Intro

Discover 5 ways to efficiently manage W9 forms, including electronic filing, IRS guidelines, and tax compliance, to streamline independent contractor payments and avoid errors.

The W9 form is a crucial document used by the Internal Revenue Service (IRS) to gather information from independent contractors, freelancers, and vendors. It is essential for businesses to obtain a completed W9 form from each of their non-employee workers to ensure compliance with tax regulations. In this article, we will delve into the importance of the W9 form, its components, and provide guidance on how to fill it out accurately.

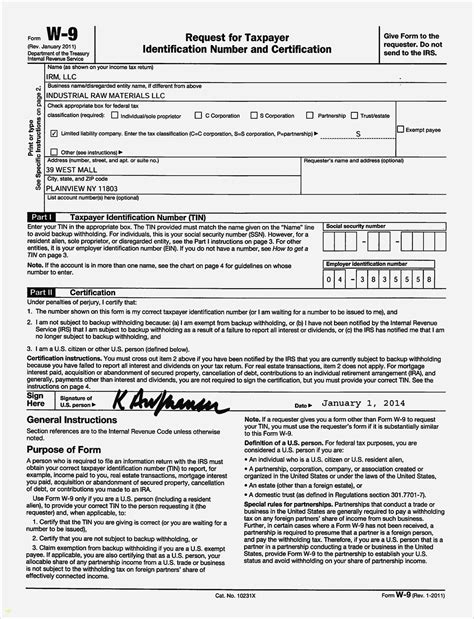

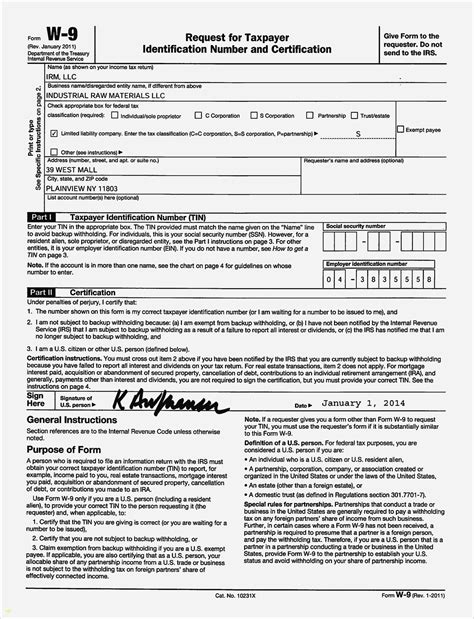

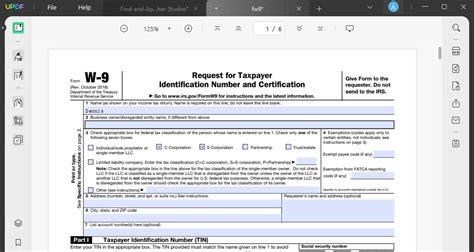

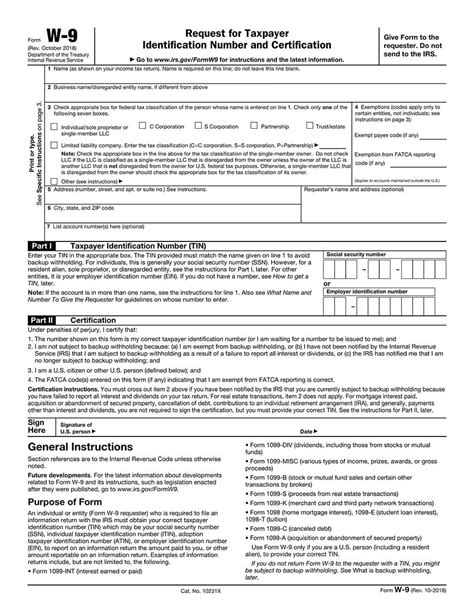

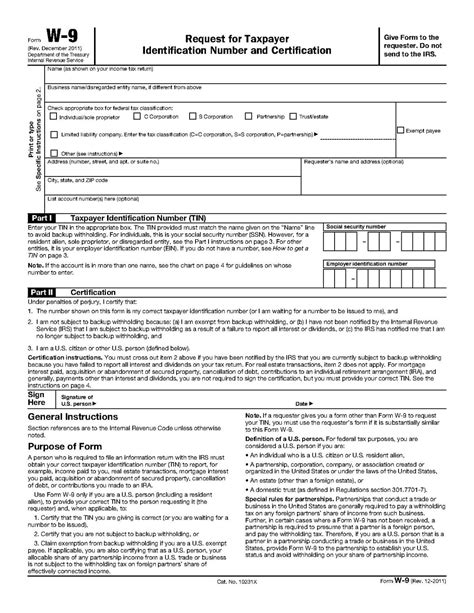

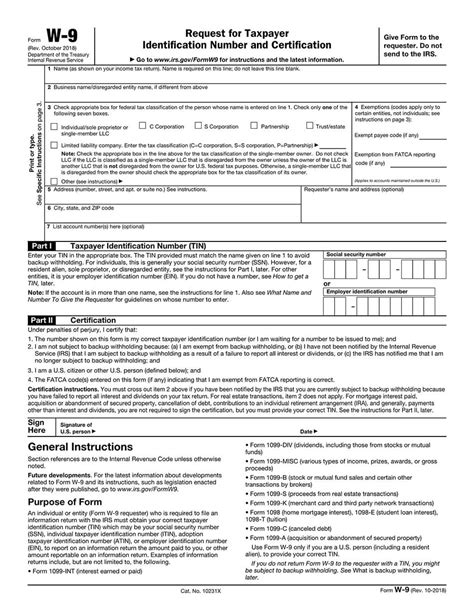

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is used to collect information such as the taxpayer identification number, business name, and address. This information is necessary for businesses to report payments made to non-employee workers on the 1099-MISC form. The 1099-MISC form is used to report miscellaneous income, such as freelance work, independent contracting, and other types of non-employee compensation.

Understanding the W9 form is vital for both businesses and independent contractors. It helps to establish a clear understanding of the working relationship and ensures that both parties are in compliance with tax laws. In the following sections, we will explore the components of the W9 form, provide guidance on how to fill it out, and discuss the importance of accuracy and compliance.

What is a W9 Form?

Components of the W9 Form

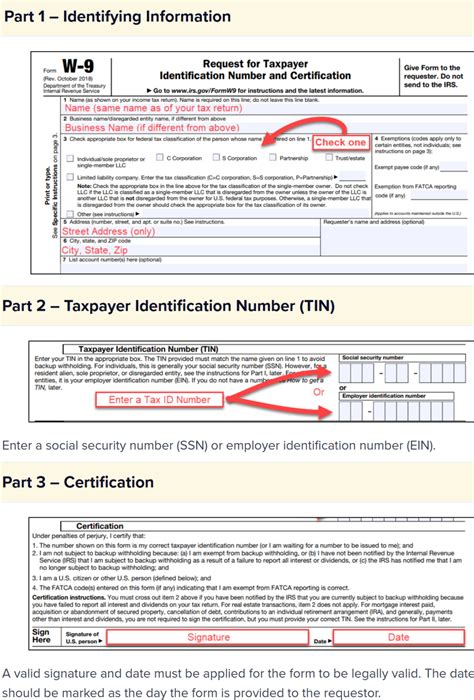

The W9 form consists of four main sections: * Part I: Taxpayer Identification Number (TIN) * Part II: Business Name * Part III: Address * Part IV: CertificationEach section requires specific information, and it is essential to fill out the form accurately to avoid any delays or penalties.

How to Fill Out a W9 Form

It is essential to review the form carefully before submitting it to ensure that all information is accurate and complete.

Tips for Filling Out the W9 Form

Here are some tips to keep in mind when filling out the W9 form: * Use your legal business name and address. * Ensure that your TIN is accurate and matches the one on your tax return. * Sign and date the form. * Keep a copy of the completed form for your records.By following these tips, you can ensure that your W9 form is filled out accurately and that you are in compliance with tax regulations.

Importance of the W9 Form

