Intro

Download W9 Form instantly and learn about tax compliance, independent contractors, and IRS requirements with our expert guide, featuring W9 instructions and filing tips.

The W9 form is a crucial document for businesses and individuals in the United States, serving as a request for taxpayer identification number and certification. This form is typically provided by independent contractors, freelancers, and vendors to their clients, verifying their identity and tax status. In this article, we will delve into the importance of the W9 form, its components, and the process of obtaining one.

The W9 form is essential for compliance with tax laws and regulations. It helps businesses and individuals avoid penalties and fines associated with incorrect or missing tax information. By providing a W9 form, independent contractors and vendors can ensure that their clients have the necessary information to report income and taxes accurately. This form is usually required when an individual or business earns more than $600 in a calendar year from a client.

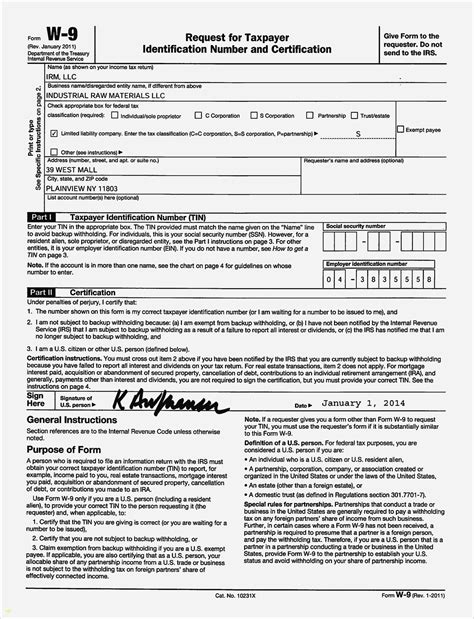

The W9 form contains vital information, including the taxpayer's name, business name, address, tax classification, and taxpayer identification number. This information is used to verify the identity of the taxpayer and to determine the correct tax withholding and reporting requirements. The form also includes a certification section, where the taxpayer certifies that the information provided is accurate and that they are not subject to backup withholding.

To obtain a W9 form, individuals and businesses can download it from the official Internal Revenue Service (IRS) website or request a copy from their client or accountant. The form is typically filled out and signed by the taxpayer, then returned to the client or payer. It's essential to keep a copy of the completed W9 form for record-keeping purposes.

Understanding the W9 Form

The W9 form is a simple, one-page document that requires basic information from the taxpayer. The form is divided into four parts: Part I, Part II, Part III, and Part IV. Part I requires the taxpayer's name, business name, and address. Part II asks for the taxpayer's tax classification, such as individual, sole proprietor, or corporation. Part III requires the taxpayer's taxpayer identification number, which can be a Social Security number or an Employer Identification Number (EIN). Part IV is the certification section, where the taxpayer certifies that the information provided is accurate.

Benefits of the W9 Form

The W9 form provides several benefits to both taxpayers and clients. For taxpayers, the W9 form helps ensure that their tax information is accurate and up-to-date, reducing the risk of errors or penalties. For clients, the W9 form provides a convenient way to verify the identity and tax status of their independent contractors and vendors, ensuring compliance with tax laws and regulations.Some of the key benefits of the W9 form include:

- Accurate tax reporting and withholding

- Reduced risk of penalties and fines

- Simplified tax compliance

- Improved record-keeping and organization

- Enhanced security and verification of taxpayer identity

How to Fill Out the W9 Form

Filling out the W9 form is a straightforward process that requires basic information from the taxpayer. Here's a step-by-step guide to help you fill out the form:

- Download the W9 form from the IRS website or request a copy from your client or accountant.

- Fill out Part I with your name, business name, and address.

- Complete Part II by selecting your tax classification.

- Provide your taxpayer identification number in Part III.

- Certify that the information provided is accurate in Part IV.

- Sign and date the form.

- Return the completed form to your client or payer.

