Intro

Navy Federal members face fraud charges amid identity theft, phishing scams, and account security breaches, highlighting cyber threats and financial risks for credit union members.

The importance of financial security and trust cannot be overstated, especially when it comes to banking and credit unions. For members of Navy Federal Credit Union, one of the world's largest credit unions, the sense of security and trust is paramount. However, recent events have shaken this trust, as some members have faced fraud charges. This article aims to delve into the details of these fraud charges, the impact on Navy Federal members, and the measures being taken to prevent such incidents in the future.

Financial institutions like Navy Federal Credit Union are built on trust and reliability. Members entrust their savings, investments, and personal financial information to these institutions, expecting them to safeguard their assets and maintain confidentiality. The occurrence of fraud within such an institution not only jeopardizes the financial well-being of its members but also erodes the foundation of trust upon which these institutions are built. Understanding the nature of these fraud charges and how they affect Navy Federal members is crucial for maintaining transparency and ensuring that corrective measures are put in place.

The fraud charges faced by Navy Federal members can stem from various sources, including identity theft, phishing scams, and unauthorized transactions. In today's digital age, where financial transactions are increasingly conducted online, the risk of cybercrime and fraud has escalated. Members may unknowingly fall victim to sophisticated scams, leading to unauthorized access to their accounts and subsequent fraudulent activities. The emotional and financial distress caused by such incidents can be significant, highlighting the need for robust security measures and swift action by financial institutions to protect their members.

Understanding Fraud in Financial Institutions

To comprehend the scope of fraud within financial institutions, it's essential to recognize the types of fraud that can occur. These include credit card fraud, loan fraud, and identity theft, among others. Each type of fraud poses a unique challenge for both the institution and its members, necessitating a multifaceted approach to prevention and mitigation. By understanding the mechanisms and warning signs of fraud, members can take proactive steps to protect themselves and their financial information.

Types of Fraud

- **Credit Card Fraud:** This involves the unauthorized use of credit cards or card information to make purchases or withdraw cash. - **Loan Fraud:** This type of fraud occurs when false information is provided to obtain a loan, or when loans are taken out without the intention of repayment. - **Identity Theft:** Perhaps one of the most invasive forms of fraud, identity theft involves the use of someone's personal information without their consent, often to open new credit accounts or take out loans.Impact on Navy Federal Members

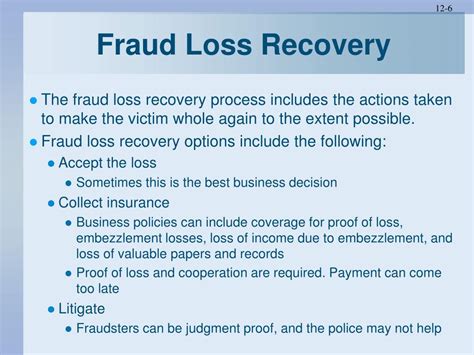

The impact of fraud on Navy Federal members can be profound, affecting not only their financial stability but also their trust in the institution. Victims of fraud may experience significant financial losses, damage to their credit scores, and emotional distress. Furthermore, the process of recovering from fraud can be lengthy and frustrating, involving extensive paperwork, communication with the credit union, and potential legal action. It is crucial for Navy Federal Credit Union to provide comprehensive support to affected members, including assistance with fraud recovery, counseling, and enhanced security measures to prevent future incidents.

Support for Affected Members

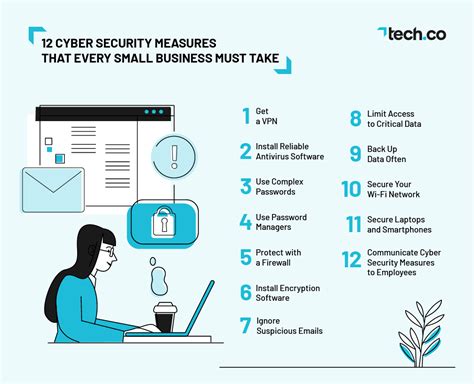

- **Fraud Recovery Assistance:** This includes help with reporting the fraud, closing compromised accounts, and opening new ones. - **Counseling Services:** Emotional support and financial counseling can be invaluable for members dealing with the aftermath of fraud. - **Enhanced Security Measures:** Implementing additional security protocols, such as two-factor authentication and regular account monitoring, can help prevent future fraud incidents.Measures to Prevent Fraud

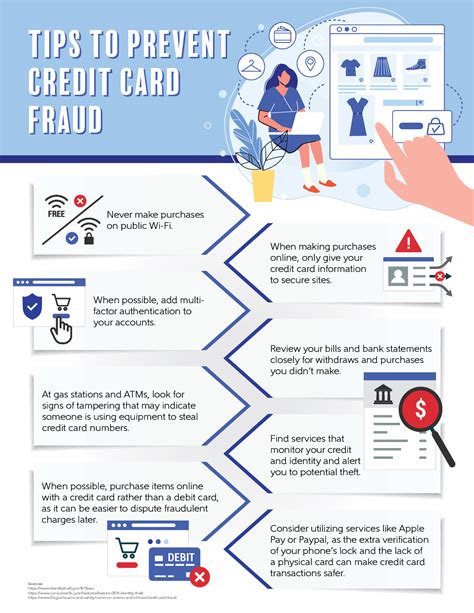

Preventing fraud requires a collaborative effort between financial institutions and their members. Institutions can enhance their security systems, implement robust verification processes, and educate members about fraud prevention. Members, on the other hand, should be vigilant about their financial activities, monitor their accounts regularly, and report any suspicious transactions promptly. Education and awareness are key components in the fight against fraud, as informed members are better equipped to protect themselves and their financial information.

Education and Awareness

- **Workshops and Seminars:** Hosting workshops and seminars on fraud prevention can empower members with the knowledge they need to stay safe. - **Online Resources:** Providing accessible online resources, such as guides and videos, can offer members a convenient way to learn about fraud prevention. - **Regular Updates:** Keeping members informed about potential scams and fraud schemes through regular updates can help them stay vigilant.Gallery of Fraud Prevention Tips

Fraud Prevention Tips Image Gallery

Frequently Asked Questions

What should I do if I suspect fraud on my account?

+If you suspect fraud, contact your financial institution immediately. They can guide you through the process of securing your account and recovering from any losses.

How can I protect myself from identity theft?

+Protecting yourself from identity theft involves being cautious with your personal information, monitoring your credit reports, and using strong, unique passwords for all accounts.

What are the signs of credit card fraud?

+Signs of credit card fraud include unauthorized transactions on your statement, unfamiliar accounts opened in your name, and unexpected changes in your credit score.

In conclusion, the issue of fraud affecting Navy Federal members is a serious concern that requires immediate attention and action. By understanding the types of fraud, their impact, and the measures to prevent them, both the institution and its members can work together to create a safer financial environment. As we move forward in this digital age, prioritizing fraud prevention and education will be essential in protecting the financial well-being of individuals and the integrity of financial institutions. We invite our readers to share their thoughts and experiences on this critical topic, and we encourage everyone to remain vigilant and proactive in the fight against fraud.