In summary, the W9 form is a vital document that plays a crucial role in ensuring tax compliance and preventing tax evasion. It is essential for businesses to obtain a completed W9 form from each of their non-employee workers and for independent contractors to fill out the form accurately.

Consequences of Not Filing the W9 Form

Failure to file the W9 form or providing inaccurate information can result in penalties and fines. Here are some of the consequences: * Delayed payments: Businesses may withhold payments until they receive a completed W9 form. * Penalties: The IRS may impose penalties for failure to file the W9 form or providing inaccurate information. * Fines: Businesses may face fines for not complying with tax regulations.It is essential to take the W9 form seriously and ensure that it is filled out accurately to avoid any consequences.

5 Ways to Use the W9 Form

By using the W9 form in these ways, businesses can ensure that they are in compliance with tax regulations and that their independent contractors are reporting their income accurately.

For more information on tax compliance and the W9 form, you can check out our article on tax preparation.

Best Practices for Managing W9 Forms

Here are some best practices for managing W9 forms: * Obtain a completed W9 form from each independent contractor before making payments. * Review the form carefully to ensure that all information is accurate and complete. * Keep a copy of the completed form for your records. * Update the form annually or as needed.By following these best practices, businesses can ensure that they are managing their W9 forms effectively and are in compliance with tax regulations.

W9 Form Image Gallery

What is the purpose of the W9 form?

+The W9 form is used to gather information from independent contractors, freelancers, and vendors, and to verify their identity and taxpayer identification number.

How do I fill out the W9 form?

+To fill out the W9 form, you will need to provide your taxpayer identification number, business name, and address, and certify your identity and acknowledge your responsibility to provide accurate information.

What are the consequences of not filing the W9 form?

+Failure to file the W9 form or providing inaccurate information can result in penalties and fines, and may delay payments from businesses.

In summary, the W9 form is a critical document that plays a vital role in ensuring tax compliance and preventing tax evasion. By understanding the importance of the W9 form, filling it out accurately, and managing it effectively, businesses and independent contractors can ensure that they are in compliance with tax regulations and avoid any consequences. We encourage you to share your thoughts and experiences with the W9 form in the comments section below. If you found this article informative, please share it with others who may benefit from this information.