Intro

Discover the perks of Navy Federals Oops Program! This article reveals 5 surprising benefits for members, including waived overdraft fees, replenished funds, and improved financial peace of mind. Learn how this program can safeguard your account, reduce stress, and provide a financial safety net. Get the inside scoop on Oops Program benefits today!

As a Navy Federal member, you're likely aware of the many benefits that come with being part of one of the world's largest credit unions. One of the most valuable benefits is the Oops Program, designed to help members avoid overdraft fees and stay on top of their finances. In this article, we'll delve into the details of the Oops Program and explore its top 5 benefits for Navy Federal members.

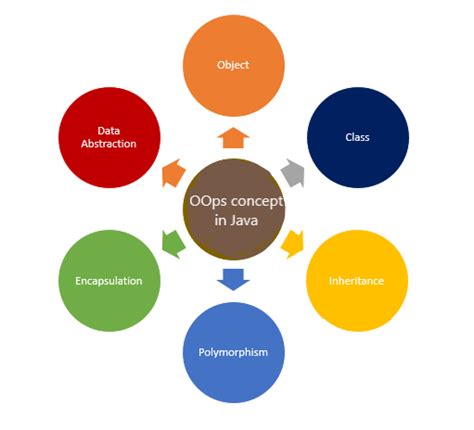

What is the Oops Program?

The Oops Program is a unique feature offered by Navy Federal to help members manage their finances and avoid overdraft fees. It's a safety net that provides an extra layer of protection against accidental overdrafts, giving members peace of mind and financial flexibility.

Benefit #1: Avoid Overdraft Fees

One of the most significant benefits of the Oops Program is the ability to avoid overdraft fees. With this program, Navy Federal members can breathe a sigh of relief knowing that they won't be charged a fee for accidental overdrafts. This can save members a significant amount of money in the long run, especially for those who tend to live paycheck to paycheck.

Benefit #2: Increased Financial Flexibility

The Oops Program provides Navy Federal members with increased financial flexibility, allowing them to manage their finances with confidence. With this program, members can make purchases or pay bills without worrying about overdraft fees, giving them more freedom to make financial decisions.

How Does it Work?

The Oops Program works by covering accidental overdrafts up to a certain amount, usually $20 or $50. If a member's account balance falls below zero, Navy Federal will cover the overdraft amount, and the member won't be charged a fee.

Benefit #3: Reduced Stress and Anxiety

The Oops Program can significantly reduce stress and anxiety related to financial management. Members can rest assured that they have a safety net in place, protecting them from overdraft fees and financial penalties.

Benefit #4: Improved Financial Management

The Oops Program encourages Navy Federal members to practice good financial management habits. By avoiding overdraft fees, members are incentivized to keep track of their account balances, monitor their spending, and make smart financial decisions.

Best Practices for Financial Management

To get the most out of the Oops Program, Navy Federal members should:

- Regularly check account balances

- Set up account alerts and notifications

- Monitor spending habits

- Create a budget and stick to it

Benefit #5: Enhanced Customer Experience

The Oops Program demonstrates Navy Federal's commitment to providing an exceptional customer experience. By offering this benefit, Navy Federal shows that it cares about its members' financial well-being and is willing to go the extra mile to help them succeed.

Oops Program Image Gallery

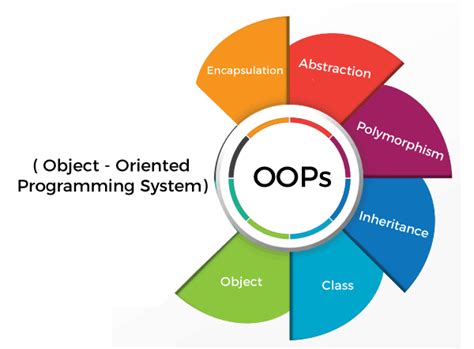

What is the Oops Program?

+The Oops Program is a benefit offered by Navy Federal to help members avoid overdraft fees and stay on top of their finances.

How does the Oops Program work?

+The Oops Program works by covering accidental overdrafts up to a certain amount, usually $20 or $50.

What are the benefits of the Oops Program?

+The Oops Program offers several benefits, including avoiding overdraft fees, increased financial flexibility, reduced stress and anxiety, improved financial management, and an enhanced customer experience.

As a Navy Federal member, taking advantage of the Oops Program can have a significant impact on your financial well-being. By avoiding overdraft fees, increasing financial flexibility, reducing stress and anxiety, improving financial management, and enhancing the customer experience, this program can help you achieve your financial goals and enjoy a more secure financial future.