Intro

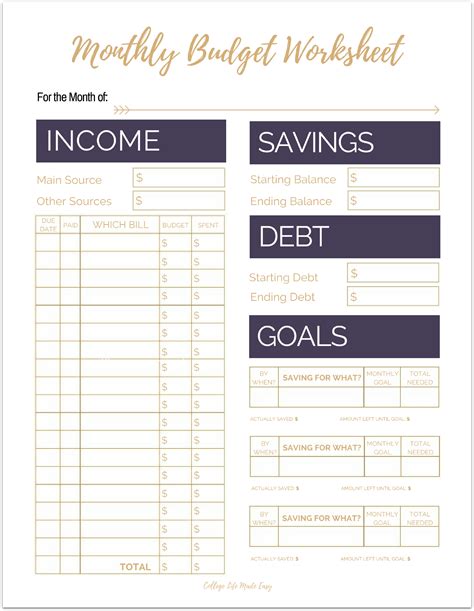

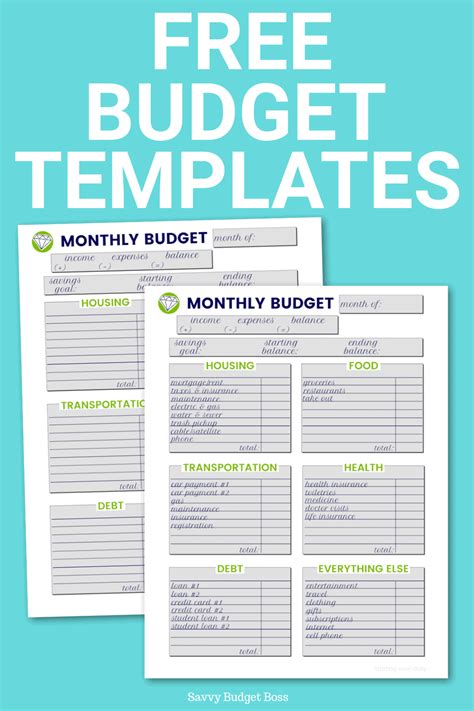

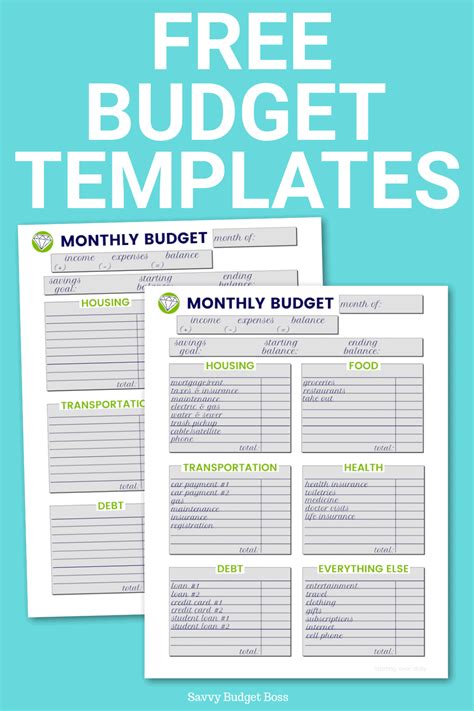

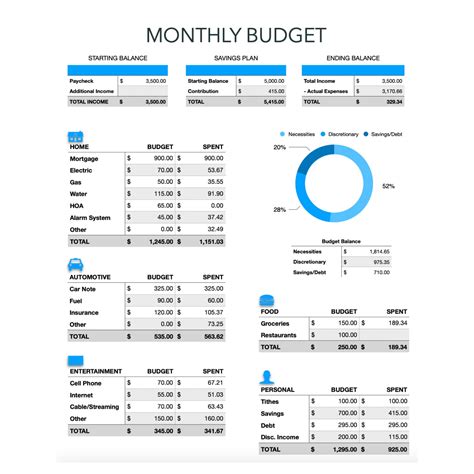

Create a personalized financial plan with our free monthly budget template printable, featuring expense tracking, income management, and savings goals to achieve financial stability and debt reduction.

