Intro

Download printable W2 forms for tax season, including fillable templates and IRS instructions for easy employee wage reporting, payroll processing, and income tax filing.

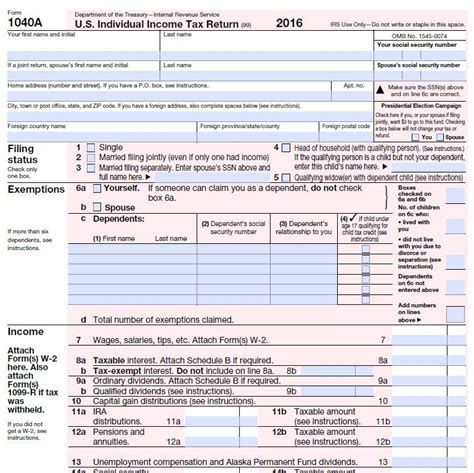

The importance of understanding and accessing the printable W2 form cannot be overstated, especially for individuals who need to file their taxes efficiently. The W2 form, also known as the Wage and Tax Statement, is a crucial document that employers are required to provide to their employees by the end of January each year. This form details the employee's income and the taxes withheld from their paycheck, which are essential for filing tax returns. For many, the ability to download and print this form is a convenient option, especially in situations where the original document is misplaced or was not received.

The process of obtaining a printable W2 form is relatively straightforward. Employers often provide these forms directly to their employees, either in physical form or through online portals. For those who need a replacement copy, contacting the employer's HR department is usually the first step. Additionally, the IRS offers guidance and resources for obtaining a W2 form, including options for individuals who are unable to get the form from their employer. Understanding the steps to obtain and utilize the printable W2 form is essential for a smooth tax filing experience.

In today's digital age, the convenience of downloadable and printable forms like the W2 has significantly streamlined the tax preparation process. Individuals can now easily access, print, and submit their tax documents without the hassle of waiting for physical copies to arrive by mail. This efficiency is particularly beneficial for those with complex tax situations or who need to file their taxes quickly to receive a refund. Moreover, the availability of printable W2 forms online has reduced the reliance on physical paperwork, contributing to a more organized and environmentally friendly approach to tax management.

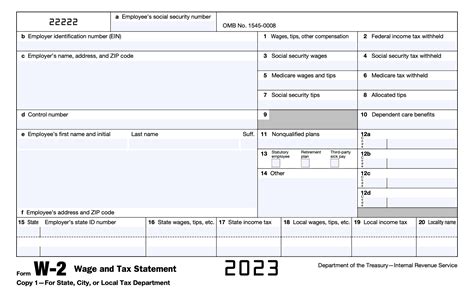

Understanding the W2 Form

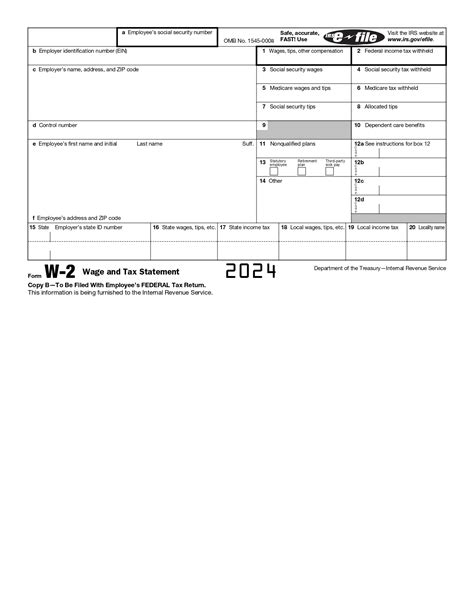

The W2 form is a vital component of the tax filing process, serving as proof of income and taxes paid. It contains several key pieces of information, including the employee's name, address, and Social Security number, as well as the employer's name, address, and Employer Identification Number (EIN). The form also details the total wages earned, federal income tax withheld, and Social Security and Medicare taxes withheld. This information is crucial for completing tax returns accurately and ensuring that individuals receive the correct refund amount or pay the appropriate tax liability.

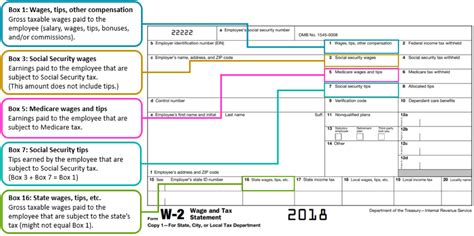

Components of the W2 Form

The W2 form is divided into several boxes, each containing specific information: - Box 1: Wages, tips, other compensation - Box 2: Federal income tax withheld - Box 3: Social Security wages - Box 4: Social Security tax withheld - Box 5: Medicare wages and tips - Box 6: Medicare tax withheld Understanding what each box represents is essential for accurately reporting income and taxes on tax returns.Benefits of Printable W2 Forms

The benefits of having access to printable W2 forms are numerous. Firstly, they offer convenience, allowing individuals to print out the forms as needed, which is particularly useful for those who need to file their taxes promptly or have misplaced their original W2. Secondly, printable W2 forms contribute to environmental sustainability by reducing the need for physical mailings. Additionally, they provide a backup option in case the original form is lost or damaged, ensuring that tax filing deadlines can still be met.

