Intro

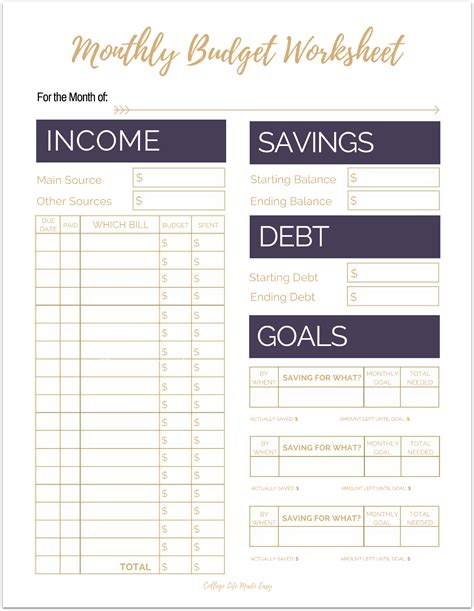

Get organized with free printable budget sheets, featuring expense trackers, financial planners, and money management templates to help you create a personalized budget and achieve financial stability.

Creating a budget is an essential step in managing one's finances effectively. It helps in tracking income and expenses, making smart financial decisions, and achieving long-term financial goals. One of the most effective tools for creating and maintaining a budget is a budget sheet. In this article, we will explore the importance of budget sheets, how to use them, and provide access to free printable budget sheets.

Budgeting is a crucial aspect of personal finance that helps individuals and families manage their money wisely. It involves identifying sources of income, tracking expenses, and making adjustments to ensure that one's financial goals are met. A well-planned budget helps in avoiding debt, building savings, and investing in the future. With the numerous benefits that come with budgeting, it's surprising that many people still fail to create and stick to a budget.

One of the main reasons people struggle with budgeting is the lack of a clear and effective tool to track their finances. This is where budget sheets come in. A budget sheet is a document that outlines projected income and expenses for a specific period, usually a month. It provides a clear picture of one's financial situation, making it easier to identify areas where adjustments need to be made. Budget sheets can be customized to fit individual needs and can be used by anyone, regardless of their financial situation.

Benefits of Using Budget Sheets

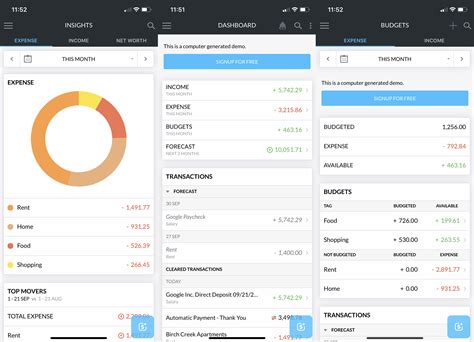

Using budget sheets has numerous benefits. Firstly, they help in tracking income and expenses, making it easier to identify areas where costs can be cut. Secondly, budget sheets provide a clear picture of one's financial situation, enabling individuals to make informed decisions about their money. Thirdly, budget sheets help in setting and achieving financial goals, such as saving for a down payment on a house or paying off debt. Finally, budget sheets promote financial discipline and accountability, helping individuals stick to their financial plans.

Types of Budget Sheets

There are several types of budget sheets available, each designed to cater to specific needs. Some of the most common types of budget sheets include: * Zero-based budget sheets: These sheets require individuals to account for every dollar they earn, ensuring that no money is wasted. * 50/30/20 budget sheets: These sheets allocate 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. * Envelope budget sheets: These sheets involve dividing expenses into categories and allocating a specific amount of cash for each category.How to Use Budget Sheets

Using budget sheets is a straightforward process. Firstly, individuals need to identify their income sources and calculate their total monthly income. Secondly, they need to track their expenses, categorizing them into necessary expenses, such as rent and utilities, and discretionary expenses, such as entertainment and hobbies. Thirdly, individuals need to set financial goals, such as saving for a specific purpose or paying off debt. Finally, they need to review and adjust their budget regularly, ensuring that they are on track to meet their financial goals.

Steps to Create a Budget Sheet

Creating a budget sheet is a simple process that involves the following steps: 1. Identify income sources: Calculate total monthly income from all sources. 2. Track expenses: Categorize expenses into necessary and discretionary expenses. 3. Set financial goals: Identify specific financial goals, such as saving for a down payment on a house. 4. Allocate funds: Assign a specific amount of money for each expense category. 5. Review and adjust: Regularly review the budget and make adjustments as necessary.Free Printable Budget Sheets

There are numerous free printable budget sheets available online, catering to different needs and preferences. Some of the most popular types of budget sheets include:

- Monthly budget sheets: These sheets provide a comprehensive overview of income and expenses for a specific month.

