Intro

Download a free Printable W4 Form Template to simplify employee tax withholding, including federal income tax, allowances, and deductions, with easy-to-use IRS W-4 forms and worksheets.

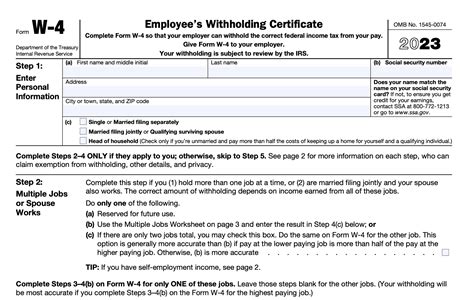

The W4 form is a crucial document for employees in the United States, as it determines the amount of federal income tax withheld from their wages. The form is typically completed by new employees when they start a new job, and it can be updated at any time if their tax situation changes. In this article, we will explore the importance of the W4 form, its components, and provide a printable W4 form template for easy use.

The W4 form is used by employers to determine the correct amount of federal income tax to withhold from an employee's wages. The form takes into account the employee's filing status, number of dependents, and other factors that may affect their tax liability. It is essential to complete the W4 form accurately to avoid overpaying or underpaying taxes throughout the year. Employees who fail to complete the form or provide inaccurate information may face penalties and fines from the Internal Revenue Service (IRS).

The W4 form is typically completed by new employees when they start a new job, but it can be updated at any time if their tax situation changes. For example, if an employee gets married, has a child, or starts a new job, they may need to update their W4 form to reflect these changes. Employers are required to provide the W4 form to new employees and to update their records accordingly.

