Intro

Plan your future with our National Guard Retirement Pay Calculator. Discover how your years of service translate into retirement benefits. Learn about National Guard retirement pay, drill pay, and pension plans. Get accurate calculations and expert insights to maximize your post-service income. Start planning your financial future today!

The National Guard is a unique branch of the US military that allows individuals to serve their country on a part-time basis while also pursuing civilian careers. One of the benefits of serving in the National Guard is the opportunity to earn a retirement pension after 20 years of service. However, understanding how much you can expect to receive in retirement pay can be complex. That's where a National Guard retirement pay calculator comes in.

For those who have dedicated their lives to serving in the National Guard, planning for retirement is a crucial step in securing their financial future. A National Guard retirement pay calculator can help you estimate how much you can expect to receive in retirement pay based on your years of service, rank, and other factors.

In this article, we will explore the benefits of using a National Guard retirement pay calculator, how it works, and what factors can impact your retirement pay. We will also provide tips on how to make the most of your National Guard retirement benefits.

Understanding National Guard Retirement Benefits

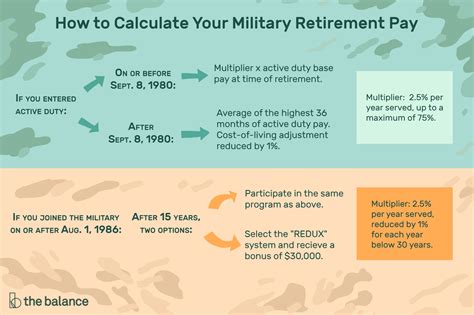

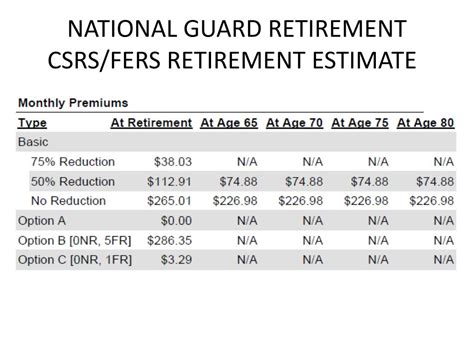

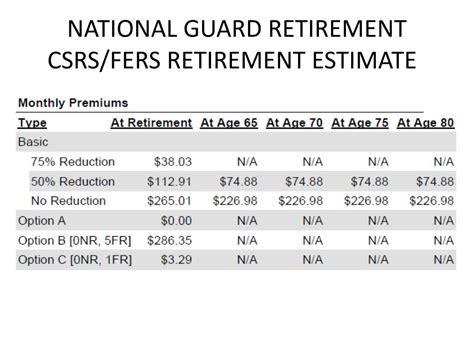

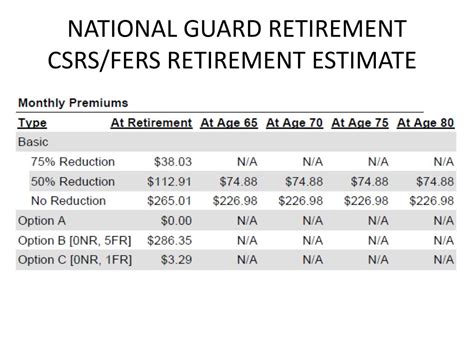

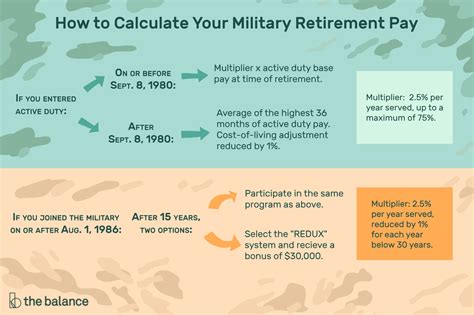

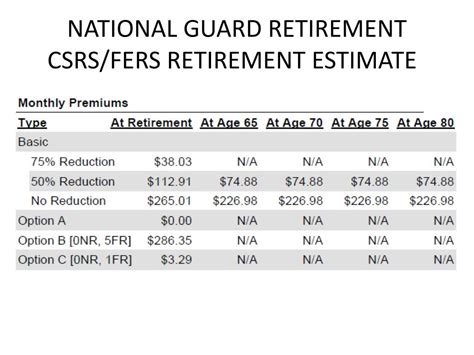

National Guard retirement benefits are based on a combination of factors, including years of service, rank, and the type of retirement plan you are enrolled in. The most common retirement plan for National Guard members is the High-3 retirement plan, which is also used by the Army, Navy, Air Force, and Marine Corps.