- Weekly budget sheets: These sheets help individuals track their daily expenses and stay on top of their finances.

- Budget sheets for students: These sheets are designed specifically for students, helping them manage their finances while in school.

For more information on managing finances, you can check out our article on personal finance.

Customizing Budget Sheets

Budget sheets can be customized to fit individual needs and preferences. Some ways to customize budget sheets include: * Adding or removing expense categories: Individuals can add or remove categories to suit their specific needs. * Changing the layout: The layout of the budget sheet can be adjusted to make it more user-friendly. * Including debt repayment: Individuals can include a debt repayment plan in their budget sheet.Common Budgeting Mistakes

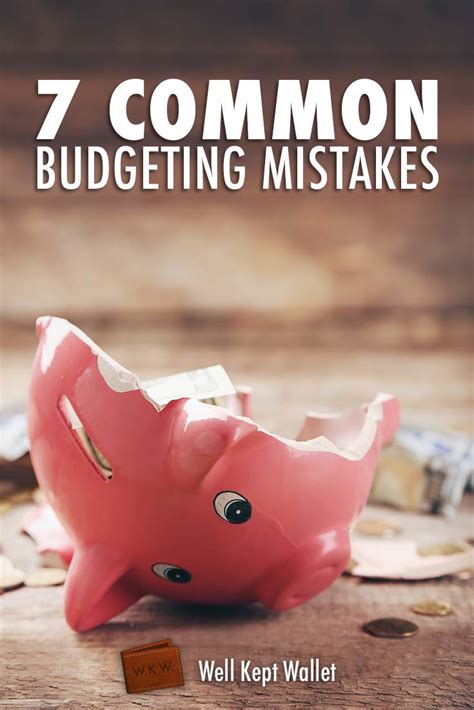

There are several common budgeting mistakes that individuals should avoid. Some of these mistakes include:

- Failing to track expenses: Not tracking expenses can lead to overspending and financial difficulties.

- Not accounting for irregular expenses: Irregular expenses, such as car maintenance, can catch individuals off guard if not accounted for.

- Not prioritizing needs over wants: Failing to prioritize needs over wants can lead to financial difficulties and debt.

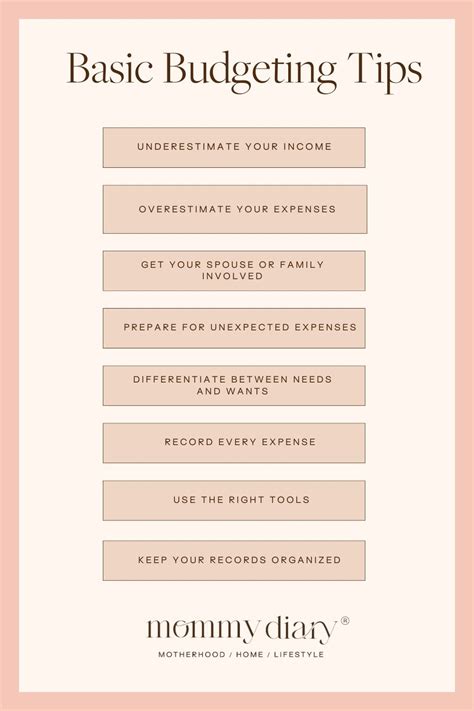

Budgeting Tips

Some budgeting tips that can help individuals manage their finances effectively include: * Creating a budget: Having a budget is essential for managing finances effectively. * Prioritizing needs over wants: Prioritizing needs over wants can help individuals avoid financial difficulties. * Avoiding debt: Avoiding debt can help individuals achieve financial stability and security.Conclusion and Next Steps

In conclusion, budget sheets are essential tools for managing finances effectively. They help individuals track their income and expenses, make informed financial decisions, and achieve their financial goals. By using budget sheets and avoiding common budgeting mistakes, individuals can take control of their finances and achieve financial stability and security.

Budgeting Image Gallery

What is a budget sheet?

+A budget sheet is a document that outlines projected income and expenses for a specific period, usually a month.

Why is it important to use a budget sheet?

+Using a budget sheet helps individuals track their income and expenses, make informed financial decisions, and achieve their financial goals.

How can I customize my budget sheet?

+You can customize your budget sheet by adding or removing expense categories, changing the layout, and including debt repayment plans.

We hope this article has provided you with valuable information on the importance of budget sheets and how to use them effectively. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them take control of their finances. Remember, budgeting is a crucial step towards achieving financial stability and security. Start using budget sheets today and take the first step towards a brighter financial future!