Creating a budget is an essential step in managing your finances effectively. It helps you understand where your money is going, identify areas for improvement, and make conscious decisions about how you want to allocate your resources. A free monthly budget template printable can be a valuable tool in this process, allowing you to track your income and expenses with ease.

Budgeting is not just about cutting back on unnecessary expenses, but also about making sure you have enough money for the things that matter most to you. Whether you're trying to save up for a big purchase, pay off debt, or simply build up your emergency fund, having a clear picture of your financial situation is crucial. With a budget template, you can set financial goals and develop a plan to achieve them.

In today's digital age, there are many budgeting apps and software programs available, but sometimes, a simple printable template can be just what you need. It allows you to sit down with a pen and paper, review your financial situation, and make adjustments as needed. Plus, having a physical copy of your budget can be a great way to stay accountable and motivated.

Benefits of Using a Budget Template

Using a budget template can have numerous benefits. For one, it helps you stay organized and ensures that you don't forget to account for any of your expenses. It also allows you to see your financial situation at a glance, making it easier to identify areas where you can cut back. Additionally, having a budget template can help you avoid overspending and reduce financial stress.

Some of the key benefits of using a budget template include:

- Helping you track your income and expenses

- Allowing you to set financial goals and develop a plan to achieve them

- Enabling you to identify areas where you can cut back and reduce unnecessary expenses

- Providing a clear picture of your financial situation, making it easier to make informed decisions

- Reducing financial stress and anxiety

How to Use a Budget Template

To get the most out of a budget template, it's essential to use it correctly. Here are some steps to follow: 1. Start by gathering all of your financial information, including your income, expenses, and debt. 2. Fill out the template, making sure to account for every single transaction. 3. Review your budget regularly, making adjustments as needed. 4. Use the template to set financial goals and develop a plan to achieve them. 5. Consider sharing your budget with a financial advisor or accountability partner to get additional support and guidance.Types of Budget Templates

