Intro

Discover 5 essential tips for a vehicle bill, including financing options, insurance costs, and maintenance expenses, to help you manage car ownership costs and make informed decisions about your automotive budget and vehicle expenses.

The world of vehicle bills can be a complex and often overwhelming place, especially for those who are new to the process of buying and owning a vehicle. With so many different factors to consider, from the initial purchase price to ongoing maintenance and repair costs, it's easy to get lost in the details. However, by taking the time to understand the key components of a vehicle bill and how to navigate the process, individuals can make more informed decisions and avoid costly mistakes.

When it comes to vehicle bills, there are several important things to keep in mind. First and foremost, it's essential to have a clear understanding of the total cost of ownership, including not just the purchase price but also ongoing expenses like fuel, maintenance, and insurance. Additionally, individuals should be aware of the different financing options available to them, including loans and leases, and carefully consider the terms and conditions of each.

In recent years, the process of buying and owning a vehicle has become increasingly complex, with a wide range of factors to consider and a multitude of options available. From electric and hybrid vehicles to advanced safety features and infotainment systems, the modern vehicle is a sophisticated and often high-tech piece of machinery. However, with so many different options and features to choose from, it can be difficult for individuals to make sense of it all and determine which vehicle is right for them.

Understanding Vehicle Bills

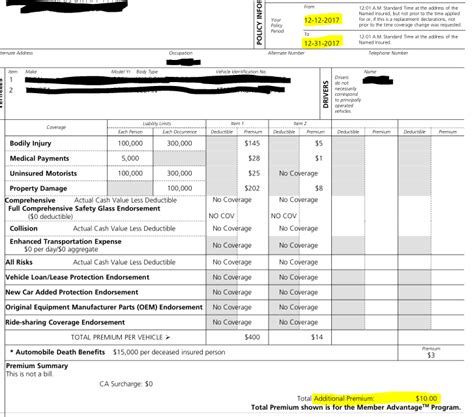

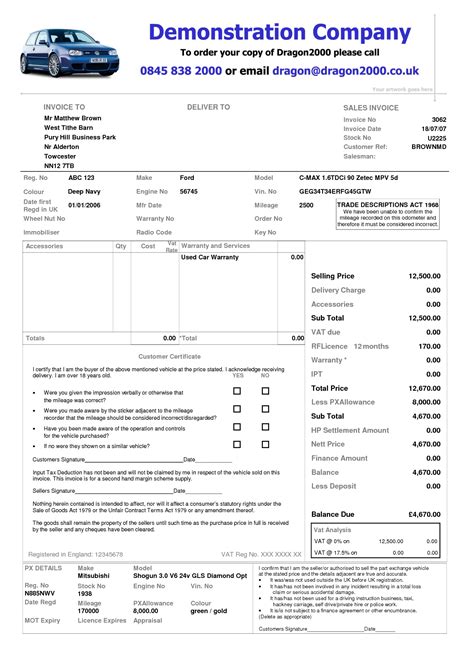

One of the most important things to consider when reviewing a vehicle bill is the total cost of ownership. This includes not just the purchase price but also ongoing expenses like fuel, maintenance, and insurance. Additionally, individuals should be aware of the different financing options available to them, including loans and leases, and carefully consider the terms and conditions of each.

Key Components of a Vehicle Bill

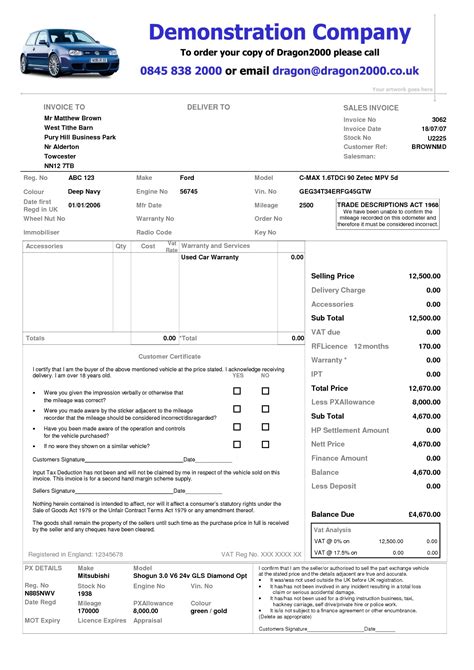

When reviewing a vehicle bill, there are several key components to consider. These include: * Purchase price: The initial cost of the vehicle, including any discounts or incentives. * Financing terms: The terms and conditions of the loan or lease, including the interest rate, monthly payment, and length of the agreement. * Ongoing expenses: Ongoing costs like fuel, maintenance, and insurance. * Warranty and maintenance: The manufacturer's warranty and any maintenance or repair costs.5 Tips for Managing Vehicle Bills

For more information on managing vehicle bills, check out our post on vehicle financing options.

