Intro

Discover the Old Navy Barclay Credit Cards benefits, rewards, and drawbacks in this in-depth review, covering cashback, discounts, and exclusive perks for frequent shoppers.

The world of credit cards can be overwhelming, with numerous options available to consumers. One such option is the Old Navy Barclay Credit Card, which is designed specifically for frequent shoppers at Old Navy and its sister stores. In this article, we will delve into the details of this credit card, exploring its benefits, drawbacks, and overall value proposition. Whether you're a die-hard Old Navy fan or just a casual shopper, this review aims to provide you with a comprehensive understanding of what the Old Navy Barclay Credit Card has to offer.

For those who regularly shop at Old Navy, Gap, Banana Republic, or Athleta, the Old Navy Barclay Credit Card can be a great way to earn rewards and save money. The card offers a rewards program that allows cardholders to earn points for every dollar spent, which can be redeemed for discounts and other perks. Additionally, cardholders can enjoy exclusive benefits, such as early access to sales and special promotions. However, as with any credit card, it's essential to carefully consider the terms and conditions before applying.

The Old Navy Barclay Credit Card is issued by Barclays, a well-established bank with a reputation for providing high-quality credit card products. The card is designed to be used at Old Navy and its sister stores, but it can also be used anywhere Visa is accepted. This makes it a versatile option for those who want to earn rewards and enjoy benefits both in-store and online.

Benefits and Features

The Old Navy Barclay Credit Card offers a range of benefits and features that make it an attractive option for frequent shoppers. Some of the key benefits include:

- 5 points for every $1 spent at Old Navy, Gap, Banana Republic, and Athleta

- 1 point for every $1 spent elsewhere

- Exclusive access to sales and promotions

- Early access to new arrivals and special offers

- Free shipping on online orders

- Birthday bonus points

In addition to these benefits, the Old Navy Barclay Credit Card also offers a rewards program that allows cardholders to earn points for every dollar spent. These points can be redeemed for discounts, free merchandise, and other perks. The program is relatively straightforward, with cardholders earning 5 points for every $1 spent at Old Navy and its sister stores, and 1 point for every $1 spent elsewhere.

How the Rewards Program Works

The rewards program is designed to be easy to use and understand. Cardholders earn points for every dollar spent, and these points can be redeemed for rewards. The rewards program is tiered, with cardholders earning more points for every dollar spent as they reach certain spending thresholds. For example, cardholders who spend $1,000 or more in a calendar year earn 20% more points on all purchases.Application and Approval Process

The application and approval process for the Old Navy Barclay Credit Card is relatively straightforward. Applicants can apply online or in-store, and the approval process typically takes just a few minutes. To be eligible for the card, applicants must be at least 18 years old, have a valid Social Security number, and have a physical address in the United States.

The approval process involves a credit check, and applicants with good credit are more likely to be approved. However, even those with poor credit may be eligible for the card, although they may be offered a lower credit limit or a higher interest rate.

Credit Score Requirements

The credit score requirements for the Old Navy Barclay Credit Card are relatively lenient. Applicants with good credit, typically defined as a credit score of 700 or higher, are more likely to be approved. However, even those with poor credit, typically defined as a credit score below 600, may be eligible for the card. In these cases, the credit limit may be lower, and the interest rate may be higher.Fees and Interest Rates

The Old Navy Barclay Credit Card has several fees and interest rates that cardholders should be aware of. These include:

- Annual fee: $0

- Interest rate: 26.99% (variable)

- Late fee: up to $38

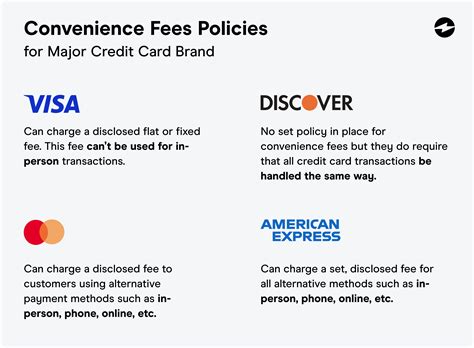

- Foreign transaction fee: 3%

The interest rate is variable, which means it can change over time. The late fee is charged when a payment is late, and the foreign transaction fee is charged when the card is used outside the United States.

Avoiding Fees and Interest

To avoid fees and interest, cardholders should make their payments on time and pay their balance in full each month. This will help to avoid the late fee and interest charges. Additionally, cardholders should avoid using the card for foreign transactions, as the foreign transaction fee can add up quickly.Customer Service

The Old Navy Barclay Credit Card offers customer service 24/7. Cardholders can contact customer service by phone, email, or online chat. The customer service team is available to answer questions, resolve issues, and provide assistance with account management.

Online Account Management

Cardholders can manage their account online, including paying their bill, checking their balance, and viewing their transaction history. The online account management system is secure and easy to use, and cardholders can access it from anywhere with an internet connection.Security and Protection

The Old Navy Barclay Credit Card offers several security and protection features, including:

- Zero liability protection: cardholders are not responsible for unauthorized transactions

- Identity theft protection: cardholders are protected against identity theft

- Fraud monitoring: the card issuer monitors accounts for suspicious activity

These security and protection features provide cardholders with peace of mind, knowing that their account is protected against unauthorized activity.

Additional Security Measures

Cardholders can take additional security measures to protect their account, such as: * Monitoring their account activity regularly * Reporting suspicious activity immediately * Keeping their account information confidentialBy taking these additional security measures, cardholders can help to prevent unauthorized activity and protect their account.

Old Navy Barclay Credit Card Image Gallery

What are the benefits of the Old Navy Barclay Credit Card?

+The Old Navy Barclay Credit Card offers several benefits, including 5 points for every $1 spent at Old Navy, Gap, Banana Republic, and Athleta, exclusive access to sales and promotions, and early access to new arrivals and special offers.

How do I apply for the Old Navy Barclay Credit Card?

+Applicants can apply online or in-store, and the approval process typically takes just a few minutes. To be eligible for the card, applicants must be at least 18 years old, have a valid Social Security number, and have a physical address in the United States.

What is the interest rate on the Old Navy Barclay Credit Card?

+The interest rate on the Old Navy Barclay Credit Card is 26.99% (variable), which means it can change over time.

In summary, the Old Navy Barclay Credit Card is a great option for frequent shoppers at Old Navy and its sister stores. The card offers a range of benefits, including rewards points, exclusive access to sales and promotions, and early access to new arrivals and special offers. While the interest rate is variable, cardholders can avoid interest charges by paying their balance in full each month. Overall, the Old Navy Barclay Credit Card is a great choice for those who want to earn rewards and enjoy benefits both in-store and online. We invite you to share your thoughts and experiences with the Old Navy Barclay Credit Card in the comments below.