Common Mistakes to Avoid

When filling out the W9 form, it's essential to avoid common mistakes that can lead to errors or penalties. Some of the most common mistakes include: * Inaccurate or missing taxpayer identification numbers * Incorrect tax classification * Failure to certify the information provided * Incomplete or unsigned formsTo avoid these mistakes, make sure to:

- Double-check your taxpayer identification number

- Select the correct tax classification

- Certify the information provided

- Sign and date the form

- Keep a copy of the completed form for record-keeping purposes

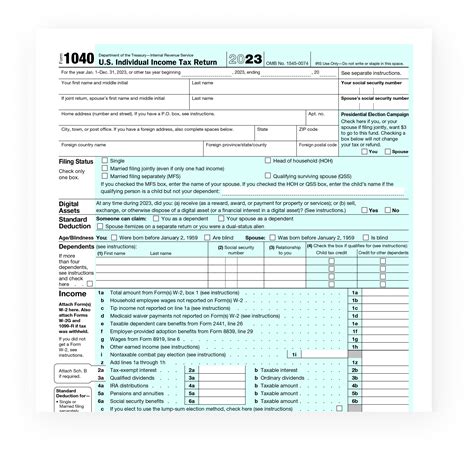

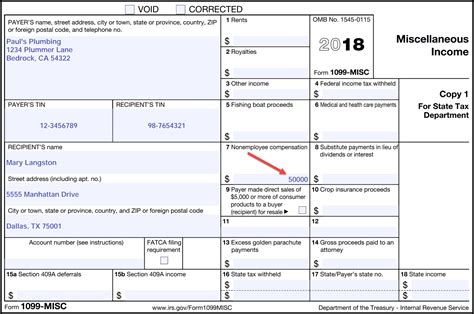

W9 Form vs. 1099 Form

The W9 form and the 1099 form are two separate documents that serve different purposes. The W9 form is used to request taxpayer identification numbers and certifications, while the 1099 form is used to report income and taxes. The 1099 form is typically filed by clients or payers to report income paid to independent contractors and vendors.

Here are some key differences between the W9 form and the 1099 form:

- Purpose: The W9 form is used to request taxpayer identification numbers and certifications, while the 1099 form is used to report income and taxes.

- Filing requirements: The W9 form is typically filed by independent contractors and vendors, while the 1099 form is filed by clients or payers.

- Deadline: The W9 form is usually required before payment is made, while the 1099 form is typically filed by January 31st of each year.

For more information on tax forms and compliance, you can visit our article on tax preparation.

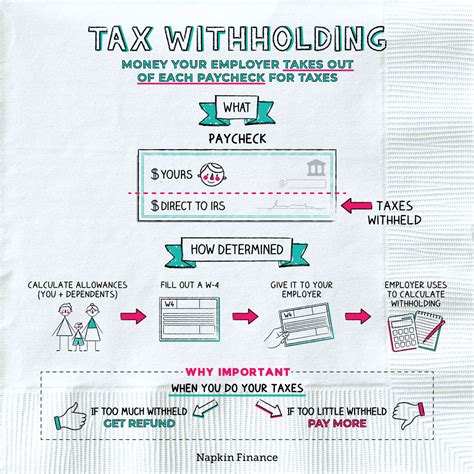

Importance of Accurate Tax Reporting

Accurate tax reporting is crucial for both taxpayers and clients. Inaccurate or missing tax information can lead to penalties, fines, and even audits. By providing accurate and complete tax information, taxpayers can ensure that their tax obligations are met, and clients can avoid penalties and fines associated with incorrect tax reporting.Some of the consequences of inaccurate tax reporting include:

- Penalties and fines

- Audits and examinations

- Delayed or denied tax refunds

- Increased tax liabilities

To avoid these consequences, it's essential to:

