Intro

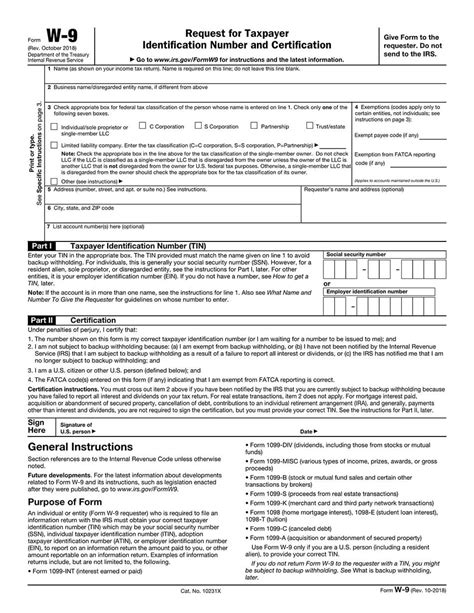

Download the printable W9 form for tax purposes, including independent contractor income and IRS requirements, with easy online access and filling instructions for a seamless tax filing experience.

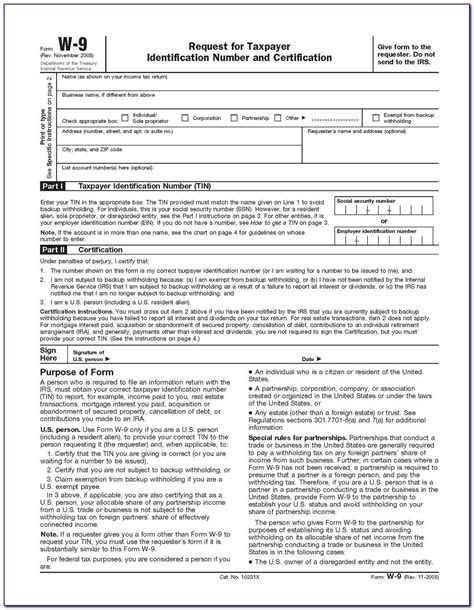

The importance of properly managing tax-related documents cannot be overstated, especially for businesses and individuals who engage in freelance work or contract employment. One crucial document in this context is the W9 form, which is used to provide a taxpayer identification number (TIN) to the Internal Revenue Service (IRS) and to certify that the individual or entity is not subject to backup withholding. The W9 form is essential for ensuring compliance with tax laws and for facilitating smooth financial transactions between parties. In this article, we will delve into the details of the W9 form, its purpose, and how to obtain a printable W9 form download.

For those who are new to the concept of tax forms and financial compliance, understanding the role of the W9 form can seem daunting. However, it is relatively straightforward. Essentially, the W9 form serves as a verification document that confirms the identity and tax status of an individual or business. This information is critical for employers, financial institutions, and other entities that need to report income and taxes to the IRS. By providing a W9 form, individuals and businesses can ensure that they are in compliance with tax laws and regulations, thereby avoiding potential penalties and fines.

The process of obtaining a W9 form is relatively simple. The IRS provides a downloadable version of the form on its official website, which can be accessed and printed out for completion. Alternatively, individuals and businesses can also obtain a W9 form from their employer or financial institution. It is essential to note that the W9 form should be completed accurately and thoroughly, as any errors or omissions can lead to delays or complications in the tax reporting process. To facilitate the completion of the W9 form, it is recommended that individuals and businesses have all necessary information and documentation readily available, including their taxpayer identification number, business name, and address.

What is a W9 Form?

Benefits of Using a W9 Form

The W9 form offers several benefits to individuals and businesses. One of the primary advantages is that it helps to ensure compliance with tax laws and regulations. By providing a W9 form, individuals and businesses can verify their tax status and avoid potential penalties and fines. Additionally, the W9 form helps to facilitate smooth financial transactions between parties, as it provides a standardized format for reporting income and taxes. The W9 form also helps to prevent errors and omissions, as it requires individuals and businesses to provide accurate and complete information.How to Complete a W9 Form

Tips for Completing a W9 Form

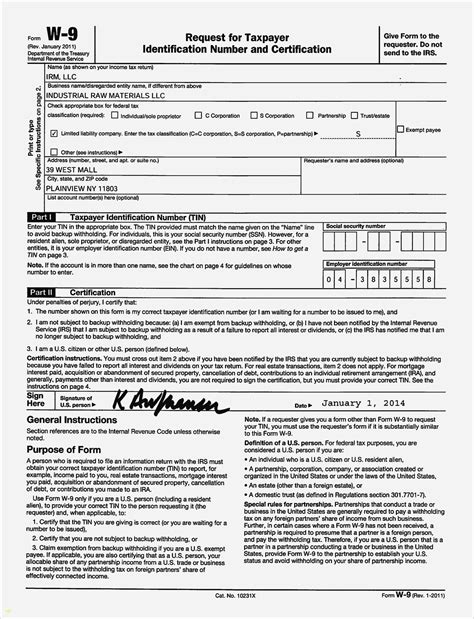

To ensure that the W9 form is completed accurately and thoroughly, individuals and businesses should follow these tips: * Read the instructions carefully and complete the form in its entirety. * Use black ink and print clearly. * Provide all required information, including name, business name, address, and taxpayer identification number. * Certify that you are not subject to backup withholding and that you are a U.S. person. * Sign and date the form. * Keep a copy of the completed form for your records.Printable W9 Form Download

For more information on tax forms and financial compliance, you can check out our article on tax compliance.