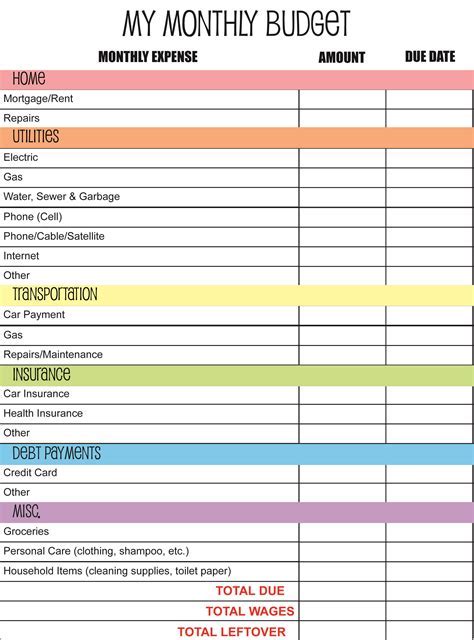

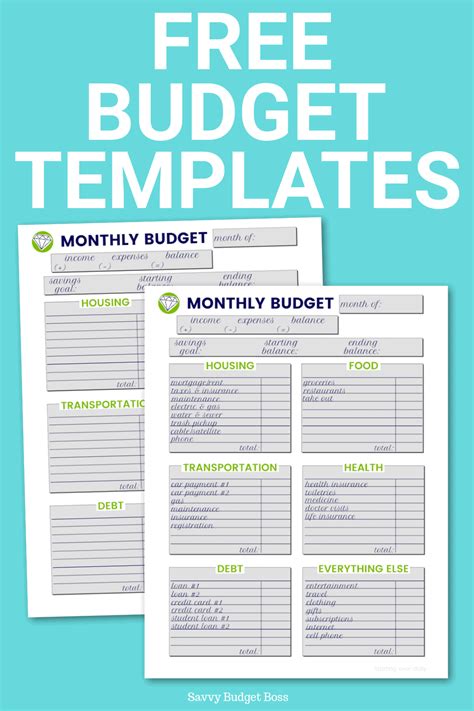

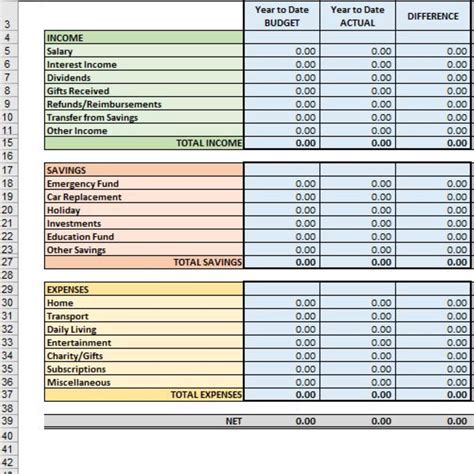

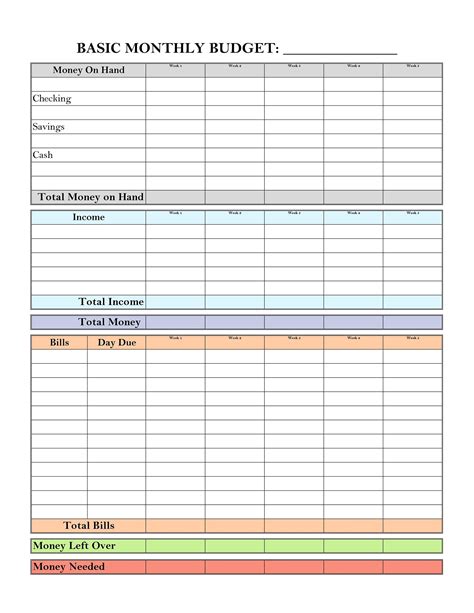

There are many different types of budget templates available, each with its own unique features and benefits. Some popular options include:

- Zero-based budgeting templates, which require you to account for every single dollar

- 50/30/20 budgeting templates, which allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment

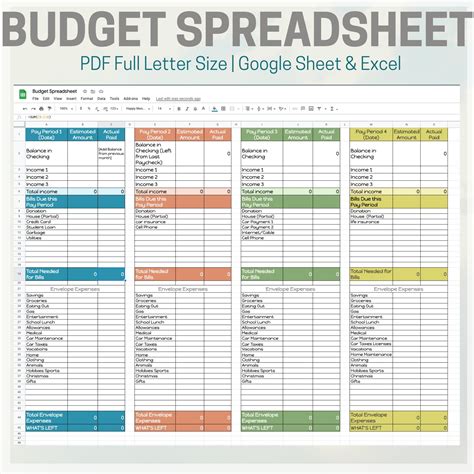

- Envelope budgeting templates, which involve dividing your expenses into categories and allocating a specific amount of cash for each one

- Budgeting templates for specific expenses, such as wedding planning or holiday spending

Choosing the Right Budget Template

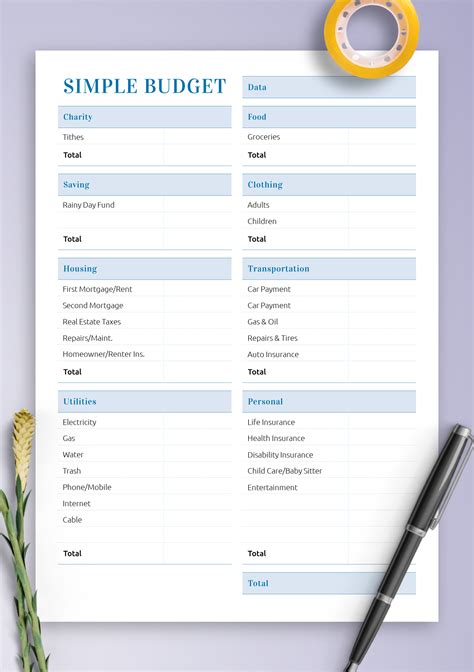

With so many different budget templates available, it can be challenging to choose the right one. Here are some factors to consider: * Your income and expenses: Look for a template that is tailored to your specific financial situation. * Your financial goals: Consider a template that is designed to help you achieve your goals, whether that's saving up for a big purchase or paying off debt. * Your level of comfort with technology: If you're not comfortable using digital tools, a printable template may be the way to go. * Your personal preferences: Consider a template that is visually appealing and easy to use.Creating a Custom Budget Template