- Provide accurate and complete tax information

- Verify taxpayer identification numbers

- Certify the information provided

- Keep accurate records and documentation

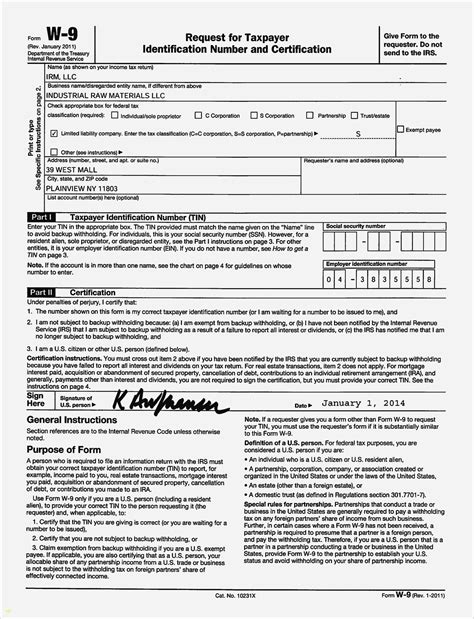

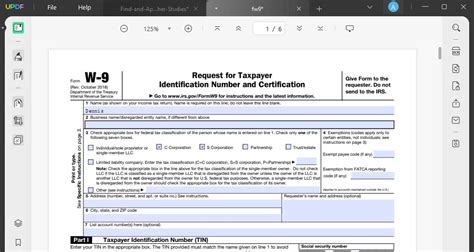

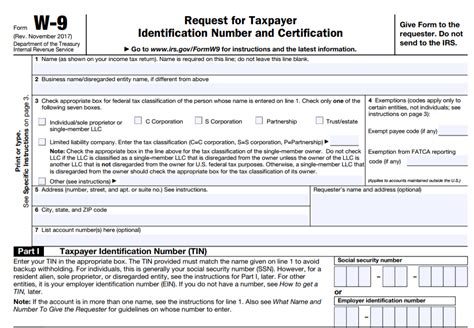

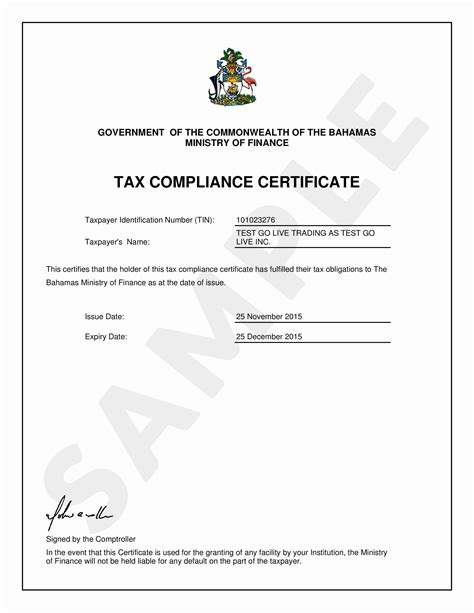

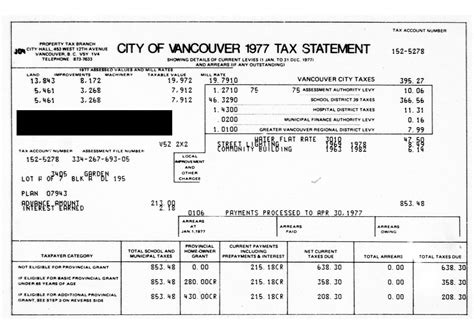

Gallery of W9 Forms and Tax-Related Documents

W9 Form Image Gallery

Frequently Asked Questions

What is the purpose of the W9 form?

+The W9 form is used to request taxpayer identification numbers and certifications from independent contractors and vendors.

Who is required to fill out the W9 form?

+Independent contractors, freelancers, and vendors are typically required to fill out the W9 form.

What is the difference between the W9 form and the 1099 form?

+The W9 form is used to request taxpayer identification numbers and certifications, while the 1099 form is used to report income and taxes.

How do I obtain a W9 form?

+You can download the W9 form from the IRS website or request a copy from your client or accountant.

What are the consequences of inaccurate tax reporting?

+Inaccurate tax reporting can lead to penalties, fines, audits, and delayed or denied tax refunds.

In summary, the W9 form is a critical document for businesses and individuals in the United States, serving as a request for taxpayer identification numbers and certifications. By understanding the importance of the W9 form, its components, and the process of obtaining one, taxpayers and clients can ensure accurate tax reporting and compliance. If you have any further questions or concerns about the W9 form or tax-related topics, please don't hesitate to comment below or share this article with others.