Intro

Discover how 9/11 revolutionized US payment systems. Learn about the lasting impact on financial security, identity verification, and transaction monitoring. Explore the 5 key ways the tragedy transformed payment processing, risk assessment, and regulatory compliance, shaping the modern payments landscape.

The September 11 attacks in 2001 were a pivotal moment in modern history, causing widespread devastation and loss of life. In the aftermath of the tragedy, the world was forever changed, including the way we conduct financial transactions. The attacks led to a significant overhaul of the US payment systems, with a focus on security, surveillance, and compliance. In this article, we will explore five ways 9/11 changed our payment systems forever.

Increased Surveillance and Monitoring

In the years following 9/11, the US government implemented various measures to monitor and track financial transactions. The USA PATRIOT Act, signed into law in 2001, expanded the authority of law enforcement agencies to gather intelligence and conduct surveillance on individuals and organizations. This led to the creation of the Financial Crimes Enforcement Network (FinCEN), which is responsible for tracking and analyzing financial transactions to identify potential terrorist activity.

The increased surveillance and monitoring of financial transactions have led to a significant increase in the number of suspicious activity reports (SARs) filed by financial institutions. According to FinCEN, the number of SARs filed has increased from approximately 200,000 in 2001 to over 2 million in 2020.

Benefits and Drawbacks of Increased Surveillance

While increased surveillance and monitoring have helped to prevent and detect terrorist financing, they have also raised concerns about privacy and civil liberties. Some argue that the measures have gone too far, infringing on individuals' right to financial privacy and potentially leading to discrimination against certain groups.

On the other hand, proponents of increased surveillance argue that it is necessary to prevent and detect terrorist activity, and that the benefits outweigh the drawbacks. They point to the fact that the measures have helped to disrupt and prevent numerous terrorist plots, and that they have also helped to detect and prevent other financial crimes, such as money laundering and fraud.

Implementation of Anti-Money Laundering (AML) Regulations

The 9/11 attacks also led to a significant increase in anti-money laundering (AML) regulations. The USA PATRIOT Act and subsequent regulations, such as the Bank Secrecy Act, require financial institutions to implement AML programs to detect and prevent money laundering and terrorist financing.

These regulations require financial institutions to:

- Verify the identity of customers and maintain accurate records

- Monitor and report suspicious activity

- Implement policies and procedures to prevent money laundering and terrorist financing

- Provide training to employees on AML regulations and procedures

Benefits and Drawbacks of AML Regulations

While AML regulations have helped to prevent and detect money laundering and terrorist financing, they have also imposed significant costs and burdens on financial institutions. Some argue that the regulations have gone too far, and that they have led to a culture of over-compliance, where financial institutions are reluctant to provide services to certain customers or engage in certain transactions due to fear of regulatory scrutiny.

On the other hand, proponents of AML regulations argue that they are necessary to prevent and detect financial crimes, and that the benefits outweigh the drawbacks. They point to the fact that the regulations have helped to disrupt and prevent numerous terrorist plots, and that they have also helped to detect and prevent other financial crimes, such as money laundering and fraud.

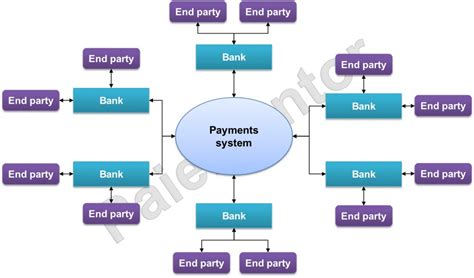

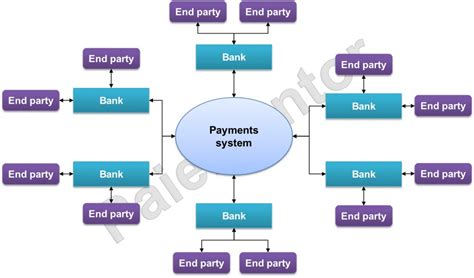

Increased Use of Digital Payments

The 9/11 attacks also led to an increase in the use of digital payments. In the aftermath of the attacks, there was a significant increase in the use of online banking and digital payment systems, as individuals and businesses sought to reduce their reliance on cash and checks.

