Intro

Streamline payroll with Paycore Semi Monthly Payroll Calendar, featuring bi-monthly payment schedules, payroll processing, and employee compensation management for efficient payroll administration.

The Paycore semi-monthly payroll calendar is a vital tool for businesses and organizations that need to manage their payroll processes efficiently. Payroll calendars help employers stay organized and ensure that their employees are paid accurately and on time. In this article, we will delve into the importance of payroll calendars, the benefits of using a semi-monthly payroll calendar, and provide a comprehensive guide on how to create and manage a Paycore semi-monthly payroll calendar.

Payroll calendars are essential for businesses of all sizes, as they help to streamline payroll processes, reduce errors, and improve employee satisfaction. A well-structured payroll calendar enables employers to plan and manage their payroll cycles, including pay dates, pay periods, and deadlines for submitting payroll data. This, in turn, helps to ensure that employees are paid correctly and on time, which is critical for maintaining a positive and productive work environment.

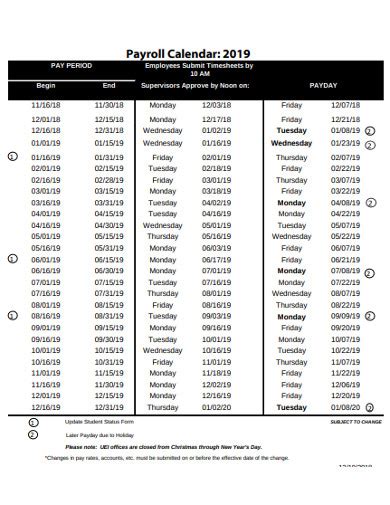

The Paycore semi-monthly payroll calendar is a popular choice among businesses, as it offers a number of benefits. With a semi-monthly payroll calendar, employees are paid twice a month, typically on the 15th and 30th of each month. This frequency of payment can help to improve cash flow for employees, as they receive their paychecks more frequently than with a monthly payroll calendar. Additionally, a semi-monthly payroll calendar can help to reduce the administrative burden on payroll staff, as there are fewer pay periods to manage each year.

Understanding the Paycore Semi-Monthly Payroll Calendar

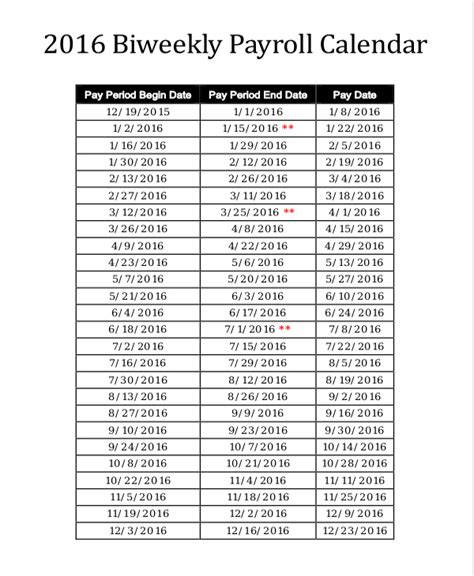

To understand the Paycore semi-monthly payroll calendar, it's essential to familiarize yourself with the key components of a payroll calendar. These include pay dates, pay periods, and deadlines for submitting payroll data. Pay dates refer to the dates on which employees receive their paychecks, while pay periods refer to the periods of time during which employees earn their pay. Deadlines for submitting payroll data are critical, as they ensure that payroll information is processed correctly and on time.

Benefits of Using a Semi-Monthly Payroll Calendar

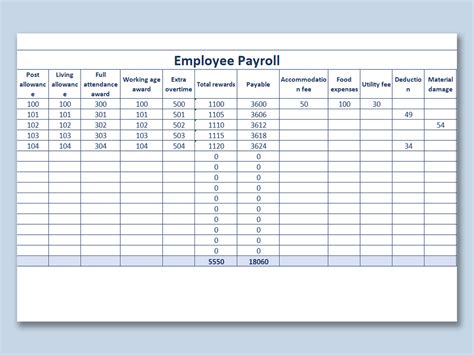

The benefits of using a semi-monthly payroll calendar are numerous. Some of the most significant advantages include: * Improved cash flow for employees * Reduced administrative burden on payroll staff * Increased accuracy and efficiency in payroll processing * Better management of payroll cycles and deadlines * Enhanced employee satisfaction and engagementCreating a Paycore Semi-Monthly Payroll Calendar

Creating a Paycore semi-monthly payroll calendar is a straightforward process that involves several key steps. These include:

- Determining pay dates and pay periods

- Setting deadlines for submitting payroll data

- Establishing a payroll processing schedule

- Communicating payroll information to employees

- Reviewing and updating the payroll calendar regularly

Steps to Manage a Paycore Semi-Monthly Payroll Calendar

To manage a Paycore semi-monthly payroll calendar effectively, follow these steps: * Review and update the payroll calendar regularly to ensure accuracy and efficiency * Communicate payroll information to employees clearly and transparently * Establish a payroll processing schedule that meets deadlines and pay dates * Monitor and manage payroll cycles and deadlines to prevent errors and delays * Continuously evaluate and improve the payroll calendar to meet the evolving needs of the business and its employeesBest Practices for Implementing a Paycore Semi-Monthly Payroll Calendar