W9 Form FAQs

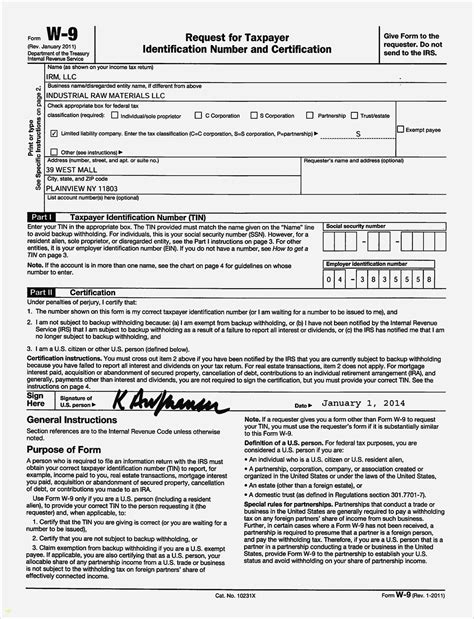

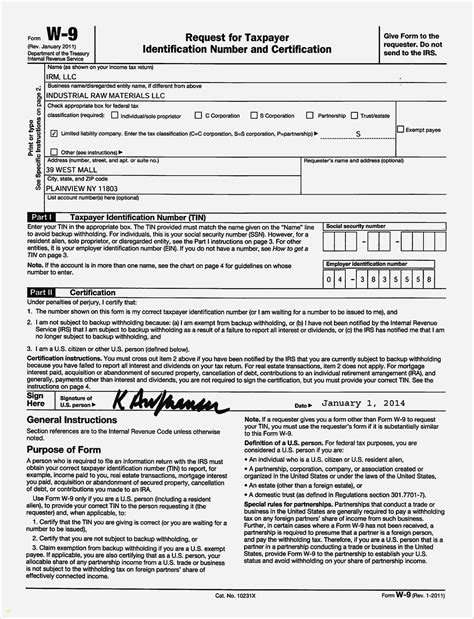

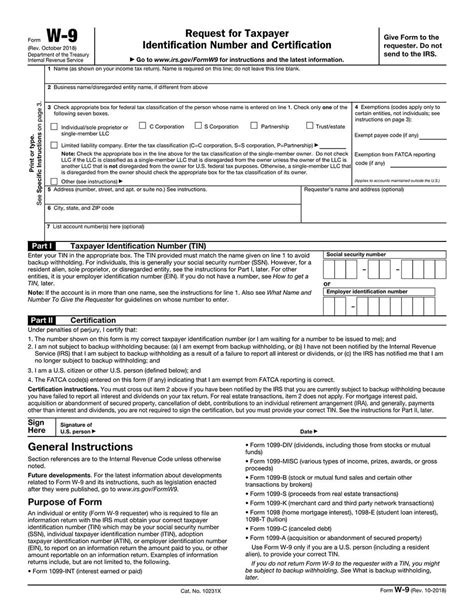

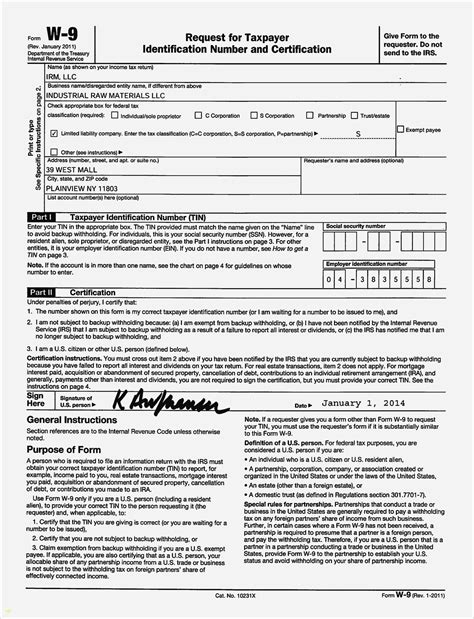

Here are some frequently asked questions about the W9 form: * What is a W9 form? A W9 form is a document used by the IRS to collect information from individuals and businesses. * Who needs to complete a W9 form? Independent contractors, freelancers, and vendors who provide services to businesses and organizations need to complete a W9 form. * How do I obtain a W9 form? You can download the W9 form from the IRS website or obtain a copy from your employer or financial institution. * What information do I need to provide on the W9 form? You need to provide your name, business name, address, and taxpayer identification number (TIN).W9 Form Gallery

