Intro

Master budgeting with 5 essential budget worksheets, featuring expense trackers, income calculators, and financial planners to optimize savings, manage debt, and boost financial stability.

Creating a budget is an essential step in managing one's finances effectively. It helps in understanding where the money is going and making informed decisions about how to allocate resources. Budgeting can seem daunting, especially for those who are new to personal finance management. However, with the right tools and a bit of practice, anyone can create and stick to a budget. One of the most useful tools for budgeting is a budget worksheet. In this article, we will explore the concept of budget worksheets, their importance, and provide examples of how to use them effectively.

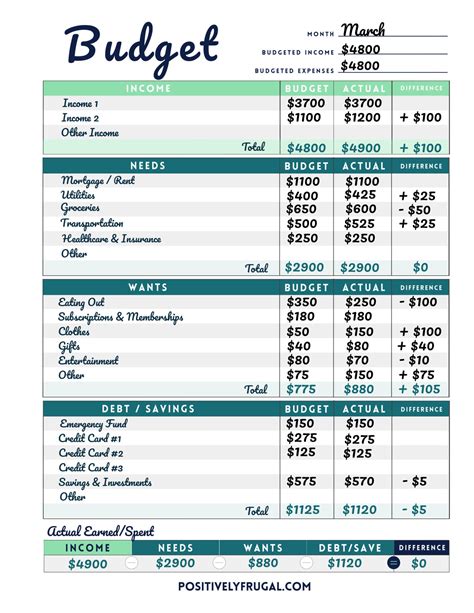

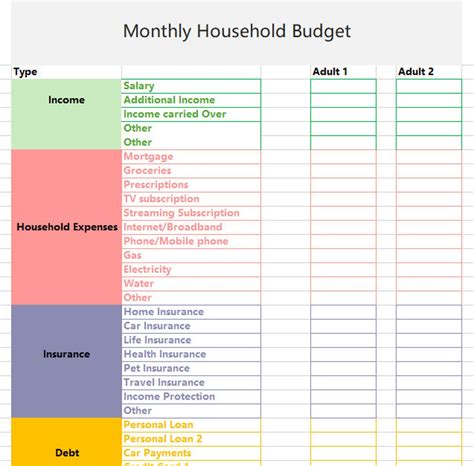

A budget worksheet is a document or spreadsheet that outlines projected income and expenses for a specific period. It's a practical way to visualize finances, set financial goals, and track spending. Budget worksheets can be tailored to individual needs, whether it's for personal, family, or business use. They typically include categories for income, fixed expenses, variable expenses, savings, and debt repayment. By filling out a budget worksheet regularly, individuals can identify areas where they can cut back, prioritize their spending, and make adjustments as needed.

Effective budgeting is key to achieving financial stability and security. It allows individuals to manage their money wisely, avoid debt, and build wealth over time. Budgeting also reduces financial stress and anxiety, providing peace of mind and the freedom to pursue long-term goals. Whether it's saving for a down payment on a house, funding a retirement account, or paying off credit card debt, a well-planned budget is the foundation upon which all financial decisions are made.

Types of Budget Worksheets

There are various types of budget worksheets available, catering to different financial situations and goals. Some common types include:

- Zero-Based Budgeting Worksheet: This type of budgeting starts from a "zero balance," where every dollar of income is assigned a job, whether it's for expenses, savings, or debt repayment.

- 50/30/20 Budgeting Worksheet: This worksheet allocates 50% of income towards necessary expenses like rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Envelope Budgeting Worksheet: This method involves dividing expenses into categories (e.g., housing, transportation, entertainment) and allocating a specific amount of cash for each category, using envelopes to keep track of spending.

Benefits of Using Budget Worksheets

The benefits of using budget worksheets are numerous. They help in:

- Identifying unnecessary expenses and areas for cost-cutting.

- Prioritizing spending based on financial goals and values.

- Reducing debt by allocating funds towards debt repayment.

- Increasing savings by setting aside a portion of income regularly.

- Enhancing financial awareness and discipline.

Budget worksheets also provide a clear picture of one's financial situation, making it easier to make informed decisions about large purchases, investments, or significant life changes. They can be adjusted as financial circumstances change, ensuring that the budget remains relevant and effective.