To implement a Paycore semi-monthly payroll calendar successfully, consider the following best practices:

- Automate payroll processes wherever possible to reduce errors and increase efficiency

- Communicate payroll information to employees clearly and transparently

- Establish a payroll processing schedule that meets deadlines and pay dates

- Continuously evaluate and improve the payroll calendar to meet the evolving needs of the business and its employees

- Provide training and support to payroll staff to ensure they are equipped to manage the payroll calendar effectively

Common Challenges and Solutions

When implementing a Paycore semi-monthly payroll calendar, businesses may encounter several common challenges. These include: * Managing payroll cycles and deadlines * Ensuring accuracy and efficiency in payroll processing * Communicating payroll information to employees * Managing payroll staff and resourcesTo overcome these challenges, consider the following solutions:

- Automate payroll processes wherever possible

- Establish a payroll processing schedule that meets deadlines and pay dates

- Communicate payroll information to employees clearly and transparently

- Provide training and support to payroll staff to ensure they are equipped to manage the payroll calendar effectively

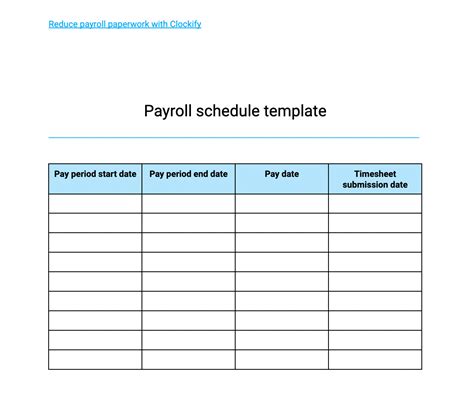

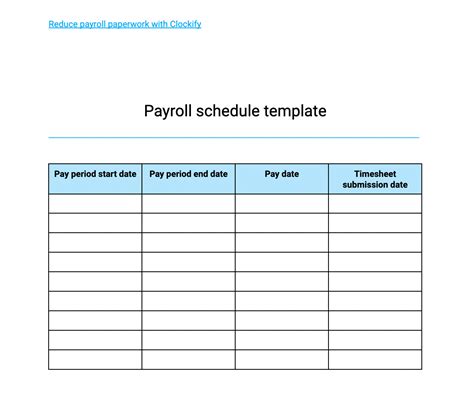

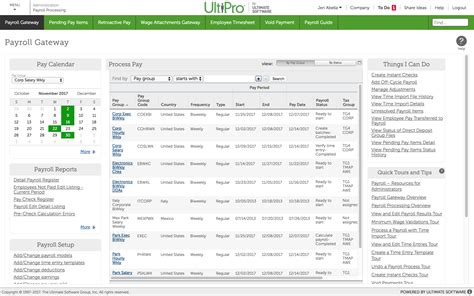

Paycore Semi-Monthly Payroll Calendar Templates

To create a Paycore semi-monthly payroll calendar, businesses can use a variety of templates and tools. These include:

- Payroll calendar templates

- Payroll scheduling software

- Payroll processing tools

- Employee communication platforms

When selecting a template or tool, consider the following factors:

- Ease of use and navigation

- Customization options

- Integration with existing payroll systems

- Scalability and flexibility

Conclusion and Next Steps

In conclusion, a Paycore semi-monthly payroll calendar is a valuable tool for businesses that need to manage their payroll processes efficiently. By understanding the benefits and challenges of using a semi-monthly payroll calendar, businesses can create and manage a payroll calendar that meets their unique needs and requirements. To get started, consider the following next steps: * Review and update the payroll calendar regularly * Communicate payroll information to employees clearly and transparently * Establish a payroll processing schedule that meets deadlines and pay dates * Continuously evaluate and improve the payroll calendar to meet the evolving needs of the business and its employeesPayroll Calendar Image Gallery

What is a Paycore semi-monthly payroll calendar?

+A Paycore semi-monthly payroll calendar is a tool used to manage payroll processes, with employees being paid twice a month, typically on the 15th and 30th of each month.

What are the benefits of using a semi-monthly payroll calendar?

+The benefits of using a semi-monthly payroll calendar include improved cash flow for employees, reduced administrative burden on payroll staff, and increased accuracy and efficiency in payroll processing.

How do I create a Paycore semi-monthly payroll calendar?

+To create a Paycore semi-monthly payroll calendar, determine pay dates and pay periods, set deadlines for submitting payroll data, establish a payroll processing schedule, and communicate payroll information to employees.

We hope this article has provided you with a comprehensive understanding of the Paycore semi-monthly payroll calendar and its benefits. If you have any further questions or would like to share your experiences with using a semi-monthly payroll calendar, please don't hesitate to comment below. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from this information.