Intro

Get the latest Download Printable W9 Form for tax purposes, including IRS instructions, filing requirements, and independent contractor guidelines, to ensure accurate completion and submission of the W-9 tax form.

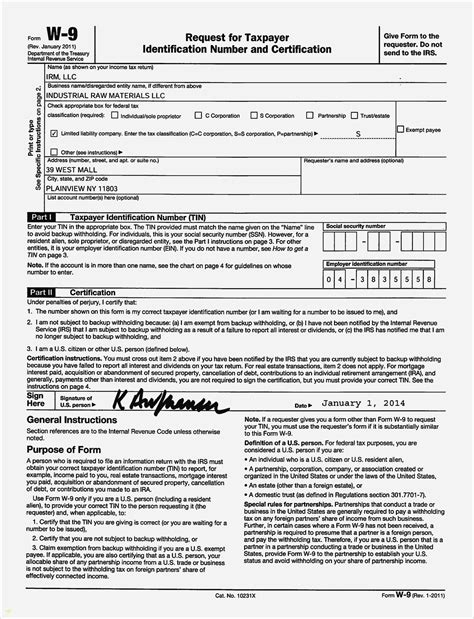

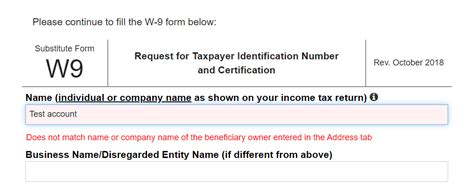

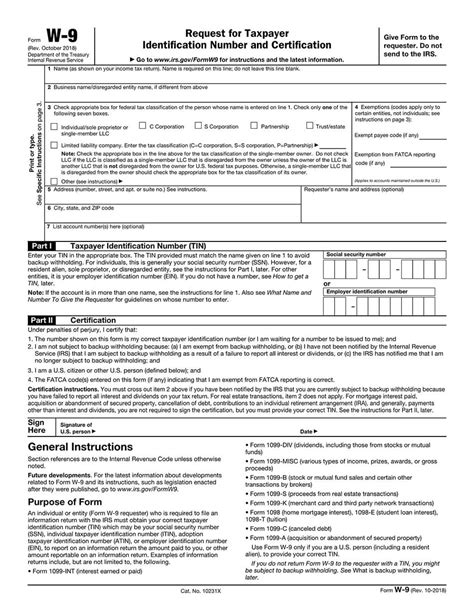

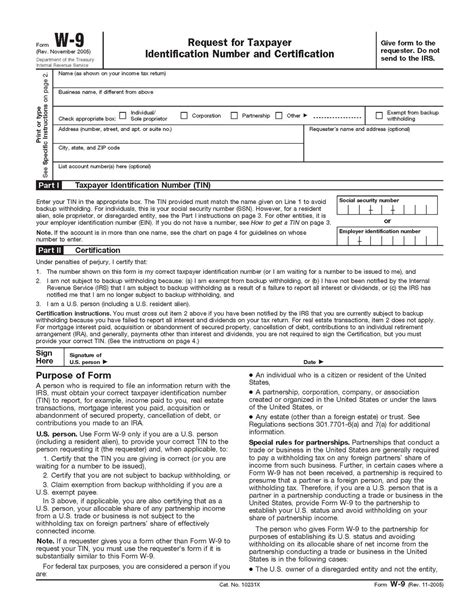

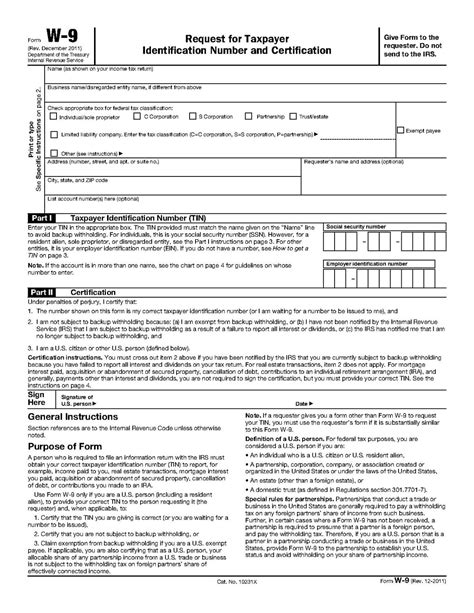

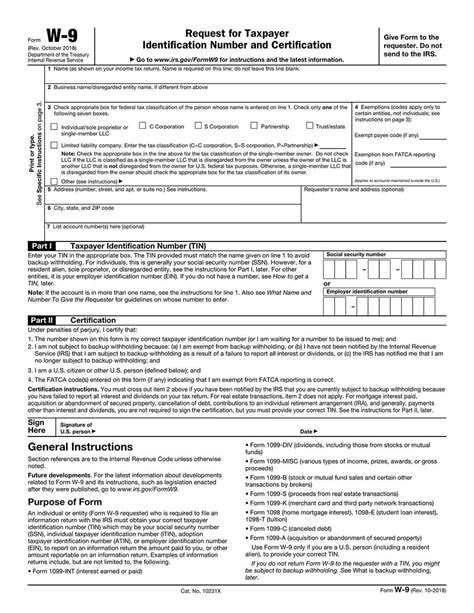

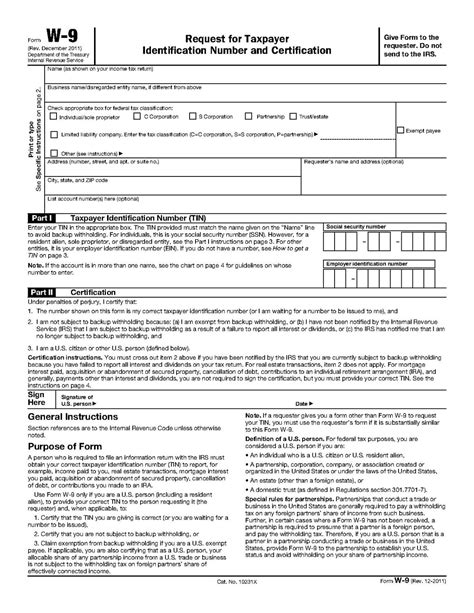

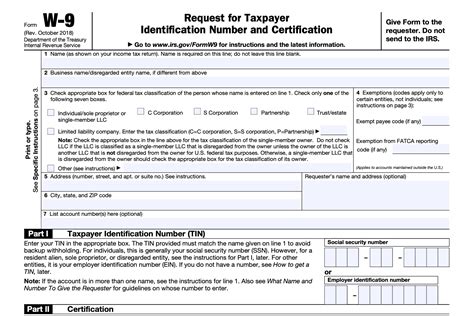

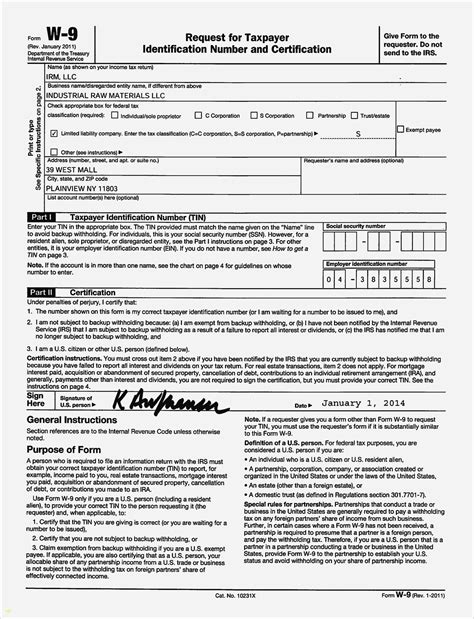

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by businesses and individuals to provide their taxpayer identification number to other entities. This form is typically required when an individual or business is working as an independent contractor, freelancer, or vendor for another company. The W9 form is used to certify the taxpayer identification number, which can be a Social Security number or an Employer Identification number, and to confirm that the individual or business is not subject to backup withholding.

In today's digital age, it's easier than ever to download and complete a printable W9 form. The Internal Revenue Service (IRS) provides a downloadable version of the W9 form on their website, which can be easily accessed and printed. Many businesses and financial institutions also offer downloadable W9 forms on their websites, making it convenient for individuals and businesses to obtain the form.

