Intro

Download printable 1099 forms for tax filing, including 1099-MISC and 1099-INT. Access free templates and learn about IRS requirements for independent contractors and self-employment income reporting.

The importance of accurately filing tax forms cannot be overstated, especially for businesses and individuals who need to report various types of income to the Internal Revenue Service (IRS). One crucial form for this purpose is the 1099 form, which is used to report different types of income that are not necessarily from an employer-employee relationship. The 1099 form is essential for freelancers, independent contractors, and businesses that pay non-employee compensation. Understanding how to obtain, fill out, and file this form correctly is vital for compliance with tax laws and avoiding potential penalties.

For those who are new to the process, the 1099 form might seem daunting, but with the right guidance, it can be navigated efficiently. The IRS provides printable 1099 forms that can be downloaded from their official website, making it easier for individuals and businesses to access the forms they need. However, it's crucial to ensure that the forms are downloaded from a reliable source to avoid any issues with authenticity or compliance. The IRS website is the most secure place to download these forms, ensuring that the downloaded 1099 forms are accurate and up-to-date.

The process of filing taxes, especially when it involves the 1099 form, requires attention to detail and adherence to deadlines. The IRS sets specific deadlines for filing these forms, both for the recipients of the income (who receive the 1099 forms) and for the entities that issue them (who must submit copies to the IRS). Missing these deadlines can result in penalties, emphasizing the importance of timely and accurate filing. Moreover, the information reported on the 1099 form will be used by the recipient to report income on their tax return, making accuracy in filling out these forms crucial for both parties involved.

