Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to personal loans, auto loans, mortgages, and more. If you're considering taking out a loan with Navy Federal, here are five tips to help you make the most of your borrowing experience.

The first step in taking out a loan with Navy Federal is to determine how much you can afford to borrow. This involves considering your income, expenses, and credit score, as well as the interest rate and repayment terms of the loan. Navy Federal offers a range of loan calculators and tools on its website to help you determine how much you can afford to borrow and what your monthly payments will be. By taking the time to carefully consider your financial situation and borrowing needs, you can ensure that you're taking out a loan that you can afford to repay.

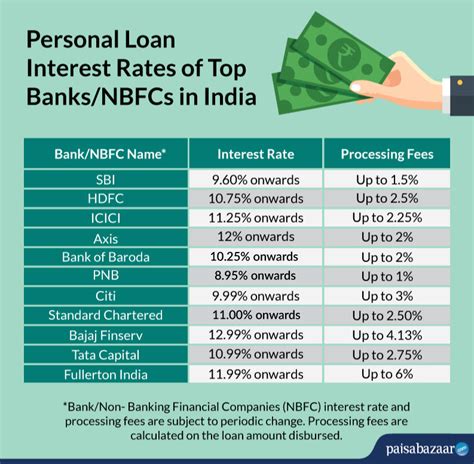

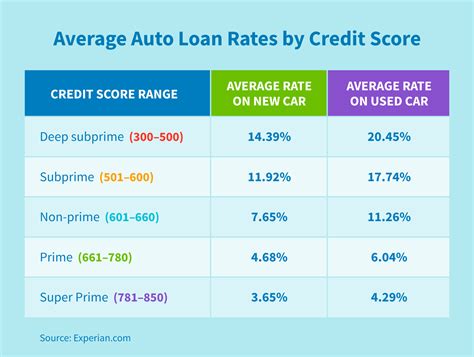

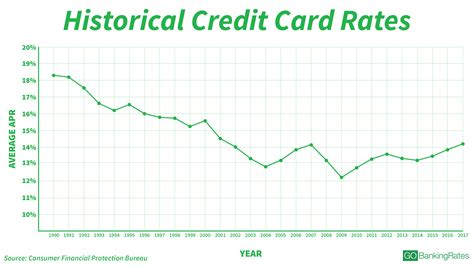

Another important consideration when taking out a loan with Navy Federal is the interest rate. Navy Federal offers competitive interest rates on its loans, but the rate you qualify for will depend on your credit score and other factors. To get the best interest rate possible, it's a good idea to check your credit report and score before applying for a loan, and to work on improving your credit if necessary. You can also consider applying for a loan with a co-signer, such as a spouse or family member, which can help you qualify for a lower interest rate.

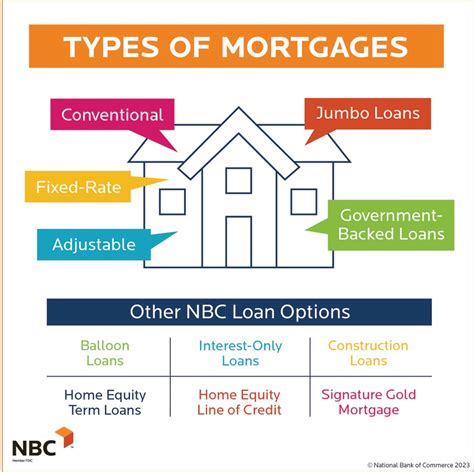

Understanding Navy Federal Loan Options

Benefits of Navy Federal Loans

In addition to offering competitive interest rates and flexible repayment terms, Navy Federal loans also offer a range of benefits and perks. For example, Navy Federal members can take advantage of special discounts and incentives on auto loans, as well as exclusive offers and promotions on personal loans and mortgages. Navy Federal also offers a range of tools and resources to help members manage their debt and improve their financial health, including financial counseling and credit monitoring services.Applying for a Navy Federal Loan

Navy Federal Loan Requirements

To be eligible for a Navy Federal loan, you'll need to meet certain requirements, such as being a member of the credit union and having a good credit history. You'll also need to provide documentation, such as pay stubs and tax returns, to verify your income and employment history. Navy Federal also offers a range of loan options for members with poor or limited credit, including secured loans and credit-builder loans.Managing Your Navy Federal Loan

Navy Federal Loan Repayment Options

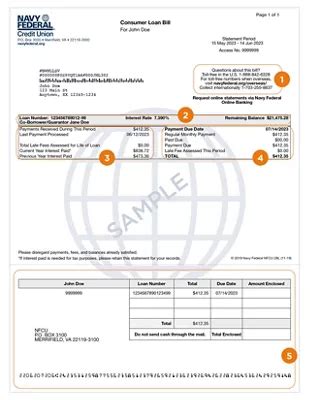

Navy Federal offers a range of repayment options to help members manage their loans and avoid default. For example, you can choose to make monthly payments online, by phone, or by mail, or you can set up automatic payments to be deducted from your paycheck or bank account. Navy Federal also offers a range of repayment plans, including income-driven repayment plans and extended repayment plans, to help members who are struggling to make their payments.Navy Federal Loan Benefits for Military Members

Navy Federal Loan Options for Veterans

In addition to offering loan benefits and perks for military members, Navy Federal also offers a range of loan options and benefits for veterans. For example, Navy Federal offers special discounts and incentives on mortgages and home equity loans for veterans, as well as exclusive offers and promotions on personal loans and credit cards. Navy Federal also offers a range of tools and resources to help veterans manage their finances and plan for the future, including financial counseling and credit monitoring services.Navy Federal Loan Customer Service

Navy Federal Loan FAQs

Here are some frequently asked questions about Navy Federal loans: * What types of loans does Navy Federal offer? * How do I apply for a Navy Federal loan? * What are the interest rates and repayment terms for Navy Federal loans? * Can I get a loan with bad credit? * How do I manage my Navy Federal loan?Navy Federal Loan Image Gallery

What are the benefits of taking out a loan with Navy Federal?

+The benefits of taking out a loan with Navy Federal include competitive interest rates, flexible repayment terms, and exclusive offers and promotions for military members and their families.

How do I apply for a Navy Federal loan?

+You can apply for a Navy Federal loan online, by phone, or in person at a local branch. You'll need to provide some basic information, such as your name, address, and social security number, as well as financial information, such as your income and employment history.

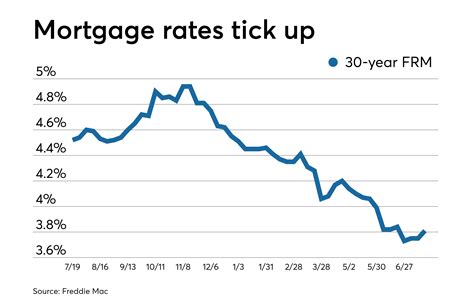

What are the interest rates and repayment terms for Navy Federal loans?

+The interest rates and repayment terms for Navy Federal loans vary depending on the type of loan and your credit score. You can check the current interest rates and repayment terms on the Navy Federal website or by contacting a customer service representative.

In summary, Navy Federal loans offer a range of benefits and perks for military members and their families, including competitive interest rates, flexible repayment terms, and exclusive offers and promotions. By understanding the different types of loans available and carefully considering your options, you can make the most of your borrowing experience and achieve your financial goals. If you have any questions or concerns about Navy Federal loans, don't hesitate to contact a customer service representative for assistance. Share your thoughts and experiences with Navy Federal loans in the comments below, and don't forget to share this article with friends and family who may be considering taking out a loan.