How to Create a Budget Worksheet

Creating a budget worksheet involves several steps:

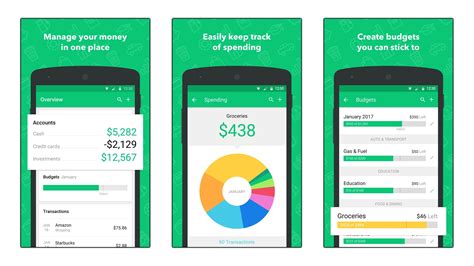

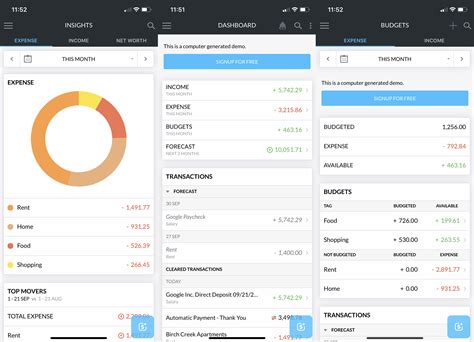

- Track Income and Expenses: Start by monitoring where your money is coming from and where it's going. This can be done using a budgeting app, spreadsheet, or simply by keeping receipts and writing down every transaction.

- Categorize Expenses: Divide expenses into categories such as housing, food, transportation, entertainment, etc.

- Set Financial Goals: Determine what you want to achieve with your budget, whether it's saving for a specific purpose, paying off debt, or building an emergency fund.

- Assign Budget Categories: Allocate funds to each expense category based on necessity, priority, and financial goals.

- Review and Adjust: Regularly review the budget to ensure it's working effectively and make adjustments as needed.

For those looking for more detailed information on budgeting and financial management, consider checking out our internal link to another post on budgeting tips.

Practical Examples of Budget Worksheets

Here are some practical examples of how budget worksheets can be used:

- Monthly Budget for a Single Person: Allocate $3,000 for housing, $800 for food, $500 for transportation, and $1,000 for entertainment and savings.

- Family Budget: Divide income into categories such as housing, utilities, food, childcare, and entertainment, ensuring that each family member's needs are considered.

Challenges in Budgeting and How to Overcome Them

Common challenges in budgeting include:

- Sticking to the Budget: It can be hard to resist impulse purchases or stick to spending limits.

- Unexpected Expenses: Car repairs, medical bills, or other unexpected expenses can throw off even the best-laid budget plans.

- Lack of Motivation: Budgeting can seem tedious, leading to a lack of motivation to continue.

To overcome these challenges, it's essential to:

- Set Realistic Goals: Make sure financial goals are achievable and aligned with current financial situations.

- Automate Savings: Use automatic transfers to ensure that savings goals are met without having to think about it.

- Review and Adjust Regularly: Regular budget reviews can help identify areas for improvement and keep motivation levels high.

Advanced Budgeting Techniques

For those who have mastered the basics of budgeting, advanced techniques can offer even more control over finances. These include:

- Investment Budgeting: Allocating funds towards investments such as stocks, bonds, or real estate.

- Retirement Planning: Setting aside funds specifically for retirement, using tools like 401(k) or IRA accounts.

- Tax Planning: Strategically managing income and expenses to minimize tax liability.

Gallery of Budgeting Tips

Budgeting Tips Image Gallery

Frequently Asked Questions

What is the best way to start budgeting?

+The best way to start budgeting is by tracking your income and expenses to understand where your money is going. Then, categorize your expenses and set financial goals.

How often should I review my budget?

+What are some common budgeting mistakes to avoid?

+Common budgeting mistakes include not accounting for irregular expenses, failing to prioritize needs over wants, and not regularly reviewing and adjusting the budget.

In conclusion, budgeting is a powerful tool for managing finances, achieving financial stability, and securing long-term financial health. By utilizing budget worksheets and understanding the importance of budgeting, individuals can take control of their financial futures. Whether you're a seasoned budgeter or just starting out, the key to successful budgeting is consistency, flexibility, and a commitment to your financial goals. We invite you to share your budgeting tips and experiences, and to explore our other resources on personal finance and budgeting for more information on how to manage your money wisely.