Intro

Create a budget with ease using 5 budget worksheet tips, including expense tracking, financial planning, and money management strategies to achieve fiscal stability and savings goals.

Creating a budget is a crucial step in managing one's finances effectively. It helps in understanding where the money is going and making informed decisions about how to allocate resources. A budget worksheet is a valuable tool in this process, allowing individuals to track income and expenses, identify areas for savings, and set financial goals. In this article, we will explore five budget worksheet tips that can help individuals make the most out of their financial planning.

Budgeting is not just about cutting back on expenses; it's about making conscious decisions about how to use one's money to achieve financial stability and security. A well-crafted budget worksheet can be the foundation of a successful financial plan, helping individuals to prioritize their spending, reduce debt, and build savings. By following a few simple tips, anyone can create a budget worksheet that works for them, regardless of their financial situation.

Effective budgeting requires a clear understanding of one's financial situation, including income, expenses, debts, and financial goals. A budget worksheet provides a framework for organizing this information and making sense of it. By using a budget worksheet, individuals can identify areas where they can cut back on unnecessary expenses, allocate more funds towards savings and debt repayment, and make progress towards their long-term financial objectives. Whether you're looking to pay off debt, build an emergency fund, or save for a big purchase, a budget worksheet can help you get there.

Understanding the Basics of Budget Worksheets

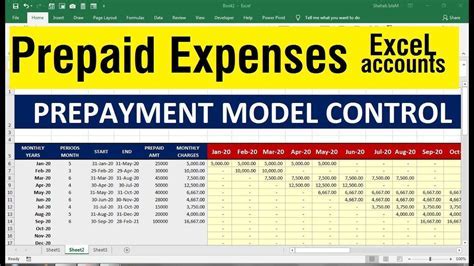

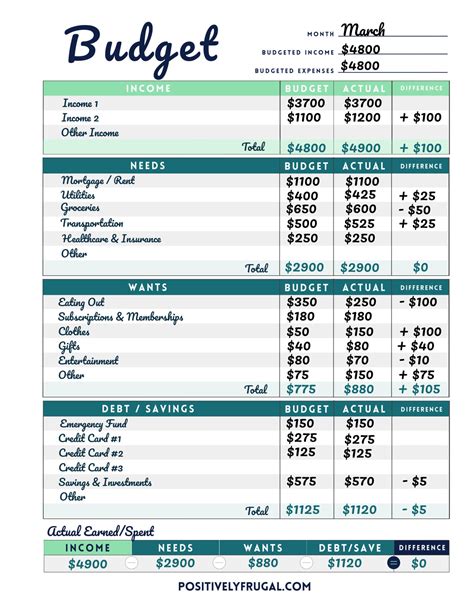

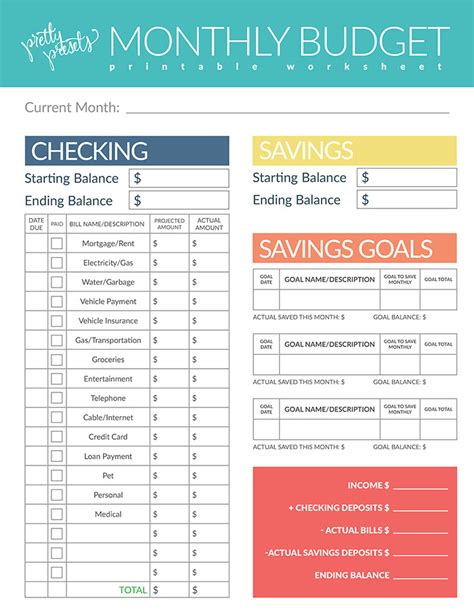

Before diving into the tips, it's essential to understand the basics of budget worksheets. A budget worksheet typically includes columns for income, fixed expenses, variable expenses, savings, and debt repayment. It may also include sections for tracking progress towards financial goals, such as paying off debt or building an emergency fund. By filling out a budget worksheet regularly, individuals can get a clear picture of their financial situation and make informed decisions about how to manage their money.

Benefits of Using a Budget Worksheet

Using a budget worksheet can have numerous benefits, including: * Improved financial awareness and understanding * Increased control over spending and saving * Enhanced ability to achieve financial goals * Reduced stress and anxiety related to money management * Improved credit score and overall financial healthTip 1: Track Every Expense

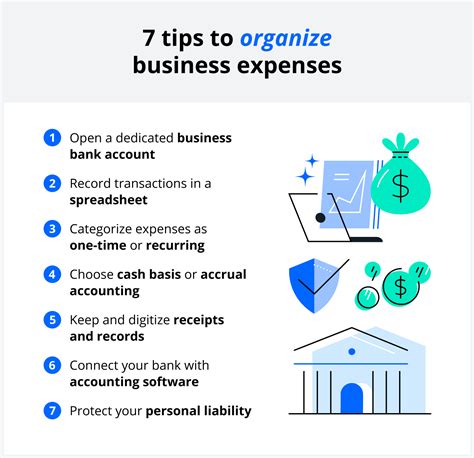

The first tip for using a budget worksheet effectively is to track every expense, no matter how small it may seem. This includes everything from rent and utilities to groceries and entertainment. By accounting for every dollar spent, individuals can identify areas where they can cut back and allocate more funds towards savings and debt repayment. It's also essential to track expenses regularly, whether it's daily, weekly, or monthly, to ensure that the budget worksheet remains accurate and up-to-date.