Benefits of Carefully Managing Vehicle Bills

By carefully managing vehicle bills, individuals can avoid costly mistakes and make more informed decisions. This includes: * Avoiding costly surprises: By carefully reviewing the vehicle bill and understanding all of the key components, individuals can avoid costly surprises down the road. * Making informed decisions: By considering the total cost of ownership and comparing financing options, individuals can make more informed decisions and choose the vehicle that's right for them. * Saving money: By negotiating the price and reviewing the warranty, individuals can save money and reduce their overall costs.Common Mistakes to Avoid

Best Practices for Vehicle Bill Management

To get the most out of vehicle bill management, it's essential to follow best practices. These include: * Carefully reviewing the vehicle bill: Take the time to carefully review the vehicle bill and understand all of the key components. * Considering the total cost of ownership: In addition to the purchase price, consider the total cost of ownership, including ongoing expenses like fuel, maintenance, and insurance. * Comparing financing options: Carefully compare the different financing options available, including loans and leases, and consider the terms and conditions of each.Vehicle Bill Management Tools and Resources

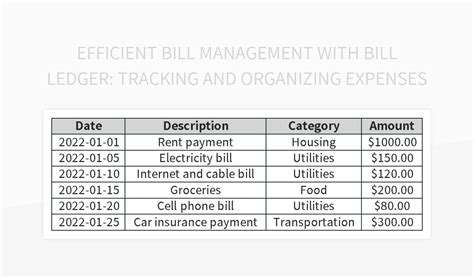

Vehicle Bill Management Software Options

There are several vehicle bill management software options available, including: * Vehicle bill tracking software: This software allows individuals to track and manage their vehicle bills, including ongoing expenses and maintenance costs. * Financial management software: This software provides a comprehensive view of an individual's finances, including vehicle bills and other expenses. * Budgeting software: This software helps individuals create and manage a budget, including vehicle bills and other expenses.Gallery of Vehicle Bill Management

Vehicle Bill Management Image Gallery

Frequently Asked Questions

What is a vehicle bill?

+A vehicle bill is a document that outlines the terms and conditions of a vehicle purchase or lease, including the purchase price, financing terms, and ongoing expenses.

How do I manage my vehicle bill?

+To manage your vehicle bill, carefully review the document and understand all of the key components, including the purchase price, financing terms, and ongoing expenses. Consider the total cost of ownership and compare financing options to make informed decisions.

What are some common mistakes to avoid when managing a vehicle bill?

+Common mistakes to avoid when managing a vehicle bill include not carefully reviewing the document, not considering the total cost of ownership, and not comparing financing options. By avoiding these mistakes, individuals can make more informed decisions and avoid costly surprises.

What tools and resources are available to help me manage my vehicle bill?

+There are several tools and resources available to help individuals manage their vehicle bills, including online calculators, financial advisors, and vehicle bill management software. These tools can provide expert advice and guidance, help individuals track and manage their vehicle bills, and make more informed decisions.

How can I save money on my vehicle bill?

+To save money on your vehicle bill, consider negotiating the price, reviewing the warranty, and comparing financing options. Additionally, individuals can save money by carefully tracking and managing their vehicle bills, including ongoing expenses and maintenance costs.

In conclusion, managing a vehicle bill requires careful consideration and attention to detail. By understanding the key components of a vehicle bill, avoiding common mistakes, and using the right tools and resources, individuals can make more informed decisions and avoid costly surprises. Whether you're a seasoned car owner or a first-time buyer, taking the time to carefully manage your vehicle bill can save you money and reduce financial strain. So why not take the first step today and start managing your vehicle bill like a pro? Share your thoughts and experiences in the comments below, and don't forget to share this article with your friends and family who may be in the market for a new vehicle.