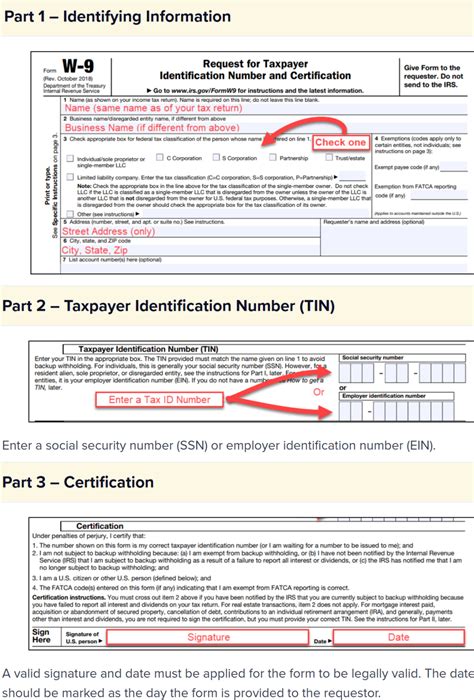

The W9 form is a simple, one-page document that requires the individual or business to provide their name, business name, address, and taxpayer identification number. The form also requires the individual or business to certify that they are not subject to backup withholding and that they are a U.S. person, which includes citizens, resident aliens, and certain organizations. The W9 form is typically completed and signed by the individual or business, and then returned to the requesting entity.

Importance of the W9 Form

Benefits of Using a Printable W9 Form

Using a printable W9 form offers several benefits, including convenience, accessibility, and efficiency. With a downloadable W9 form, individuals and businesses can quickly and easily obtain the form, complete it, and return it to the requesting entity. This eliminates the need to wait for the form to be mailed or to visit a physical location to obtain it.Some of the key benefits of using a printable W9 form include:

- Convenience: Downloadable W9 forms can be easily accessed and printed from anywhere, at any time.

- Accessibility: Printable W9 forms can be obtained by anyone with an internet connection, making it easier for individuals and businesses to comply with tax regulations.

- Efficiency: Completing a printable W9 form can save time and reduce errors, as the form can be easily filled out and reviewed before submission.

How to Complete a Printable W9 Form

Tips for Completing a Printable W9 Form

To ensure that the W9 form is completed correctly, individuals and businesses should follow these tips: * Use a black pen to complete the form, as this will make it easier to read and scan. * Make sure to sign and date the form, as this is required for the form to be valid. * Double-check the form for errors and inaccuracies before submitting it. * Keep a copy of the completed form for your records.For more information on tax-related topics, you can visit our internal link to another post.

Common Mistakes to Avoid When Completing a Printable W9 Form

Consequences of Not Completing a W9 Form Correctly

Failing to complete a W9 form correctly can have serious consequences, including penalties and fines. If an individual or business fails to provide a completed W9 form, they may be subject to backup withholding, which can result in a significant reduction in their payments. Additionally, failing to complete a W9 form correctly can lead to delays in payment and may even result in the termination of a contract or agreement.Gallery of W9 Forms and Related Topics

W9 Form Image Gallery

Frequently Asked Questions

What is a W9 form used for?

+A W9 form is used to provide a taxpayer identification number and certify that an individual or business is not subject to backup withholding.

How do I complete a W9 form?

+To complete a W9 form, provide your name, business name, and address, and enter your taxpayer identification number. Certify that you are not subject to backup withholding and sign and date the form.

What are the consequences of not completing a W9 form correctly?

+Failing to complete a W9 form correctly can result in penalties and fines, including backup withholding, delays in payment, and termination of a contract or agreement.

Where can I download a W9 form?

+A W9 form can be downloaded from the IRS website or other trusted sources, such as financial institutions or business websites.

How often do I need to complete a W9 form?

+A W9 form typically only needs to be completed once, unless there are changes to your taxpayer identification number or business information.

In summary, the W9 form is a crucial document used to provide a taxpayer identification number and certify that an individual or business is not subject to backup withholding. Completing a printable W9 form is a straightforward process that requires providing your taxpayer identification number and certifying your status. By following the tips and guidelines outlined in this article, individuals and businesses can ensure that they complete the W9 form correctly and avoid potential penalties and fines. If you have any further questions or concerns about the W9 form, please don't hesitate to comment below or share this article with others who may find it helpful.