Intro

Discover 5 ways printable W2 forms simplify tax season, including easy employee access, instant downloads, and secure storage, making payroll and tax compliance a breeze with online W2 printing and electronic W2 distribution solutions.

The importance of printable W2 forms cannot be overstated, especially during tax season. For employees and employers alike, having access to these forms is crucial for filing taxes accurately and on time. In this article, we will delve into the world of printable W2 forms, exploring their benefits, how they work, and the steps to obtain them. Whether you are an individual looking to file your taxes or a business owner seeking to provide your employees with their necessary tax documents, understanding the ins and outs of printable W2 forms is essential.

Printable W2 forms are a convenient and efficient way to manage tax documentation. They can be easily downloaded, printed, and distributed to employees, saving time and reducing the hassle associated with traditional paper-based systems. Moreover, these forms are environmentally friendly, as they reduce the need for physical storage space and minimize the risk of lost or damaged documents. With the advancement of technology, it has become increasingly simple to generate, print, and distribute W2 forms online, making the tax filing process smoother for everyone involved.

The benefits of using printable W2 forms extend beyond convenience and environmental considerations. They also play a critical role in ensuring compliance with tax regulations. The Internal Revenue Service (IRS) requires employers to provide their employees with a W2 form by January 31st of each year, detailing their income and tax withholding for the previous tax year. By utilizing printable W2 forms, employers can ensure they meet this deadline and provide their employees with the necessary documentation to file their taxes accurately. Furthermore, these forms can be easily stored and retrieved electronically, making it simpler for employers to maintain records and comply with auditing requirements.

