Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to competitive interest rates, flexible repayment terms, and personalized service. If you're considering taking out a loan from Navy Federal, here are five tips to help you make the most of your experience.

When it comes to borrowing money, it's essential to have a clear understanding of your financial situation and what you can afford to repay. Before applying for a loan from Navy Federal, take some time to review your budget and determine how much you can afford to borrow. Consider factors such as your income, expenses, debts, and credit score to ensure that you're making an informed decision. You can use online tools and calculators to help you determine how much you can afford to borrow and what your monthly payments will be.

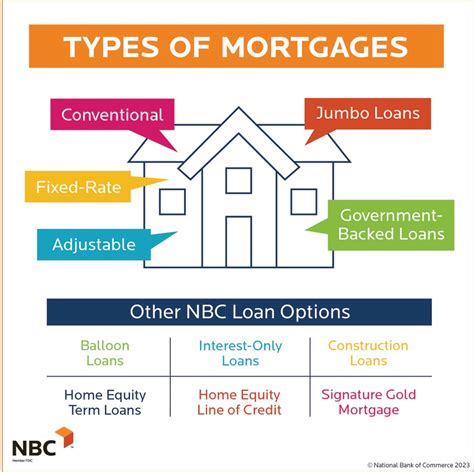

Understanding Navy Federal Loan Options

Benefits of Navy Federal Loans

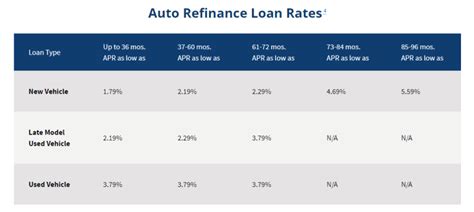

Some of the benefits of taking out a loan from Navy Federal include competitive interest rates, flexible repayment terms, and personalized service. Navy Federal also offers a range of loan programs and promotions, such as discounts for autopay and loyalty rewards for long-term members. Additionally, Navy Federal loans often have fewer fees and lower interest rates compared to traditional banks and lenders. By taking advantage of these benefits, you can save money and enjoy a more affordable and flexible loan experience.Applying for a Navy Federal Loan

Managing Your Navy Federal Loan

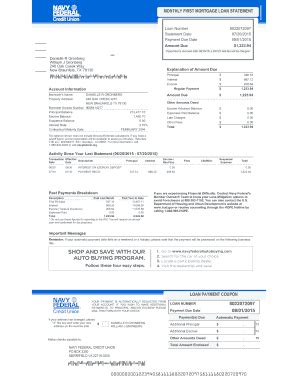

After you've been approved for a loan from Navy Federal, it's essential to manage your loan responsibly to avoid default and maintain a positive credit score. This includes making timely payments, keeping track of your balance and interest rate, and communicating with Navy Federal if you experience any financial difficulties. You can use online tools and resources to help you manage your loan, such as autopay and budgeting software. By managing your loan effectively, you can enjoy a positive and stress-free borrowing experience.Navy Federal Loan Rates and Terms

Navy Federal Loan Requirements

To be eligible for a loan from Navy Federal, you'll need to meet certain requirements, such as being a member of the credit union, having a good credit score, and providing documentation to verify your income and employment history. You'll also need to have a valid government-issued ID and a social security number. Additionally, some loans may require a co-signer or collateral, so be sure to review the requirements carefully before applying.Navy Federal Loan Calculator

Navy Federal Loan Customer Service

Navy Federal is known for its excellent customer service, with a team of experienced and knowledgeable representatives available to help you with any questions or concerns you may have. You can contact Navy Federal customer service by phone, email, or online chat, and they'll be happy to assist you with everything from applying for a loan to managing your account. By taking advantage of Navy Federal's customer service, you can enjoy a more personalized and supportive borrowing experience.Navy Federal Loan Reviews

Navy Federal Loan Alternatives

If you're not eligible for a loan from Navy Federal or prefer to explore other options, there are several alternatives available. These include traditional banks, online lenders, and peer-to-peer lending platforms. Be sure to research and compare rates, terms, and requirements carefully before making a decision, and consider factors such as interest rates, fees, and customer service.Navy Federal Loan FAQs

Navy Federal Loan Image Gallery

What are the benefits of taking out a loan from Navy Federal?

+The benefits of taking out a loan from Navy Federal include competitive interest rates, flexible repayment terms, and personalized service. Navy Federal also offers a range of loan programs and promotions, such as discounts for autopay and loyalty rewards for long-term members.

How do I apply for a loan from Navy Federal?

+To apply for a loan from Navy Federal, you can visit the credit union's website, call the customer service number, or visit a branch in person. You'll need to provide some basic information, such as your name, address, income, and employment history, as well as documentation to verify your identity and financial situation.

What are the repayment terms for Navy Federal loans?

+The repayment terms for Navy Federal loans vary depending on the type of loan and your individual financial situation. Some loans may have repayment periods of up to 60 months or more, while others may have shorter or longer repayment periods. Be sure to review the terms and conditions of your loan carefully before signing.

We hope this article has provided you with a comprehensive overview of Navy Federal loans and helped you make informed decisions about your borrowing needs. Whether you're looking to consolidate debt, finance a large purchase, or cover unexpected expenses, Navy Federal has a range of loan options to suit your needs. By following these tips and doing your research, you can enjoy a positive and stress-free borrowing experience with Navy Federal. Don't hesitate to reach out to Navy Federal customer service if you have any questions or concerns, and be sure to share your experiences with others to help them make informed decisions.