Intro

Avoid common Navy Federal mistakes with expert tips. Learn from 5 oops moments, including credit score errors, loan blunders, and account mismanagement, to improve financial management and banking security.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. As a member-owned cooperative, Navy Federal provides a wide range of financial products and services to its members, including checking and savings accounts, loans, credit cards, and investment services. However, like any other financial institution, Navy Federal is not immune to mistakes. In this article, we will explore 5 common mistakes that Navy Federal members may encounter and provide tips on how to avoid or resolve them.

The importance of being aware of these mistakes cannot be overstated. By understanding the potential pitfalls, Navy Federal members can take proactive steps to protect their financial well-being and make the most of the credit union's services. Whether you are a longtime member or just joining Navy Federal, it is essential to be informed about the potential mistakes that can occur and how to navigate them. In the following sections, we will delve into the details of each mistake, providing examples, explanations, and advice on how to avoid or resolve them.

As a member of Navy Federal, it is crucial to be vigilant and proactive in managing your finances. By being aware of the potential mistakes and taking steps to prevent them, you can ensure a smooth and successful banking experience. From avoiding overdrafts to navigating the credit union's online banking system, we will cover a range of topics that are essential for Navy Federal members to know. So, let's dive in and explore the 5 common mistakes that Navy Federal members may encounter.

Understanding Navy Federal Services

Benefits of Navy Federal Membership

Navy Federal membership comes with a range of benefits, including competitive interest rates, low fees, and exclusive discounts. Members can also take advantage of the credit union's financial education resources, including online tutorials and workshops. By understanding the benefits of Navy Federal membership, members can make the most of their membership and avoid mistakes that can cost them money.Avoiding Overdrafts

By following these tips, Navy Federal members can avoid overdrafts and the associated fees.

Understanding Overdraft Fees

Navy Federal charges an overdraft fee of $29 per transaction, up to a maximum of four transactions per day. To avoid these fees, members can take steps to prevent overdrafts, such as monitoring their account balance and setting up overdraft protection. Members can also consider opting out of overdraft protection, which can help them avoid overdraft fees but may result in declined transactions.Navigating Online Banking

By following these tips, Navy Federal members can navigate the online banking system with confidence and avoid mistakes such as unauthorized transactions.

Benefits of Online Banking

Navy Federal's online banking system offers a range of benefits, including 24/7 access to account information, bill pay, and transfer capabilities. Members can also use the system to monitor their account activity, set up account alerts, and manage their accounts on the go. By taking advantage of these benefits, members can make the most of their Navy Federal membership and avoid mistakes that can cost them time and money.Managing Credit Card Accounts

By following these tips, Navy Federal members can manage their credit card accounts effectively and avoid mistakes that can damage their credit score.

Benefits of Credit Card Rewards

Navy Federal's credit card rewards programs offer members a range of benefits, including cashback, travel points, and exclusive discounts. Members can also take advantage of the credit union's credit card benefits, such as purchase protection and travel insurance. By understanding the benefits of credit card rewards, members can make the most of their Navy Federal membership and avoid mistakes that can cost them money.Resolving Errors and Disputes

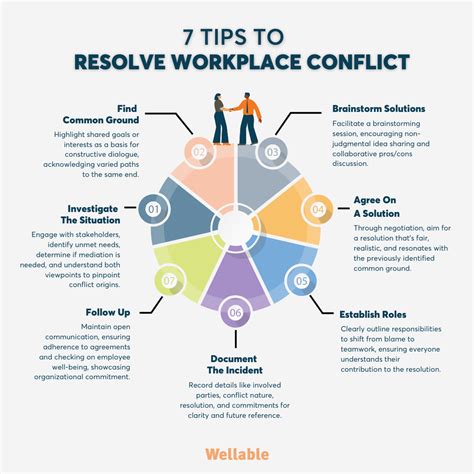

By following these tips, Navy Federal members can resolve errors and disputes quickly and efficiently, and avoid mistakes that can cost them time and money.

Benefits of Navy Federal's Dispute Resolution Process

Navy Federal's dispute resolution process is designed to provide members with a fair and efficient way to resolve errors and disputes. The process involves a series of steps, including investigation, resolution, and follow-up. By understanding the benefits of Navy Federal's dispute resolution process, members can make the most of their membership and avoid mistakes that can damage their relationship with the credit union.Navy Federal Image Gallery

What are the benefits of Navy Federal membership?

+Navy Federal membership offers a range of benefits, including competitive interest rates, low fees, and exclusive discounts. Members can also take advantage of the credit union's financial education resources, including online tutorials and workshops.

How can I avoid overdrafts?

+To avoid overdrafts, members can take several steps, including monitoring their account balance regularly, setting up overdraft protection, avoiding debit transactions that exceed their account balance, and keeping a cushion of funds in their account to cover unexpected expenses.

What are the benefits of Navy Federal's online banking system?

+Navy Federal's online banking system offers a range of benefits, including 24/7 access to account information, bill pay, and transfer capabilities. Members can also use the system to monitor their account activity, set up account alerts, and manage their accounts on the go.

How can I resolve errors and disputes?

+To resolve errors and disputes, members can take several steps, including contacting Navy Federal's customer service team, providing detailed information about the error or dispute, following up on the issue until it is resolved, and keeping a record of all correspondence and communications.

What are the benefits of Navy Federal's credit card rewards programs?

+Navy Federal's credit card rewards programs offer members a range of benefits, including cashback, travel points, and exclusive discounts. Members can also take advantage of the credit union's credit card benefits, such as purchase protection and travel insurance.

In conclusion, Navy Federal members can avoid common mistakes by understanding the credit union's services, avoiding overdrafts, navigating the online banking system, managing credit card accounts, and resolving errors and disputes. By following these tips and taking advantage of Navy Federal's resources, members can make the most of their membership and achieve their financial goals. We encourage you to share your experiences and tips for avoiding mistakes with Navy Federal in the comments below. Additionally, if you have any questions or need further clarification on any of the topics discussed, please don't hesitate to ask. By working together, we can help each other achieve financial success and make the most of our Navy Federal membership.