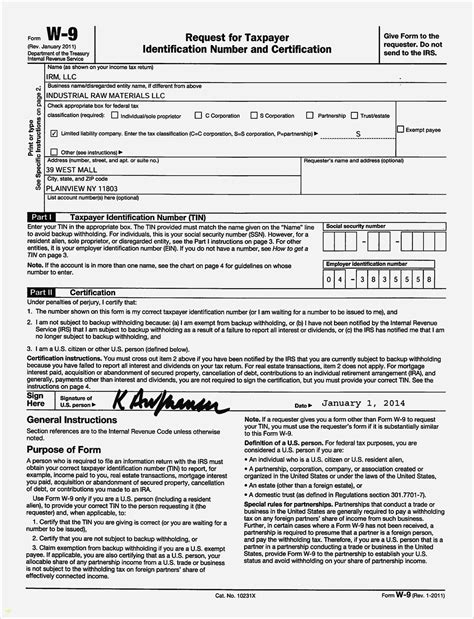

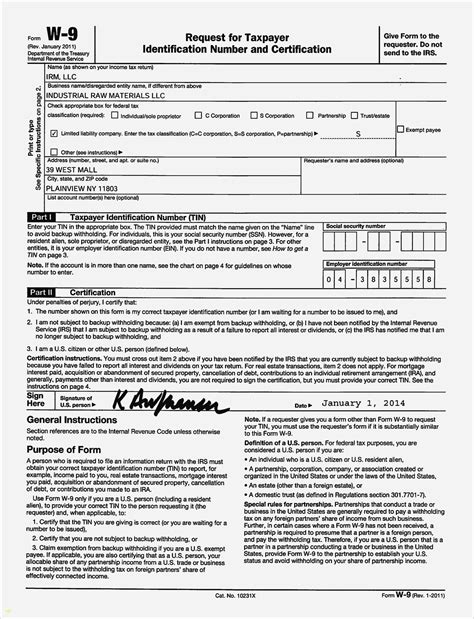

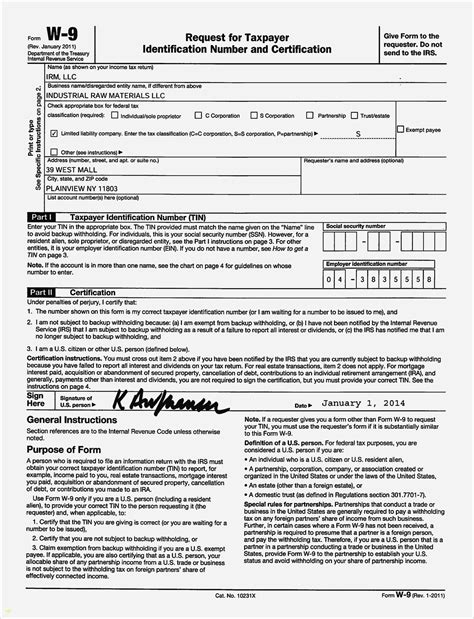

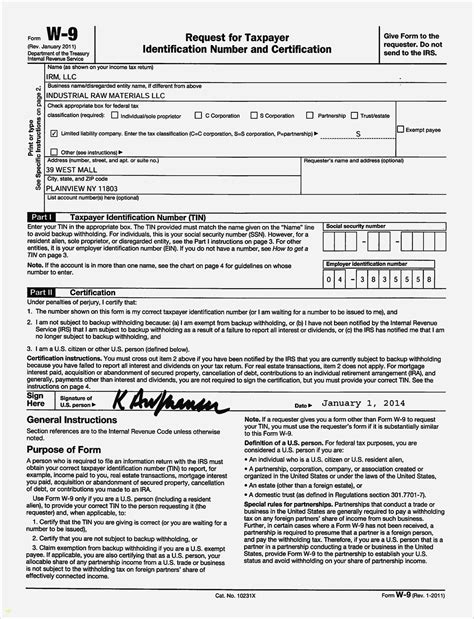

W9 Form Image Gallery

W9 Form FAQs

What is a W9 form?

+A W9 form is a document used by the IRS to collect information from individuals and businesses.

Who needs to complete a W9 form?

+Independent contractors, freelancers, and vendors who provide services to businesses and organizations need to complete a W9 form.

How do I obtain a W9 form?

+You can download the W9 form from the IRS website or obtain a copy from your employer or financial institution.

We hope this article has provided you with a comprehensive understanding of the W9 form and its importance in ensuring tax compliance. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it useful. Additionally, you can visit our website for more information on tax forms and financial compliance. By taking the time to understand and complete the W9 form accurately, individuals and businesses can avoid potential penalties and fines, and ensure a smooth and efficient tax reporting process.