outstanding taxes. * Payment schedules: The schedules outlining the payment of property taxes, including the due dates and amounts.By familiarizing themselves with these key features, property owners can navigate the complex world of property taxes with confidence. Whether you are a seasoned investor or a first-time homeowner, understanding the NYC ASP calendar is crucial for making informed decisions about your property.

NYC ASP Calendar Benefits

The NYC ASP calendar offers numerous benefits to property owners, including:

- Avoidance of penalties and fines: By understanding the key features and deadlines outlined in the calendar, property owners can avoid penalties and fines associated with late filing or payment.

- Improved budgeting: The calendar provides a roadmap for navigating the complex world of property taxes, helping owners to plan and budget accordingly.

- Increased transparency: The NYC ASP calendar provides a clear and transparent guide to the property tax assessment and collection process, helping owners to understand their obligations and responsibilities.

By taking advantage of these benefits, property owners can save time, money, and stress. Whether you are a seasoned investor or a first-time homeowner, understanding the NYC ASP calendar is essential for making informed decisions about your property.

Practical Applications of the NYC ASP Calendar

The NYC ASP calendar has numerous practical applications, including: * Tax planning: The calendar provides a roadmap for navigating the complex world of property taxes, helping owners to plan and budget accordingly. * Dispute resolution: The calendar outlines the procedures for resolving disputes related to property tax assessments and collections. * Property management: The calendar provides a clear and transparent guide to the property tax assessment and collection process, helping owners to understand their obligations and responsibilities.By applying the knowledge and insights gained from the NYC ASP calendar, property owners can make informed decisions about their properties and avoid costly mistakes.

NYC ASP Calendar Steps

The NYC ASP calendar outlines several key steps that property owners must follow, including:

- Filing tax returns: Property owners must file their tax returns by the designated deadline, typically in January or July.

- Paying taxes: Property owners must pay any outstanding taxes by the designated deadline, typically in January or July.

- Resolving disputes: Property owners who dispute their tax assessments or collections must follow the procedures outlined in the calendar.

By following these steps, property owners can ensure compliance with the NYC ASP calendar and avoid penalties, fines, and other complications.

NYC ASP Calendar FAQs

Some frequently asked questions about the NYC ASP calendar include: * What is the tax year for the NYC ASP calendar? * How are property taxes assessed and collected in New York City? * What are the key features and deadlines outlined in the NYC ASP calendar?By understanding the answers to these questions, property owners can gain a deeper understanding of the NYC ASP calendar and its relevance to their specific situation.