Under the High-3 retirement plan, your retirement pay is calculated based on your 36 months of highest basic pay. Your retirement pay is then calculated using the following formula:

Retirement Pay = (Years of Service x 2.5%) x (Highest 36 Months of Basic Pay)

For example, if you have 20 years of service and your highest 36 months of basic pay is $6,000 per month, your retirement pay would be:

Retirement Pay = (20 x 2.5%) x $6,000 = $3,000 per month

Factors That Impact National Guard Retirement Pay

There are several factors that can impact your National Guard retirement pay, including:

- Years of service: The more years you serve, the higher your retirement pay will be.

- Rank: Your rank can impact your basic pay, which in turn impacts your retirement pay.

- Type of retirement plan: There are several types of retirement plans available to National Guard members, each with its own calculation formula.

- Inflation: Your retirement pay may be adjusted for inflation over time.

- Service credit: You may be eligible for service credit for time spent on active duty, which can impact your retirement pay.

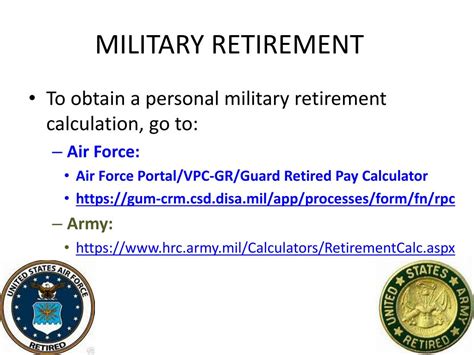

Using a National Guard Retirement Pay Calculator

A National Guard retirement pay calculator can help you estimate your retirement pay based on your individual circumstances. These calculators typically take into account your years of service, rank, and other factors to provide an estimate of your retirement pay.

To use a National Guard retirement pay calculator, you will typically need to input the following information:

- Years of service

- Rank

- Type of retirement plan

- Basic pay

- Inflation rate (optional)

Once you input this information, the calculator will provide an estimate of your retirement pay.

Tips for Using a National Guard Retirement Pay Calculator

Here are a few tips to keep in mind when using a National Guard retirement pay calculator:

- Make sure to input accurate information, including your years of service and rank.

- Consider using a calculator that takes into account inflation, as this can impact your retirement pay over time.

- Use the calculator to explore different scenarios, such as increasing your years of service or advancing in rank.

- Keep in mind that the calculator is only an estimate, and your actual retirement pay may vary.

Planning for Retirement with a National Guard Retirement Pay Calculator

A National Guard retirement pay calculator can be a valuable tool in planning for your retirement. By estimating your retirement pay, you can better plan for your financial future and make informed decisions about your retirement.

Here are a few tips for planning for retirement with a National Guard retirement pay calculator:

- Start early: The sooner you start planning for retirement, the more time you have to save and prepare.

- Consider your expenses: Make a list of your expected expenses in retirement, including housing, food, and healthcare.

- Explore different scenarios: Use the calculator to explore different scenarios, such as increasing your years of service or advancing in rank.

- Create a budget: Based on your estimated retirement pay, create a budget that outlines your income and expenses.

Conclusion

A National Guard retirement pay calculator can be a valuable tool in planning for your retirement. By estimating your retirement pay, you can better plan for your financial future and make informed decisions about your retirement. Remember to start early, consider your expenses, explore different scenarios, and create a budget based on your estimated retirement pay.

We hope this article has provided you with a better understanding of National Guard retirement benefits and how to use a National Guard retirement pay calculator. If you have any questions or would like to learn more, please don't hesitate to reach out.

National Guard Retirement Pay Calculator Image Gallery

How does the National Guard retirement pay calculator work?

+The National Guard retirement pay calculator works by estimating your retirement pay based on your years of service, rank, and other factors.

What factors can impact my National Guard retirement pay?

+Several factors can impact your National Guard retirement pay, including years of service, rank, type of retirement plan, and inflation.

How can I use a National Guard retirement pay calculator to plan for my retirement?

+You can use a National Guard retirement pay calculator to estimate your retirement pay and create a budget based on your estimated income and expenses.