The increased use of digital payments has been driven by a number of factors, including:

- Convenience: Digital payments are often faster and more convenient than traditional payment methods.

- Security: Digital payments are often more secure than traditional payment methods, as they are less susceptible to theft and loss.

- Cost: Digital payments are often less expensive than traditional payment methods, as they eliminate the need for physical infrastructure and reduce the risk of fraud.

Benefits and Drawbacks of Digital Payments

While digital payments have a number of benefits, they also have some drawbacks. Some argue that digital payments are not yet widely accepted, and that they can be vulnerable to cyber attacks and data breaches.

On the other hand, proponents of digital payments argue that they are the future of payments, and that they offer a number of benefits, including convenience, security, and cost savings. They point to the fact that digital payments have helped to reduce the risk of fraud and theft, and that they have also helped to increase financial inclusion and access to financial services.

Implementation of Know-Your-Customer (KYC) Regulations

The 9/11 attacks also led to the implementation of Know-Your-Customer (KYC) regulations. KYC regulations require financial institutions to verify the identity of their customers and maintain accurate records of customer information.

KYC regulations are designed to prevent and detect money laundering and terrorist financing, and to ensure that financial institutions are not providing services to individuals or organizations that are involved in illicit activities.

Benefits and Drawbacks of KYC Regulations

While KYC regulations have helped to prevent and detect money laundering and terrorist financing, they have also imposed significant costs and burdens on financial institutions. Some argue that the regulations have gone too far, and that they have led to a culture of over-compliance, where financial institutions are reluctant to provide services to certain customers or engage in certain transactions due to fear of regulatory scrutiny.

On the other hand, proponents of KYC regulations argue that they are necessary to prevent and detect financial crimes, and that the benefits outweigh the drawbacks. They point to the fact that the regulations have helped to disrupt and prevent numerous terrorist plots, and that they have also helped to detect and prevent other financial crimes, such as money laundering and fraud.

Increased International Cooperation

Finally, the 9/11 attacks led to an increase in international cooperation on issues related to terrorist financing and money laundering. The attacks highlighted the need for countries to work together to prevent and detect financial crimes, and to share information and best practices.

The increased international cooperation has led to the creation of a number of global initiatives and organizations, including the Financial Action Task Force (FATF), which is responsible for setting global standards for AML and combating the financing of terrorism.

Benefits and Drawbacks of International Cooperation

While international cooperation has helped to prevent and detect financial crimes, it has also raised concerns about sovereignty and the potential for regulatory overreach. Some argue that international cooperation has led to a one-size-fits-all approach to regulation, which can be overly burdensome for smaller countries or countries with limited resources.

On the other hand, proponents of international cooperation argue that it is necessary to prevent and detect financial crimes, and that the benefits outweigh the drawbacks. They point to the fact that international cooperation has helped to disrupt and prevent numerous terrorist plots, and that it has also helped to detect and prevent other financial crimes, such as money laundering and fraud.

In conclusion, the 9/11 attacks had a profound impact on our payment systems, leading to increased surveillance and monitoring, the implementation of AML regulations, the increased use of digital payments, the implementation of KYC regulations, and increased international cooperation. While these measures have helped to prevent and detect financial crimes, they have also imposed significant costs and burdens on financial institutions and individuals. As we move forward, it is essential that we strike a balance between security and convenience, and that we continue to adapt and evolve our payment systems to meet the changing needs of a rapidly evolving world.

9/11 Changed Payment Systems Image Gallery

What is the USA PATRIOT Act?

+The USA PATRIOT Act is a federal law that was enacted in 2001 to strengthen national security and prevent terrorist financing. The law expanded the authority of law enforcement agencies to gather intelligence and conduct surveillance on individuals and organizations.

What is AML?

+AML stands for Anti-Money Laundering. It refers to the laws and regulations that are designed to prevent and detect money laundering and terrorist financing.

What is KYC?

+KYC stands for Know-Your-Customer. It refers to the regulations that require financial institutions to verify the identity of their customers and maintain accurate records of customer information.