Common Expenses to Track

Some common expenses to track include: * Housing costs (rent, mortgage, utilities) * Transportation costs (car payment, insurance, gas) * Food and dining expenses * Entertainment and leisure activities * Debt repayment (credit cards, loans) * Savings and investmentsTip 2: Categorize Expenses

The second tip is to categorize expenses into different groups, such as housing, transportation, food, and entertainment. This helps to identify areas where expenses can be reduced and allocate more funds towards essential expenses. Categorizing expenses also makes it easier to track progress towards financial goals and make adjustments as needed.

Common Expense Categories

Some common expense categories include: * Housing * Transportation * Food and dining * Entertainment and leisure * Debt repayment * Savings and investmentsTip 3: Set Financial Goals

The third tip is to set financial goals, both short-term and long-term. This could include paying off debt, building an emergency fund, or saving for a big purchase. By setting clear financial goals, individuals can create a roadmap for achieving financial stability and security. It's essential to make sure that financial goals are specific, measurable, achievable, relevant, and time-bound (SMART) to ensure success.

Examples of Financial Goals

Some examples of financial goals include: * Paying off credit card debt within the next 6 months * Building an emergency fund to cover 3-6 months of living expenses * Saving for a down payment on a house * Retirement savingsTip 4: Prioritize Needs Over Wants

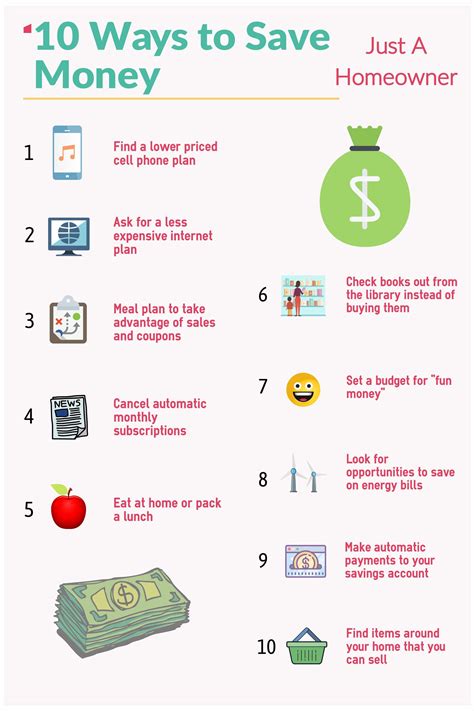

The fourth tip is to prioritize needs over wants. This means allocating more funds towards essential expenses, such as housing, food, and utilities, and reducing spending on non-essential expenses, such as entertainment and leisure activities. By prioritizing needs over wants, individuals can ensure that they have enough money for essential expenses and make progress towards their financial goals.

Distinguishing Between Needs and Wants

Some ways to distinguish between needs and wants include: * Asking yourself if the expense is essential for survival * Considering whether the expense can be postponed or reduced * Evaluating whether the expense aligns with your financial goalsTip 5: Review and Adjust Regularly

The fifth tip is to review and adjust your budget worksheet regularly. This could be monthly, quarterly, or annually, depending on your financial situation and goals. By reviewing your budget worksheet regularly, you can identify areas where you can improve, make adjustments as needed, and stay on track towards your financial goals.

Benefits of Regular Review and Adjustment

Some benefits of regular review and adjustment include: * Improved financial awareness and understanding * Increased control over spending and saving * Enhanced ability to achieve financial goals * Reduced stress and anxiety related to money managementFor more information on budgeting and financial planning, check out our article on budgeting 101.

Additional Budget Worksheet Tips

In addition to the five tips outlined above, there are several other strategies that can help you get the most out of your budget worksheet. These include:

- Using the 50/30/20 rule to allocate income towards essential expenses, non-essential expenses, and savings

- Taking advantage of tax-advantaged savings options, such as 401(k) or IRA accounts

- Avoiding lifestyle inflation by directing excess funds towards savings and debt repayment

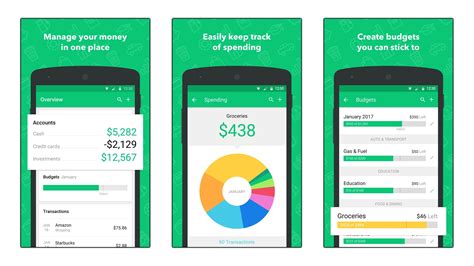

- Considering the use of budgeting apps or software to streamline the budgeting process

Budgeting Apps and Software

Some popular budgeting apps and software include: * Mint * You Need a Budget (YNAB) * Personal Capital * QuickenBudget Worksheet Image Gallery

What is a budget worksheet?

+A budget worksheet is a tool used to track income and expenses, identify areas for savings, and set financial goals.

Why is it important to track every expense?

+Tracking every expense helps to identify areas where expenses can be reduced and allocate more funds towards essential expenses and savings.

How often should I review and adjust my budget worksheet?

+It's recommended to review and adjust your budget worksheet regularly, whether it's monthly, quarterly, or annually, to ensure that you're on track towards your financial goals.

What are some common expense categories?

+Some common expense categories include housing, transportation, food and dining, entertainment and leisure, debt repayment, and savings and investments.

How can I prioritize needs over wants?

+Prioritizing needs over wants involves allocating more funds towards essential expenses, such as housing and food, and reducing spending on non-essential expenses, such as entertainment and leisure activities.

We hope that these budget worksheet tips have been helpful in creating a budget that works for you. Remember to track every expense, categorize expenses, set financial goals, prioritize needs over wants, and review and adjust your budget worksheet regularly. By following these tips and staying committed to your financial goals, you can achieve financial stability and security. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from these budget worksheet tips, and don't forget to check out our other articles on personal finance and budgeting.