While there are many pre-made budget templates available, you may find that creating a custom template is the best way to meet your specific needs. Here are some steps to follow:

- Start by identifying your income and expenses.

- Determine your financial goals and priorities.

- Decide on a budgeting method, such as zero-based or 50/30/20.

- Choose a format, such as a spreadsheet or printable template.

- Consider adding categories or columns for specific expenses, such as savings or debt repayment.

For more information on budgeting and personal finance, you can check out our article on budgeting tips.

Tips for Sticking to Your Budget

Sticking to your budget can be challenging, but there are several strategies that can help. Here are some tips: * Make sure your budget is realistic and achievable. * Track your expenses regularly, making adjustments as needed. * Consider implementing a "budgeting buddy" system, where you and a friend or family member hold each other accountable. * Reward yourself for staying on track, whether that's with a small treat or a bigger purchase. * Be patient and persistent – sticking to a budget takes time and effort.Common Budgeting Mistakes

While budgeting can be a powerful tool for managing your finances, there are several common mistakes that can derail your efforts. Here are some mistakes to avoid:

- Not tracking your expenses: Failing to account for every single transaction can make it difficult to stay on top of your finances.

- Not prioritizing needs over wants: Make sure you're allocating enough money for necessary expenses, such as rent and utilities.

- Not having an emergency fund: Aim to save 3-6 months' worth of living expenses in case of unexpected events or financial setbacks.

- Not reviewing and adjusting your budget: Your financial situation can change over time, so make sure you're regularly reviewing and adjusting your budget.

Budgeting for Specific Expenses

Certain expenses, such as weddings or holidays, can be challenging to budget for. Here are some tips: * Start by estimating the total cost of the expense. * Break down the expense into smaller categories, such as food, decorations, and gifts. * Allocate a specific amount of money for each category. * Consider setting aside a small amount each month to make saving easier.Budgeting Apps and Software

While printable budget templates can be a great tool, there are also many budgeting apps and software programs available. Here are some popular options:

- Mint: A free budgeting app that allows you to track your income and expenses, set financial goals, and receive alerts and reminders.

- You Need a Budget (YNAB): A budgeting app that helps you manage your finances and stay on top of your expenses.

- Personal Capital: A financial management tool that allows you to track your income and expenses, investments, and debts.

Conclusion and Next Steps

Creating a budget can seem like a daunting task, but with the right tools and strategies, it can be a powerful way to manage your finances and achieve your goals. By using a free monthly budget template printable, you can take control of your financial situation and make conscious decisions about how you want to allocate your resources. Remember to regularly review and adjust your budget, and don't be afraid to seek out additional resources and support when you need it.Free Monthly Budget Template Printable Image Gallery

What is a budget template?

+A budget template is a tool used to track income and expenses, helping individuals manage their finances effectively.

Why do I need a budget template?

+A budget template helps you stay organized, identify areas for improvement, and make informed decisions about your finances.

How do I choose the right budget template?

+Consider your income and expenses, financial goals, and personal preferences when selecting a budget template.

Can I create my own budget template?

+Yes, you can create a custom budget template tailored to your specific needs and financial situation.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes include not tracking expenses, not prioritizing needs over wants, and not having an emergency fund.

We hope this article has provided you with valuable insights and information on using a free monthly budget template printable. If you have any further questions or would like to share your own budgeting tips and strategies, please don't hesitate to comment below. You can also share this article with friends and family who may benefit from learning more about budgeting and personal finance.