Intro

Discover the 5 key roles of a financial manager, including financial planning, risk management, investment decisions, funding, and financial reporting. Learn how financial managers drive business growth, minimize risk, and maximize returns. Explore the skills and expertise required to excel in this critical leadership position and optimize your organizations financial performance.

In today's fast-paced and dynamic business environment, financial management plays a vital role in the success of any organization. A financial manager is responsible for overseeing and managing an organization's financial activities, ensuring that the company's financial goals and objectives are met. The role of a financial manager is multifaceted, and their responsibilities can vary depending on the organization, industry, and location.

The financial manager's role is crucial in ensuring that an organization's financial resources are utilized efficiently and effectively. They are responsible for making strategic financial decisions, managing financial risks, and ensuring that the organization is in compliance with financial regulations and laws. In this article, we will explore five key roles of a financial manager and how they contribute to the success of an organization.

Role 1: Financial Planning and Budgeting

One of the primary roles of a financial manager is to develop and implement financial plans and budgets. This involves analyzing the organization's financial data, identifying areas for improvement, and creating financial models to forecast future performance. Financial managers must also ensure that the organization's financial goals and objectives are aligned with its overall business strategy.

To achieve this, financial managers use various financial planning tools and techniques, such as financial modeling, forecasting, and budgeting. They must also stay up-to-date with changes in the market, industry trends, and regulatory requirements to ensure that the organization's financial plans are realistic and achievable.

Key Responsibilities:

- Develop and implement financial plans and budgets

- Analyze financial data and identify areas for improvement

- Create financial models to forecast future performance

- Ensure that financial goals and objectives are aligned with the organization's overall business strategy

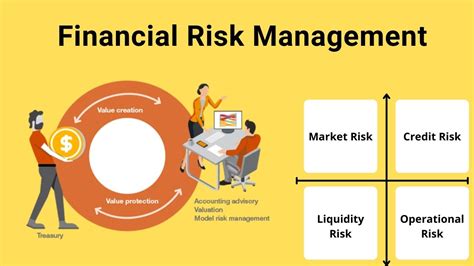

Role 2: Financial Risk Management

Another critical role of a financial manager is to identify and manage financial risks. This involves analyzing potential risks, assessing their impact, and developing strategies to mitigate them. Financial managers must also ensure that the organization has adequate risk management systems in place to minimize financial losses.

Financial risk management involves identifying and assessing various types of risks, such as market risk, credit risk, operational risk, and liquidity risk. Financial managers must also stay up-to-date with changes in the market, industry trends, and regulatory requirements to ensure that the organization's risk management systems are effective.

Key Responsibilities:

- Identify and assess potential financial risks

- Develop strategies to mitigate financial risks

- Ensure that the organization has adequate risk management systems in place

- Stay up-to-date with changes in the market, industry trends, and regulatory requirements

Role 3: Financial Reporting and Analysis

Financial managers are responsible for preparing and presenting financial reports to stakeholders, including shareholders, investors, and regulatory bodies. This involves analyzing financial data, identifying trends and patterns, and providing insights and recommendations to support business decision-making.

Financial managers must also ensure that financial reports are accurate, reliable, and comply with regulatory requirements. They must also stay up-to-date with changes in accounting standards, tax laws, and regulatory requirements to ensure that financial reports are prepared in accordance with relevant laws and regulations.

Key Responsibilities:

- Prepare and present financial reports to stakeholders

- Analyze financial data and identify trends and patterns

- Provide insights and recommendations to support business decision-making

- Ensure that financial reports are accurate, reliable, and comply with regulatory requirements

Role 4: Financial Decision-Making

Financial managers play a critical role in supporting business decision-making by providing financial insights and recommendations. This involves analyzing financial data, assessing financial risks, and identifying opportunities for cost savings and revenue growth.

Financial managers must also ensure that financial decisions are aligned with the organization's overall business strategy and goals. They must also stay up-to-date with changes in the market, industry trends, and regulatory requirements to ensure that financial decisions are informed and effective.

Key Responsibilities:

- Analyze financial data and assess financial risks

- Identify opportunities for cost savings and revenue growth

- Provide financial insights and recommendations to support business decision-making

- Ensure that financial decisions are aligned with the organization's overall business strategy and goals

Role 5: Financial Compliance and Governance

Finally, financial managers are responsible for ensuring that the organization is in compliance with financial regulations and laws. This involves staying up-to-date with changes in regulatory requirements, ensuring that financial reports are accurate and reliable, and implementing financial controls and procedures to prevent financial mismanagement.

Financial managers must also ensure that the organization has a robust system of governance in place to ensure that financial decisions are made in the best interests of the organization and its stakeholders.

Key Responsibilities:

- Ensure that the organization is in compliance with financial regulations and laws

- Stay up-to-date with changes in regulatory requirements

- Implement financial controls and procedures to prevent financial mismanagement

- Ensure that the organization has a robust system of governance in place

Financial Management Image Gallery

What is the role of a financial manager?

+The role of a financial manager is to oversee and manage an organization's financial activities, ensuring that the company's financial goals and objectives are met.

What are the key responsibilities of a financial manager?

+The key responsibilities of a financial manager include financial planning and budgeting, financial risk management, financial reporting and analysis, financial decision-making, and financial compliance and governance.

Why is financial management important?

+Financial management is important because it enables organizations to make informed financial decisions, manage financial risks, and achieve their financial goals and objectives.

We hope this article has provided valuable insights into the five key roles of a financial manager. If you have any questions or would like to learn more about financial management, please feel free to ask in the comments below. Don't forget to share this article with your friends and colleagues who may be interested in learning more about financial management.