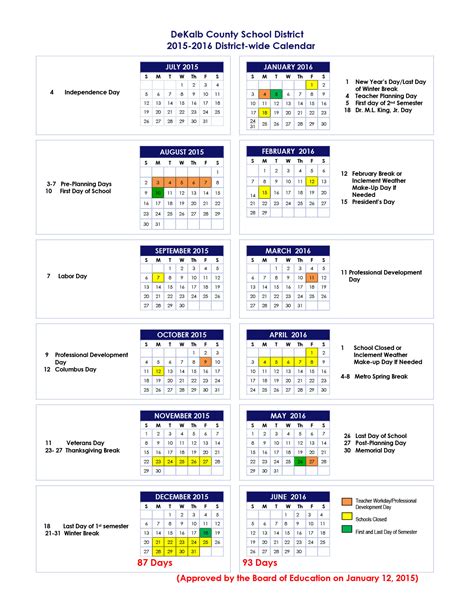

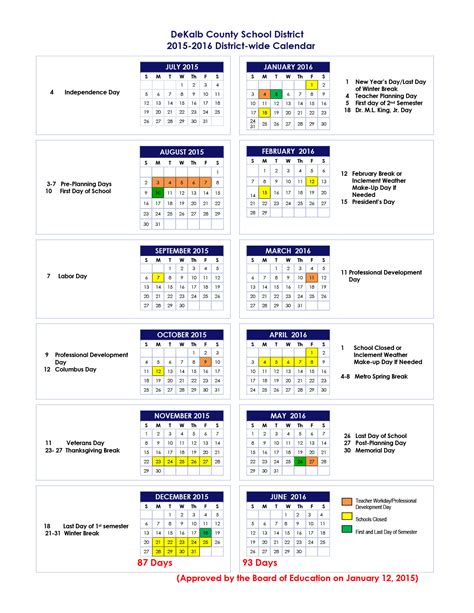

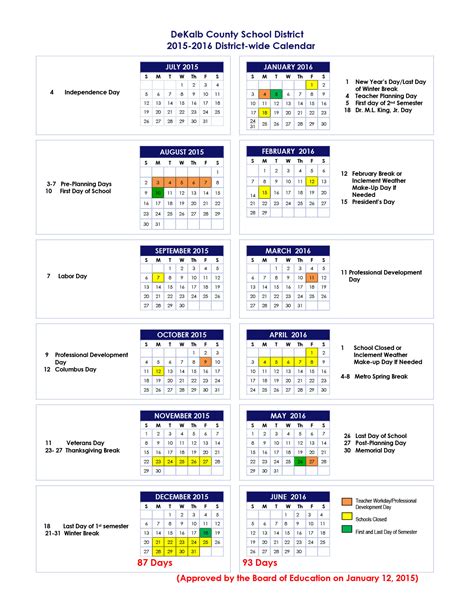

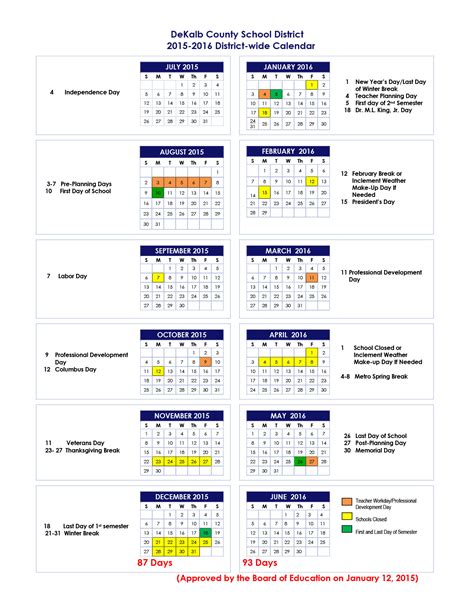

NYC ASP Calendar Gallery

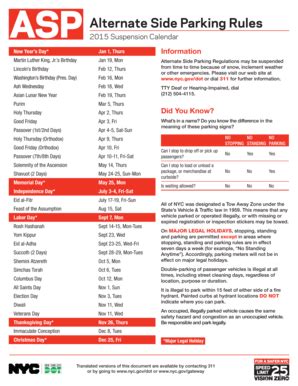

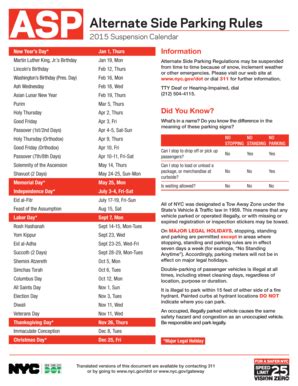

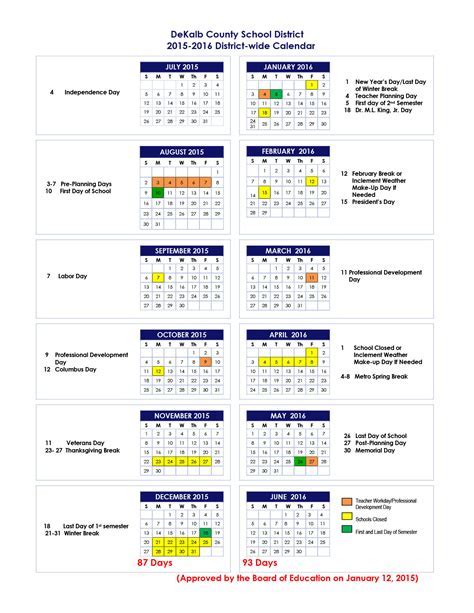

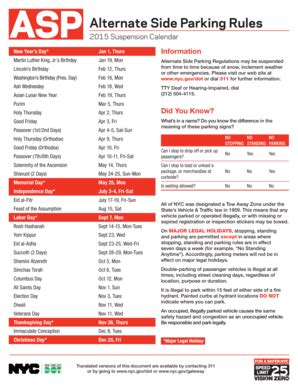

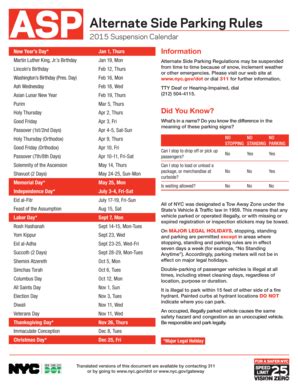

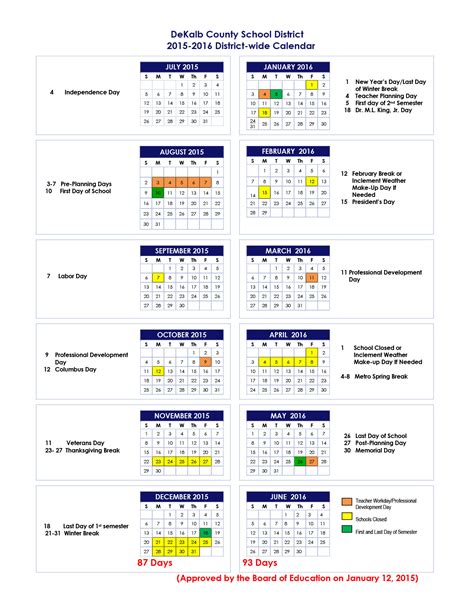

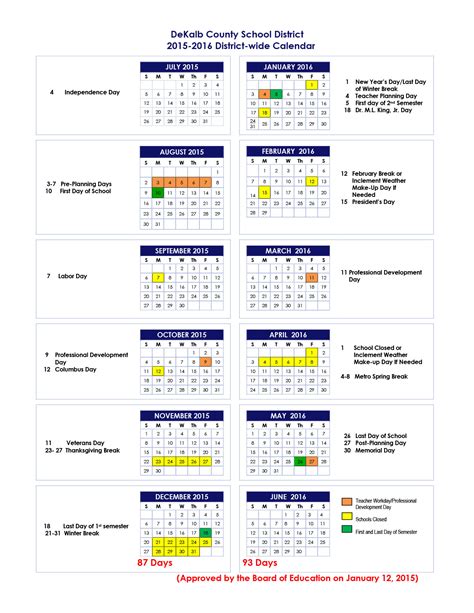

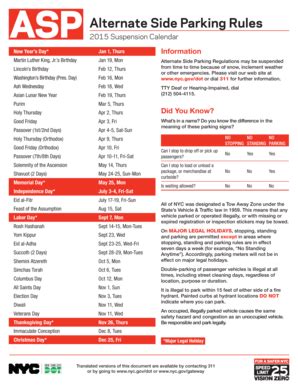

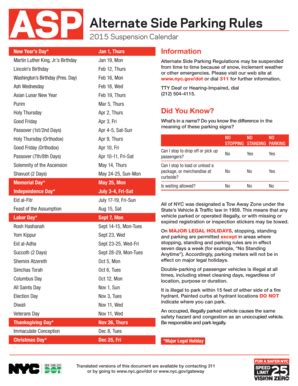

The following gallery provides a visual representation of the NYC ASP calendar, highlighting its key features and deadlines.

NYC ASP Calendar Image Gallery

NYC ASP Calendar FAQs

What is the NYC ASP calendar?

+The NYC ASP calendar is a comprehensive guide to the New York City property tax assessment and collection process.

How do I file my tax return?

+Property owners must file their tax returns by the designated deadline, typically in January or July.

What are the key features of the NYC ASP calendar?

+The NYC ASP calendar includes the tax year, assessment dates, filing deadlines, and payment schedules.

In conclusion, the NYC ASP calendar is a vital tool for property owners in New York City. By understanding its key features and deadlines, property owners can navigate the complex world of property taxes with confidence. Whether you are a seasoned investor or a first-time homeowner, it is essential to stay informed about the NYC ASP calendar and its relevance to your specific situation. We invite you to share your thoughts and experiences with the NYC ASP calendar in the comments below. Additionally, we encourage you to share this article with others who may benefit from its insights and information.