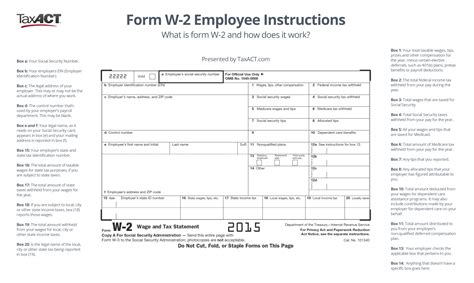

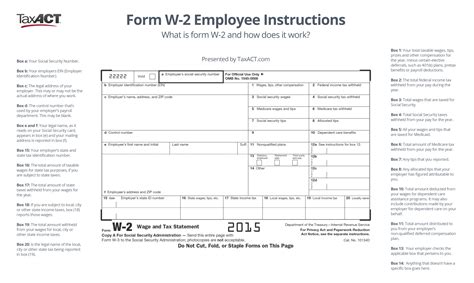

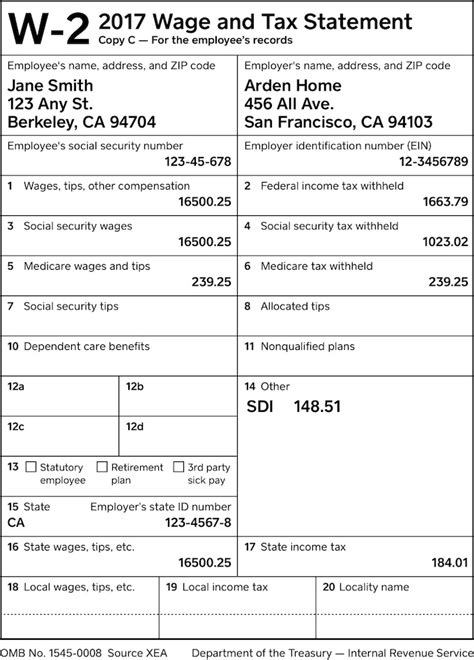

Understanding W2 Forms

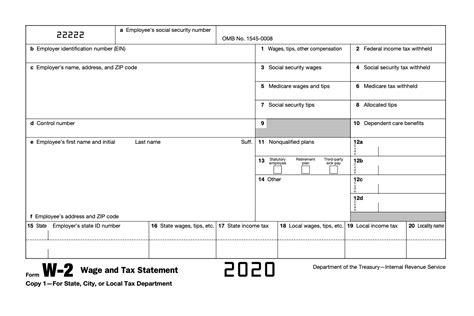

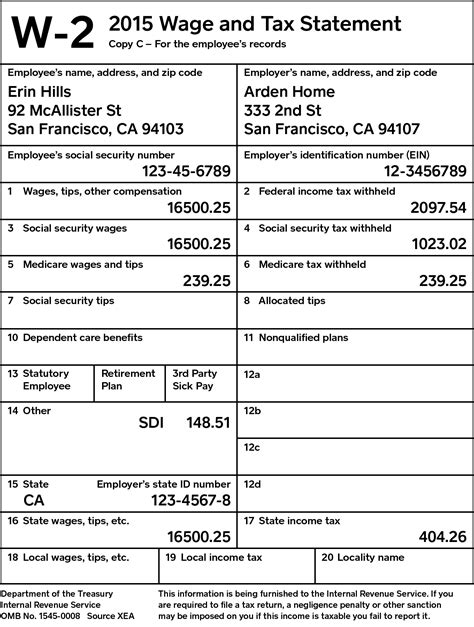

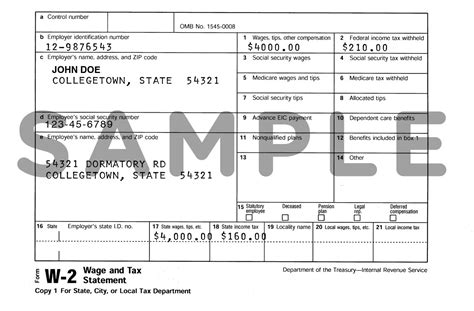

To fully appreciate the value of printable W2 forms, it's essential to understand what they are and how they are used. A W2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the IRS at the end of each year. This form reports the employee's income and the amount of taxes withheld from their paycheck. It is a critical document for tax filing, as it serves as proof of income and allows individuals to claim deductions and credits they are eligible for.

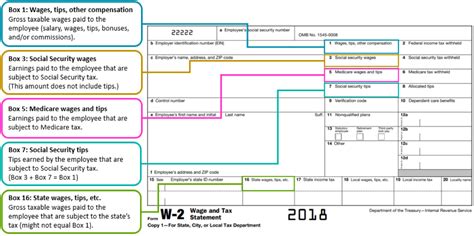

Components of a W2 Form

A standard W2 form includes several key pieces of information: - Employee's name, address, and Social Security number - Employer's name, address, and Employer Identification Number (EIN) - Wages, tips, and other compensation - Federal income tax withheld - Social Security wages and tax withheld - Medicare wages and tax withheldBenefits of Printable W2 Forms

The advantages of using printable W2 forms are numerous. For employers, they offer a streamlined process for generating and distributing tax documents, reducing administrative burdens and costs associated with traditional printing and mailing methods. For employees, they provide easy access to their tax information, enabling them to file their taxes promptly and accurately. Additionally, printable W2 forms can be stored electronically, making it easier for individuals to keep track of their tax history and for employers to maintain compliance with tax laws.

Environmental Impact

The shift towards printable W2 forms also has a positive environmental impact. By reducing the need for paper, these forms contribute to a decrease in deforestation, water pollution, and greenhouse gas emissions associated with paper production and transportation. As more businesses and individuals embrace digital solutions for tax documentation, the collective environmental benefit can be significant.How to Obtain Printable W2 Forms

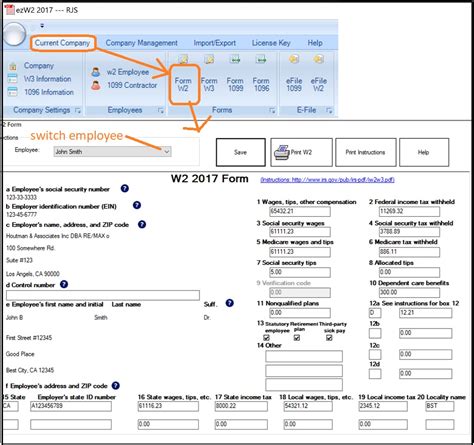

Obtaining printable W2 forms is a straightforward process. Employers can generate these forms through their payroll software or by contacting their payroll service provider. Many payroll services offer online platforms where employers can log in, generate W2 forms for their employees, and either print them directly or provide employees with access to download and print their own forms. For individuals who have not received their W2 form by the end of January, contacting their employer or former employer is the first step. If the issue persists, reaching out to the IRS for assistance may be necessary.