Accessibility and Convenience

The convenience factor of printable W2 forms is significant. With the ability to download and print these forms at any time, individuals have greater control over their tax preparation process. This accessibility is especially beneficial for those living in areas with limited access to postal services or who prefer the efficiency of digital documentation. Moreover, the option to print W2 forms as needed can help reduce clutter and disorganization, as physical copies can be produced only when required.How to Obtain a Printable W2 Form

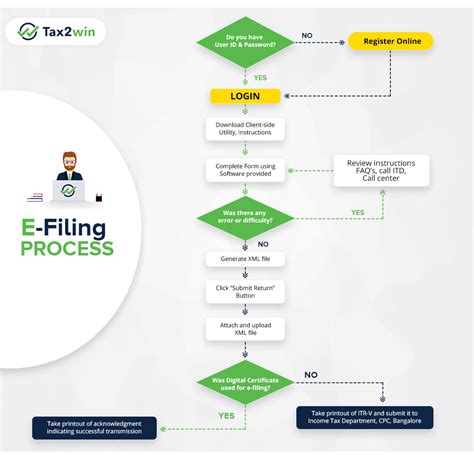

Obtaining a printable W2 form typically involves contacting the employer or accessing the form through an employer-provided online portal. Here are the steps to follow:

- Contact Your Employer: The first step is to reach out to your employer's HR or payroll department. They can provide you with a replacement W2 form or guide you on how to access it through their online system.

- Use Online Portals: Many employers offer online portals where employees can log in and access their tax documents, including W2 forms. Check your employer's website or contact HR for more information.

- IRS Website: If you are unable to obtain the W2 form from your employer, you can contact the IRS for assistance. They may be able to provide the form or offer guidance on how to proceed with your tax filing.

Steps for Employers

Employers also have specific responsibilities regarding the distribution of W2 forms. They must provide these forms to their employees by January 31st of each year. For employers, the process involves: - Preparing the W2 forms with accurate information - Distributing the forms to employees by the deadline - Filing the W2 forms with the Social Security AdministrationSecurity and Privacy Concerns

Given the sensitive nature of the information contained on W2 forms, security and privacy are significant concerns. Employers and employees alike must ensure that these documents are handled and stored securely to prevent identity theft and unauthorized access. This includes using secure online portals for distribution and storage, as well as physically safeguarding printed copies.

Best Practices for Security

To protect the sensitive information on W2 forms: - Use encrypted online portals for accessing and storing W2 forms. - Implement strong password protection for online accounts. - Keep physical copies of W2 forms in a secure, locked location. - Shred unwanted or obsolete W2 forms to prevent unauthorized access.Common Issues and Solutions

Despite the convenience and benefits of printable W2 forms, individuals may encounter several issues. These can range from difficulty accessing the form online to errors in the form's content. In such cases, contacting the employer or the IRS can provide the necessary assistance. For errors on the W2 form, employers can issue a corrected form, known as a W2c.

Troubleshooting Tips

For common issues: - **Missing W2 Form**: Contact your employer or the IRS. - **Errors on the W2 Form**: Request a corrected W2c form from your employer. - **Difficulty Accessing Online Portal**: Check with your employer's HR department for assistance.Importance of Accuracy

The accuracy of the information on the W2 form is crucial for tax filing purposes. Inaccurate information can lead to delays in processing tax returns, potential audits, and issues with receiving tax refunds. Therefore, it is essential to review the W2 form carefully for any errors or discrepancies before submitting it with your tax return.

Reviewing Your W2 Form

When reviewing your W2 form: - Verify your name, address, and Social Security number. - Check the accuracy of your income and taxes withheld. - Ensure all boxes are completed correctly.Conclusion and Next Steps

In conclusion, the printable W2 form is a vital document for tax filing, and understanding its components, benefits, and how to obtain it is essential for a smooth tax preparation process. By following the guidelines and best practices outlined, individuals can ensure accuracy, security, and convenience in their tax management. For more information on tax-related topics, consider visiting our tax guidance page for comprehensive resources and tips.

Final Thoughts

The ability to download and print W2 forms has revolutionized the way individuals approach tax preparation, offering convenience, accessibility, and environmental sustainability. As tax laws and regulations evolve, staying informed about the latest developments and best practices will be key to navigating the tax filing process efficiently.Printable W2 Form Gallery

What is a W2 form used for?

+The W2 form is used to report an employee's income and taxes withheld to the IRS and the employee.

How do I obtain a printable W2 form?

+You can obtain a printable W2 form by contacting your employer or accessing it through an employer-provided online portal.

What if there are errors on my W2 form?

+If there are errors on your W2 form, you should contact your employer to request a corrected W2c form.

We invite you to share your thoughts and experiences with printable W2 forms in the comments below. Whether you're an individual looking for tips on tax preparation or an employer seeking to streamline your tax document distribution process, your insights can help others navigate the complexities of tax management. Feel free to ask questions or offer advice based on your own experiences with W2 forms and tax filing. Additionally, if you found this article helpful, consider sharing it with others who might benefit from the information provided.