Intro

Discover 5 ways Navy Federal Pledge Loan benefits members, offering low-rate loans, flexible terms, and financial freedom with collateral-backed borrowing, secured loans, and credit-building opportunities.

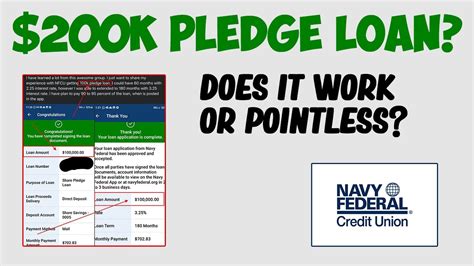

Navy Federal Credit Union has been a trusted financial institution for many years, offering a wide range of financial products and services to its members. One of the most popular products offered by Navy Federal is the Navy Federal Pledge Loan, which allows members to use their savings account or certificate as collateral to secure a loan. In this article, we will explore 5 ways that the Navy Federal Pledge Loan can benefit its members.

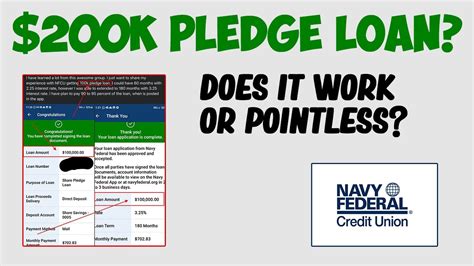

The Navy Federal Pledge Loan is a type of secured loan that allows members to borrow money at a lower interest rate than they would with an unsecured loan. By using their savings account or certificate as collateral, members can enjoy a lower interest rate and more favorable repayment terms. This type of loan is ideal for members who need to borrow money for a short period of time, but may not have the best credit score.

Understanding the Navy Federal Pledge Loan

The Navy Federal Pledge Loan is a flexible loan product that can be used for a variety of purposes, including paying off high-interest debt, financing a large purchase, or covering unexpected expenses. The loan is secured by the member's savings account or certificate, which means that the credit union has a lower risk of default. As a result, the interest rate on the loan is lower than it would be for an unsecured loan.

Benefits of the Navy Federal Pledge Loan

There are several benefits to using the Navy Federal Pledge Loan, including:

- Lower interest rates: By using their savings account or certificate as collateral, members can enjoy a lower interest rate on their loan.

- Flexible repayment terms: The Navy Federal Pledge Loan offers flexible repayment terms, including the option to repay the loan over a period of time that works for the member.

- Easy application process: The application process for the Navy Federal Pledge Loan is quick and easy, and members can apply online or in person at a Navy Federal branch.

- No credit check: Because the loan is secured by the member's savings account or certificate, there is no credit check required to apply for the loan.

- Competitive rates: Navy Federal offers competitive rates on its Pledge Loans, which means that members can save money on interest over the life of the loan.

How to Apply for a Navy Federal Pledge Loan

Applying for a Navy Federal Pledge Loan is a simple process that can be completed online or in person at a Navy Federal branch. To apply, members will need to provide some basic information, including their name, address, and social security number. They will also need to provide information about the savings account or certificate that they wish to use as collateral.

Required Documents

To apply for a Navy Federal Pledge Loan, members will need to provide the following documents:

- A valid government-issued ID

- Proof of income

- Proof of address

- Information about the savings account or certificate that will be used as collateral

Repaying a Navy Federal Pledge Loan

Repaying a Navy Federal Pledge Loan is a straightforward process that can be completed online or by mail. Members can choose to repay the loan over a period of time that works for them, and they can make payments online or by phone. It's important to note that the loan must be repaid in full, including interest, in order to avoid default.

Consequences of Default

If a member defaults on their Navy Federal Pledge Loan, they may face serious consequences, including:

- Damage to their credit score

- Loss of their savings account or certificate

- Additional fees and penalties

Alternatives to the Navy Federal Pledge Loan

While the Navy Federal Pledge Loan can be a great option for members who need to borrow money, it's not the only option available. Some alternatives to consider include:

- Personal loans: Navy Federal offers personal loans that do not require collateral.

- Credit cards: Navy Federal offers a range of credit cards that can be used for purchases and cash advances.

- Home equity loans: Members who own a home may be able to use the equity in their home to secure a loan.

Comparison of Loan Options

Here is a comparison of the different loan options available from Navy Federal:

- Navy Federal Pledge Loan: Secured by savings account or certificate, lower interest rate, flexible repayment terms

- Personal loan: Unsecured, higher interest rate, fixed repayment terms

- Credit card: Unsecured, higher interest rate, variable repayment terms

- Home equity loan: Secured by home equity, lower interest rate, fixed repayment terms

Gallery of Navy Federal Pledge Loan

Navy Federal Pledge Loan Image Gallery

Frequently Asked Questions

What is the Navy Federal Pledge Loan?

+The Navy Federal Pledge Loan is a type of secured loan that allows members to use their savings account or certificate as collateral to secure a loan.

How do I apply for a Navy Federal Pledge Loan?

+To apply for a Navy Federal Pledge Loan, members can apply online or in person at a Navy Federal branch. They will need to provide some basic information, including their name, address, and social security number, as well as information about the savings account or certificate that they wish to use as collateral.

What are the benefits of the Navy Federal Pledge Loan?

+The Navy Federal Pledge Loan offers several benefits, including lower interest rates, flexible repayment terms, and no credit check required. It's also a great option for members who need to borrow money but may not have the best credit score.

Can I repay my Navy Federal Pledge Loan early?

+Yes, members can repay their Navy Federal Pledge Loan early without penalty. In fact, repaying the loan early can help members save money on interest over the life of the loan.

What happens if I default on my Navy Federal Pledge Loan?

+If a member defaults on their Navy Federal Pledge Loan, they may face serious consequences, including damage to their credit score, loss of their savings account or certificate, and additional fees and penalties. It's important for members to make their payments on time and to communicate with Navy Federal if they are experiencing financial difficulties.

In conclusion, the Navy Federal Pledge Loan is a great option for members who need to borrow money but may not have the best credit score. With its lower interest rates, flexible repayment terms, and no credit check required, it's a loan product that can help members achieve their financial goals. Whether you're looking to pay off high-interest debt, finance a large purchase, or cover unexpected expenses, the Navy Federal Pledge Loan is definitely worth considering. So why not apply today and see how the Navy Federal Pledge Loan can help you achieve financial freedom? We invite you to share your thoughts and experiences with the Navy Federal Pledge Loan in the comments below.