Steps for Employers

For employers, the process involves: 1. **Preparing for Tax Season**: Ensure all employee and payroll information is up-to-date. 2. **Generating W2 Forms**: Use payroll software or a payroll service to generate W2 forms for all employees. 3. **Distributing W2 Forms**: Provide each employee with their W2 form by January 31st, either by mail or through an online portal. 4. **Filing with the IRS**: Submit Copy A of the W2 forms to the Social Security Administration by the deadline.Security and Compliance

Security and compliance are paramount when dealing with printable W2 forms. Employers must ensure that employee data is protected against unauthorized access, theft, or manipulation. This involves implementing robust security measures, such as encryption, secure login credentials, and access controls. Compliance with IRS regulations and deadlines is also critical to avoid penalties and fines.

Best Practices for Security

Best practices include: - **Encrypting Data**: Protect W2 forms and payroll data with strong encryption. - **Secure Access**: Limit access to authorized personnel only. - **Regular Updates**: Keep payroll software and systems updated with the latest security patches.Common Issues and Solutions

Despite the convenience and efficiency of printable W2 forms, issues can arise. Employees may not receive their W2 forms on time, or they might discover errors in their form. Employers might face challenges in generating or distributing these forms. Understanding common issues and having solutions in place can mitigate these problems.

Resolving Errors

If an error is found on a W2 form: - **Correct the Error**: The employer must correct the error and provide the employee with a revised W2 form (W2c). - **Notify the IRS**: The employer should also notify the IRS of the correction by filing a W3c form.For more information on tax-related topics, consider visiting our internal link to another post on understanding tax deductions and credits.

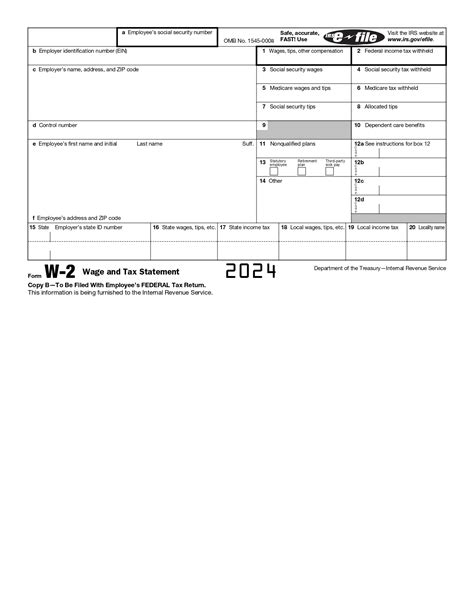

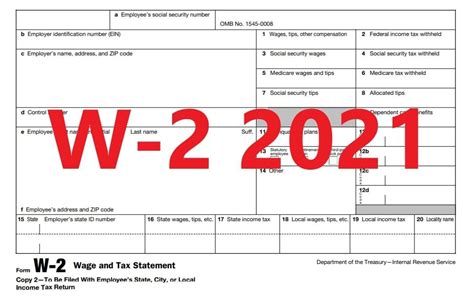

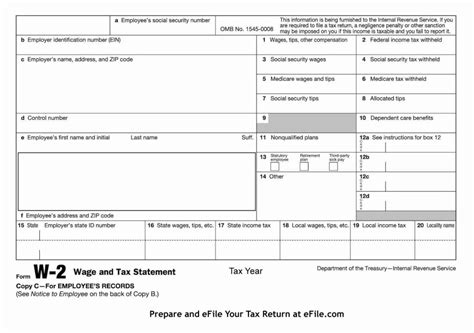

Gallery of Printable W2 Forms

Printable W2 Forms Image Gallery

Frequently Asked Questions

What is a W2 form used for?

+A W2 form is used to report an employee's income and taxes withheld to the IRS and the employee.

How do I get a copy of my W2 form?

+You can obtain a copy of your W2 form from your employer or by contacting the IRS.

What if I find an error on my W2 form?

+If you find an error, notify your employer, who will correct the error and provide you with a revised W2 form (W2c).

In conclusion, printable W2 forms are a vital component of the tax filing process, offering convenience, efficiency, and compliance with tax regulations. By understanding the benefits, mechanisms, and steps involved in obtaining these forms, both employers and employees can navigate the tax season with ease. We invite you to share your experiences or ask questions about printable W2 forms in the comments below. Additionally, feel free to share this article with others who might find it helpful, and don't hesitate to reach out if you need further guidance on tax-related matters.