Understanding the 1099 Form

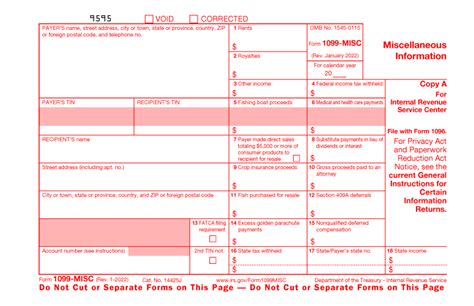

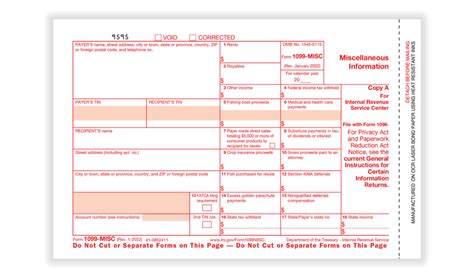

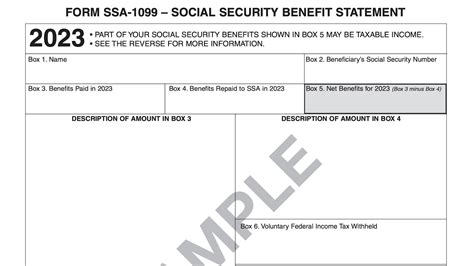

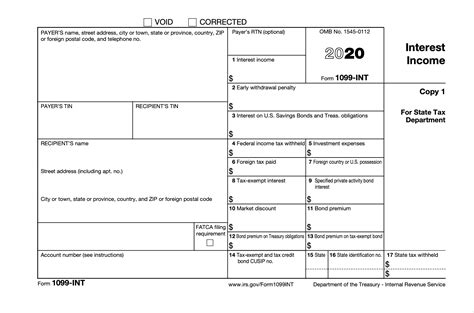

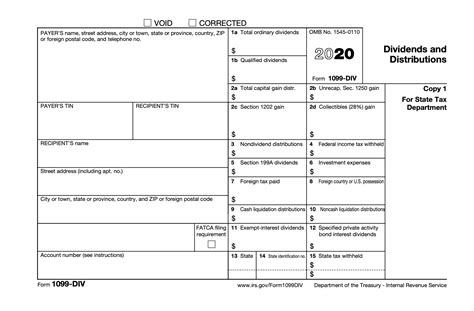

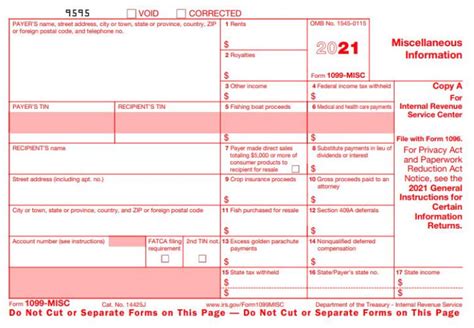

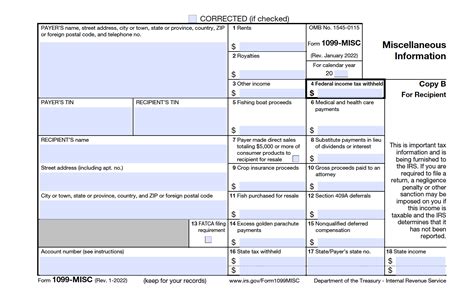

Understanding the 1099 form is the first step in navigating the process of reporting non-employee income. The 1099 form is not a single form but rather a series of forms used to report different types of income. For example, the 1099-MISC form is used to report miscellaneous income such as freelance work, while the 1099-INT form is used to report interest income. Each form has its specific instructions and requirements, making it essential to choose the correct form for the type of income being reported.

Types of 1099 Forms

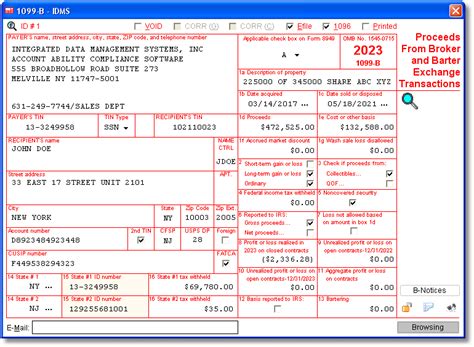

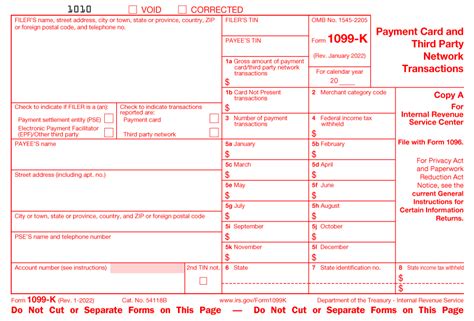

There are several types of 1099 forms, each designed for specific purposes: - **1099-MISC**: Used to report miscellaneous income, such as payments to independent contractors, freelance workers, and other non-employees. - **1099-INT**: Reports interest income, such as interest earned from savings accounts, bonds, and other investments. - **1099-DIV**: Used for reporting dividend income from stocks and other investments. - **1099-B**: Reports proceeds from broker and barter exchange transactions, including sales of stocks, bonds, and other securities. - **1099-K**: Used by payment settlement entities to report payment card and third-party network transactions.How to Download and Fill Out the 1099 Form

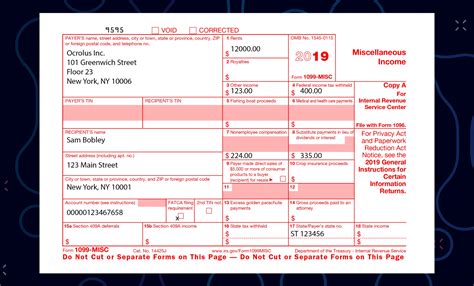

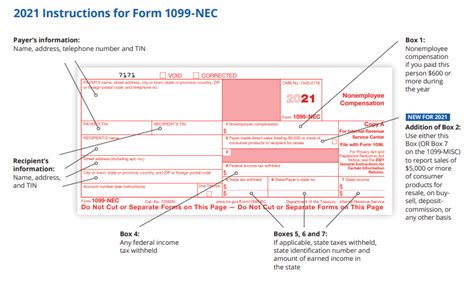

Downloading the 1099 form is a straightforward process, especially when done directly from the IRS website. Once downloaded, filling out the form requires careful attention to detail to ensure accuracy. The form will ask for the payer's and recipient's information, including names, addresses, and taxpayer identification numbers. It will also require the reporting of the specific type and amount of income being paid.

For those who are filling out the 1099 form for the first time, it might be helpful to consult the instructions provided by the IRS or to seek the advice of a tax professional. This can help in avoiding common mistakes that could lead to delays or penalties. Additionally, ensuring that all necessary copies are made and distributed according to the IRS guidelines is crucial. Typically, the payer must provide a copy of the 1099 form to the recipient by January 31st of each year, and submit copies to the IRS by February 28th (or March 31st if filing electronically).