Understanding the W4 Form

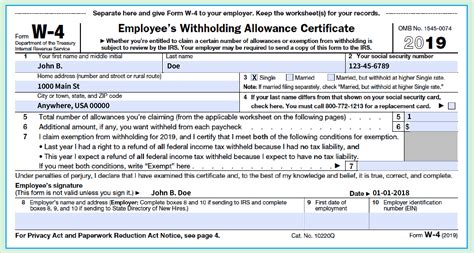

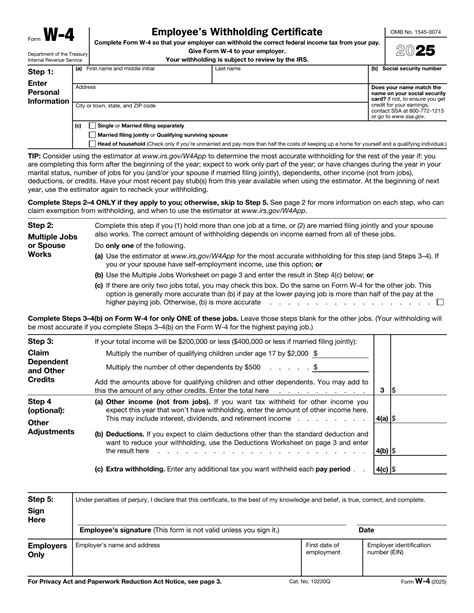

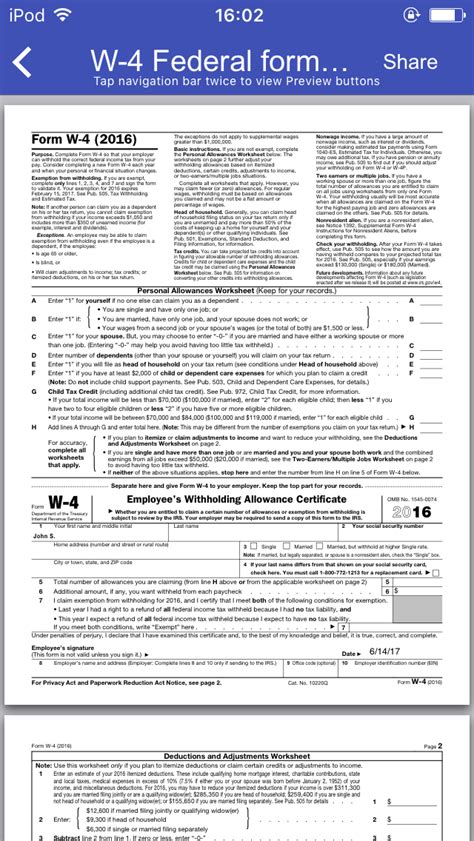

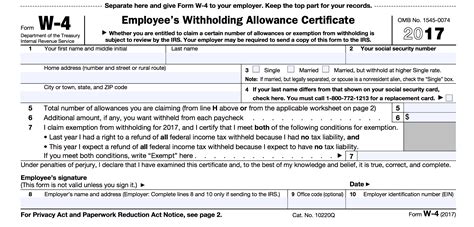

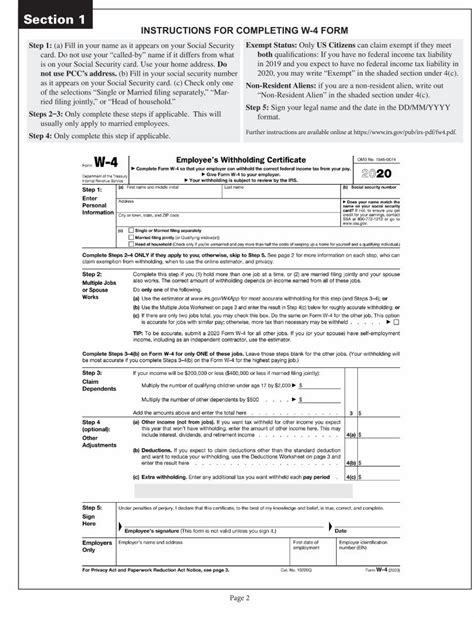

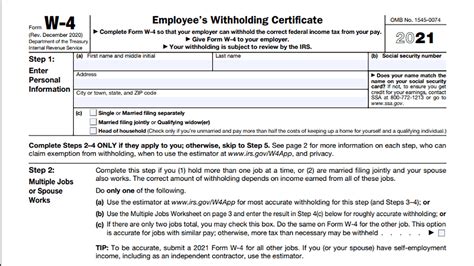

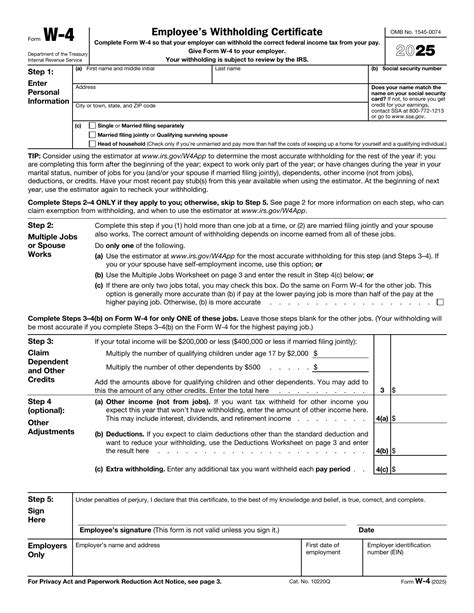

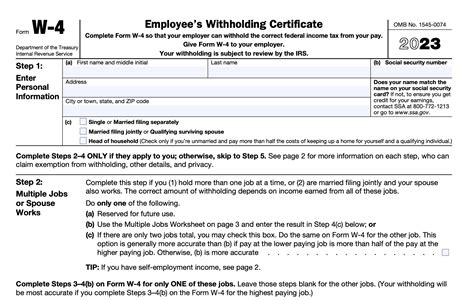

The W4 form is a simple and straightforward document that requires employees to provide basic information about their tax situation. The form is divided into several sections, each of which requires employees to provide specific information. The first section requires employees to provide their name, address, and Social Security number. The second section requires employees to indicate their filing status, which can be single, married, or head of household.

The third section of the W4 form requires employees to claim any dependents they may have. Dependents can include children, spouses, or other relatives who rely on the employee for financial support. Employees can claim a certain number of dependents, which will affect the amount of taxes withheld from their wages. The fourth section of the W4 form requires employees to indicate any other income they may have, such as investments or self-employment income.

Components of the W4 Form

The W4 form has several components that employees must complete accurately. These components include: * Employee's name and address * Social Security number * Filing status (single, married, or head of household) * Number of dependents * Other income (investments, self-employment income, etc.) * Any additional taxes the employee wants to withholdPrintable W4 Form Template

To make it easier for employees to complete the W4 form, we have provided a printable W4 form template. This template can be downloaded and printed, and it includes all the necessary sections and fields required by the IRS. The template is easy to use and understand, and it can be completed in just a few minutes.

To use the printable W4 form template, simply download and print the document. Then, fill out the required sections and fields, and sign and date the form. The form should be returned to the employer, who will use the information to determine the correct amount of federal income tax to withhold from the employee's wages.

