Intro

Unlock rewards with Old Navy Credit Card tips, including payment hacks, rewards redemption, and exclusive discounts, to maximize shopping benefits and credit score management.

The Old Navy credit card is a popular choice among shoppers who frequent Old Navy, Gap, Banana Republic, and Athleta stores. With its rewards program and exclusive discounts, it can be a valuable tool for saving money and earning points. However, like any credit card, it's essential to use it wisely to maximize its benefits and avoid potential pitfalls. In this article, we'll explore five Old Navy credit card tips to help you get the most out of your card.

Using a credit card responsibly requires a combination of financial discipline and knowledge of the card's terms and benefits. By understanding how to use your Old Navy credit card effectively, you can enjoy rewards, discounts, and exclusive offers while maintaining a healthy financial profile. Whether you're a seasoned credit card user or new to the world of credit, these tips will help you navigate the benefits and potential drawbacks of the Old Navy credit card.

The Old Navy credit card is designed to reward frequent shoppers with points, discounts, and special offers. By taking advantage of these benefits, you can save money, earn rewards, and enhance your shopping experience. However, it's crucial to remember that credit cards can also lead to overspending and debt if not used responsibly. By following these five tips, you can enjoy the benefits of your Old Navy credit card while maintaining a healthy financial outlook.

Understanding the Old Navy Credit Card Rewards Program

How to Earn Points with the Old Navy Credit Card

Earning points with the Old Navy credit card is straightforward. For every dollar you spend at Old Navy, Gap, Banana Republic, and Athleta stores, you'll earn five points. For every dollar spent on other purchases, you'll earn two points. You can also earn bonus points during special promotions and events. By taking advantage of these opportunities, you can accumulate points quickly and redeem them for rewards.Maximizing Your Old Navy Credit Card Benefits

Old Navy Credit Card Exclusive Offers

The Old Navy credit card offers exclusive discounts, free merchandise, and special promotions to cardholders. These offers can help you save money and enjoy more rewards. You'll receive notifications about upcoming events, sales, and promotions, allowing you to plan your shopping trips and maximize your savings. By taking advantage of these offers, you can enjoy more benefits and enhance your shopping experience.Managing Your Old Navy Credit Card Account

Old Navy Credit Card Account Alerts

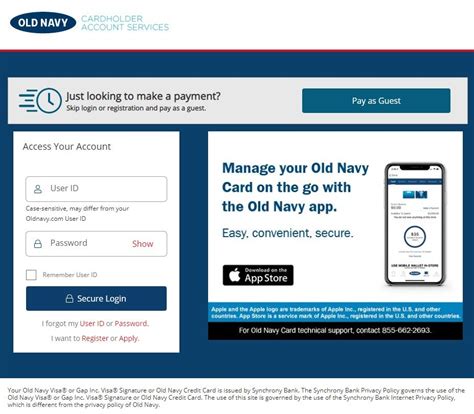

The Old Navy credit card offers account alerts to help you stay on top of your account activity. You can set up alerts for payment due dates, account balances, and credit limit notifications. These alerts can help you avoid late fees, interest charges, and negative credit reporting. By staying informed about your account activity, you can manage your credit card effectively and maintain a healthy financial profile.Avoiding Common Pitfalls with the Old Navy Credit Card

Old Navy Credit Card Interest Rates and Fees

The Old Navy credit card has an interest rate and fees associated with it. The interest rate can range from 15.99% to 25.99% APR, depending on your creditworthiness. You'll also be charged fees for late payments, foreign transactions, and balance transfers. By understanding these rates and fees, you can avoid accumulating debt and minimize your costs. You should also pay your bills on time and keep your credit utilization ratio low to avoid negative credit reporting.Using the Old Navy Credit Card for Everyday Purchases

Old Navy Credit Card Cashback and Rewards Programs

The Old Navy credit card offers a rewards program that allows you to earn points for every dollar spent. You can redeem these points for discounts, free merchandise, and exclusive offers. By taking advantage of this program, you can save money and enjoy more rewards. You should also consider other cashback and rewards programs, such as the Chase Sapphire Preferred or Capital One Quicksilver Cash Rewards Credit Card.Old Navy Credit Card Image Gallery

What are the benefits of the Old Navy credit card?

+The Old Navy credit card offers rewards, discounts, and exclusive offers to cardholders. You can earn points for every dollar spent, redeem them for rewards, and enjoy special promotions and events.

How do I apply for the Old Navy credit card?

+You can apply for the Old Navy credit card online or in-store. You'll need to provide personal and financial information, such as your name, address, income, and credit history.

What is the interest rate on the Old Navy credit card?

+The interest rate on the Old Navy credit card ranges from 15.99% to 25.99% APR, depending on your creditworthiness. You'll also be charged fees for late payments, foreign transactions, and balance transfers.

Can I use my Old Navy credit card for everyday purchases?

+Yes, you can use your Old Navy credit card for everyday purchases, such as gas, groceries, and dining out. You'll earn points for every dollar spent and can redeem them for rewards.

How do I manage my Old Navy credit card account?

+You can manage your Old Navy credit card account online or through the mobile app. You can pay your bills, monitor your account activity, and set up account alerts to stay on top of your account.

In