Steps to Fill Out the 1099 Form

1. **Download the Correct Form**: Ensure you are downloading the correct 1099 form for the type of income you are reporting. 2. **Gather Necessary Information**: Collect the payer's and recipient's information, including names, addresses, and taxpayer identification numbers. 3. **Report Income Accurately**: Carefully report the type and amount of income being paid, ensuring all figures are accurate. 4. **Complete All Required Boxes**: Fill out all necessary boxes on the form, leaving no required information blank. 5. **Make Copies**: Make the necessary copies for the recipient and for your records, and submit them according to IRS deadlines.Benefits of Using Printable 1099 Forms

Using printable 1099 forms offers several benefits, especially for small businesses and individuals who may not have the resources to invest in specialized tax software. These forms are readily available, can be easily downloaded, and are free, making them an accessible option for anyone who needs to report non-employee income. Additionally, printable forms can be filled out at the user's pace, allowing for careful consideration and review of the information being reported, which can help in reducing errors.

Moreover, printable 1099 forms can be useful for record-keeping purposes. Once filled out, these forms can be easily stored in physical files or scanned and saved digitally, providing a clear and organized record of income reported. This can be particularly helpful during tax audits or if there are any discrepancies in reported income.

Advantages of Printable 1099 Forms

- **Accessibility**: Forms are easily downloadable from the IRS website. - **Cost-Effective**: Printable forms are free, reducing costs associated with tax compliance. - **Error Reduction**: Allows for careful review and filling out of forms to minimize errors. - **Record Keeping**: Provides a physical or digital record of reported income for future reference.Common Mistakes to Avoid

When dealing with tax forms like the 1099, avoiding mistakes is crucial to prevent delays, penalties, and potential audits. One of the most common mistakes is incorrect or missing recipient information, which can lead to the form being rejected by the IRS. Another mistake is reporting incorrect income amounts or types, which can lead to discrepancies in tax returns and potential audits.

Additionally, failing to file the 1099 form by the deadline or not providing copies to recipients on time can result in penalties. It's also important to ensure that all forms are filled out completely and accurately, as incomplete forms may not be processed.

Tips for Avoiding Mistakes

- **Double-Check Information**: Ensure all recipient and payer information is correct and complete. - **Report Income Accurately**: Verify the type and amount of income being reported. - **Meet Deadlines**: File the 1099 form and provide copies to recipients by the specified deadlines. - **Use Correct Forms**: Ensure you are using the correct 1099 form for the type of income being reported.Gallery of 1099 Form Examples

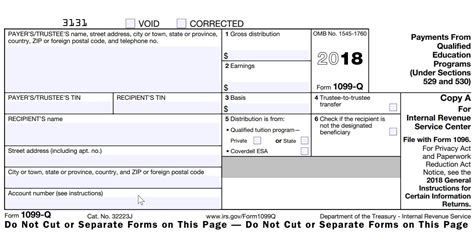

1099 Form Image Gallery

Frequently Asked Questions

What is the deadline for filing the 1099 form?

+The deadline for providing copies of the 1099 form to recipients is January 31st, and for filing with the IRS, it is February 28th (or March 31st if filing electronically).

How do I download a printable 1099 form?

+You can download printable 1099 forms directly from the IRS website. Ensure you select the correct form for the type of income you are reporting.

What are the penalties for not filing the 1099 form on time?

+Penalties for late filing can range from $30 to $100 per form, depending on how late the filing is. The maximum penalty can be up to $500,000 per year for small businesses and $1,500,000 for larger businesses.

Can I file the 1099 form electronically?

+Yes, you can file the 1099 form electronically through the IRS's Filing Information Returns Electronically (FIRE) system. This method is required if you are filing 250 or more forms.

Where can I find more information about the 1099 form?

+For more detailed information about the 1099 form, including instructions and deadlines, you can visit the IRS website or consult with a tax professional.

In conclusion, navigating the process of downloading, filling out, and filing the 1099 form can seem complex, but with the right guidance, it becomes more manageable. Ensuring accuracy, meeting deadlines, and avoiding common mistakes are key to successful compliance with tax laws. For those who are unsure about any aspect of the process, consulting the IRS website or seeking the advice of a tax professional can provide the necessary clarity and assurance. By understanding the importance and process of filing the 1099 form, individuals and businesses can ensure they are in compliance with tax regulations, avoiding potential penalties and audits. If you have any further questions or need more information on tax-related topics, consider visiting our tax guide page for more resources and insights.