Benefits of Using a Printable W4 Form Template

Using a printable W4 form template can provide several benefits, including: * Convenience: The template can be downloaded and printed from anywhere, making it easy to complete and return to the employer. * Accuracy: The template includes all the necessary sections and fields, reducing the risk of errors or omissions. * Time-saving: The template can be completed quickly and easily, saving time and effort for both employees and employers.How to Complete the W4 Form

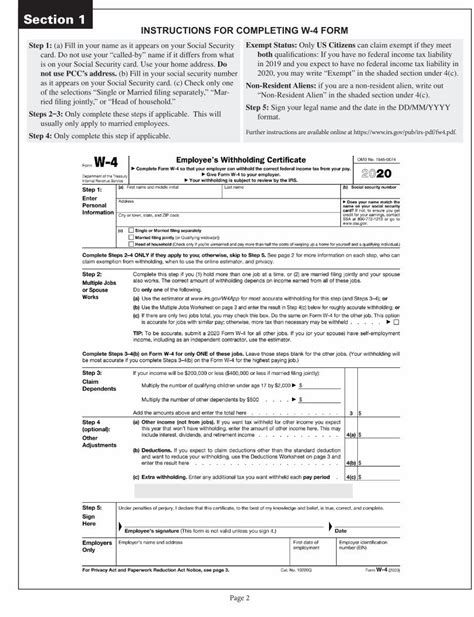

Completing the W4 form is a straightforward process that requires employees to provide basic information about their tax situation. Here are the steps to follow:

- Download and print the W4 form template.

- Fill out the required sections and fields, including name, address, Social Security number, filing status, and number of dependents.

- Indicate any other income, such as investments or self-employment income.

- Sign and date the form.

- Return the form to the employer.

Tips for Completing the W4 Form

Here are some tips for completing the W4 form: * Make sure to use the correct form: The W4 form is updated annually, so make sure to use the current year's form. * Read the instructions carefully: The instructions provided with the form can help employees understand what information is required and how to complete the form accurately. * Use the correct filing status: The filing status indicated on the W4 form should match the employee's actual filing status. * Claim the correct number of dependents: Employees should claim only the dependents they are eligible for, as claiming too many dependents can result in penalties and fines.Common Mistakes to Avoid

When completing the W4 form, there are several common mistakes to avoid. These include:

- Failing to sign and date the form

- Providing inaccurate information

- Claiming too many dependents

- Failing to update the form when tax situations change

Consequences of Inaccurate W4 Forms

Inaccurate W4 forms can result in several consequences, including: * Overpaying or underpaying taxes * Penalties and fines from the IRS * Delayed tax refunds * Increased tax liabilityUpdating the W4 Form

The W4 form should be updated whenever an employee's tax situation changes. This can include changes in filing status, number of dependents, or other income. Employees can update their W4 form by completing a new form and returning it to their employer.

When to Update the W4 Form

Here are some situations when the W4 form should be updated: * Marriage or divorce * Birth or adoption of a child * Change in filing status * Change in number of dependents * Change in other incomeFor more information on tax-related topics, you can visit our internal link to another post on tax planning and preparation.

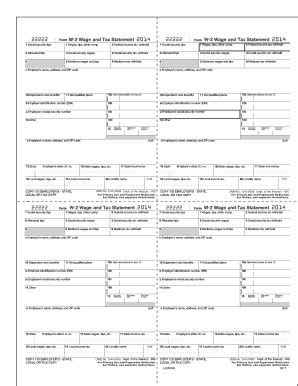

W4 Form Image Gallery

What is the purpose of the W4 form?

+The W4 form is used by employers to determine the correct amount of federal income tax to withhold from an employee's wages.

How often should I update my W4 form?

+You should update your W4 form whenever your tax situation changes, such as when you get married, have a child, or start a new job.

What happens if I make a mistake on my W4 form?

+If you make a mistake on your W4 form, you may be subject to penalties and fines from the IRS. You should correct the mistake as soon as possible and update your form accordingly.

We hope this article has provided you with a comprehensive understanding of the W4 form and its importance in determining the correct amount of federal income tax to withhold from your wages. If you have any questions or concerns about the W4 form, please don't hesitate to comment below. You can also share this article with others who may find it helpful. Remember to always consult with a tax professional if you are unsure about any aspect of the W4 form or your tax situation. By taking the time to understand and complete the W4 form accurately, you can ensure that you are paying the correct amount of taxes and avoiding any potential penalties or fines.