Intro

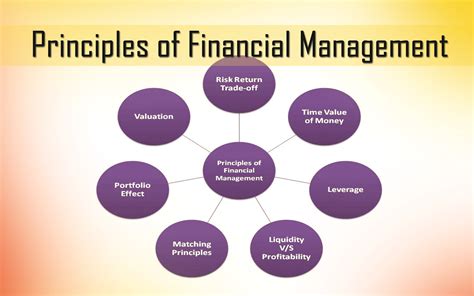

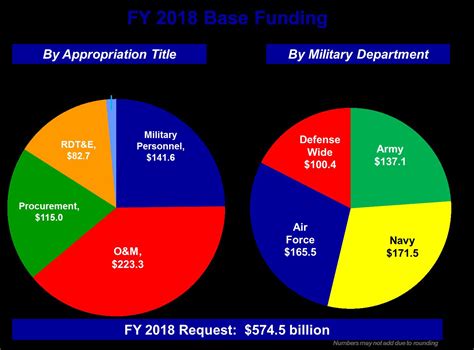

Boost military financial efficiency with these 6 expert-approved strategies for improving defense financial management. Discover how to enhance budgeting, forecasting, and financial reporting, while mitigating risks and ensuring compliance with regulatory requirements. Learn how to optimize financial operations, leveraging tools like financial analytics and performance metrics.

Effective defense financial management is crucial for ensuring that a country's military resources are utilized efficiently and effectively. With the increasing complexity of modern warfare and the rising costs of defense spending, it is essential for defense organizations to adopt best practices in financial management. In this article, we will discuss six ways to improve defense financial management.

Improving defense financial management is critical for ensuring that a country's military is equipped to respond to emerging threats and protect national interests. With the rising costs of defense spending, it is essential for defense organizations to adopt best practices in financial management to ensure that resources are utilized efficiently and effectively. Poor financial management can lead to inefficient use of resources, reduced military effectiveness, and decreased accountability.

The importance of effective defense financial management cannot be overstated. It is essential for ensuring that a country's military is equipped to respond to emerging threats and protect national interests. By adopting best practices in financial management, defense organizations can improve their ability to plan, budget, and execute defense programs, leading to more efficient and effective use of resources.

1. Implement Enterprise Resource Planning (ERP) Systems

One way to improve defense financial management is to implement Enterprise Resource Planning (ERP) systems. ERP systems provide a centralized platform for managing financial data, enabling defense organizations to streamline financial processes, improve financial reporting, and enhance decision-making. By implementing ERP systems, defense organizations can reduce manual errors, improve data accuracy, and increase transparency in financial reporting.

ERP systems can also help defense organizations to improve their budgeting and forecasting processes. By providing a centralized platform for managing financial data, ERP systems enable defense organizations to track expenditures, identify trends, and make informed decisions about resource allocation. This can help to ensure that defense programs are executed within budget and that resources are utilized efficiently.

Benefits of ERP Systems in Defense Financial Management

- Improved financial reporting and transparency

- Enhanced decision-making through real-time financial data

- Reduced manual errors and improved data accuracy

- Improved budgeting and forecasting processes

- Increased efficiency and effectiveness in financial management

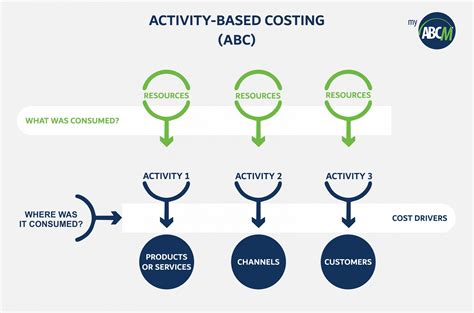

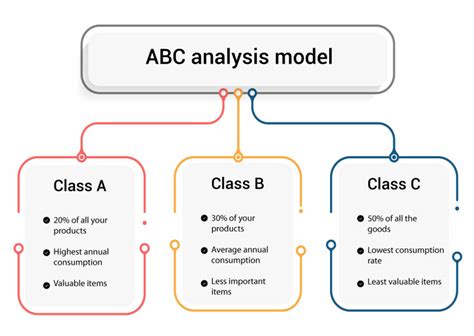

2. Adopt Activity-Based Costing (ABC) Methodology

Another way to improve defense financial management is to adopt Activity-Based Costing (ABC) methodology. ABC methodology provides a framework for assigning costs to specific activities and products, enabling defense organizations to gain a better understanding of the costs associated with different defense programs. By adopting ABC methodology, defense organizations can improve their ability to track costs, identify areas for cost reduction, and make informed decisions about resource allocation.

ABC methodology can also help defense organizations to improve their financial reporting and transparency. By providing a detailed breakdown of costs by activity and product, ABC methodology enables defense organizations to provide stakeholders with a clearer understanding of how resources are being utilized. This can help to increase transparency and accountability in defense financial management.

Benefits of ABC Methodology in Defense Financial Management

- Improved cost tracking and analysis

- Enhanced decision-making through detailed cost information

- Increased transparency and accountability in financial reporting

- Better understanding of the costs associated with different defense programs

- Improved ability to identify areas for cost reduction

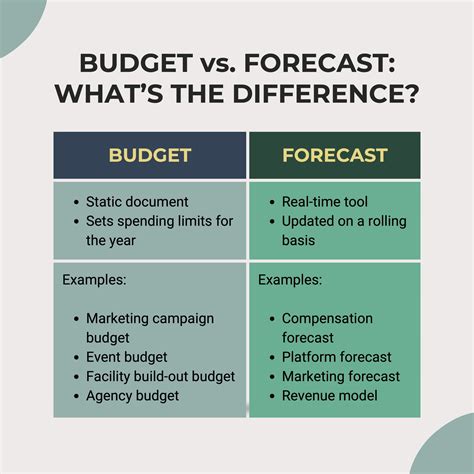

3. Implement Budgeting and Forecasting Tools

Implementing budgeting and forecasting tools is another way to improve defense financial management. Budgeting and forecasting tools provide a framework for planning and managing defense programs, enabling defense organizations to track expenditures, identify trends, and make informed decisions about resource allocation. By implementing budgeting and forecasting tools, defense organizations can improve their ability to execute defense programs within budget and ensure that resources are utilized efficiently.

Budgeting and forecasting tools can also help defense organizations to improve their financial reporting and transparency. By providing a detailed breakdown of budgeted and actual expenditures, budgeting and forecasting tools enable defense organizations to provide stakeholders with a clearer understanding of how resources are being utilized. This can help to increase transparency and accountability in defense financial management.

Benefits of Budgeting and Forecasting Tools in Defense Financial Management

- Improved budgeting and forecasting processes

- Enhanced decision-making through real-time financial data

- Increased transparency and accountability in financial reporting

- Better understanding of the costs associated with different defense programs

- Improved ability to identify areas for cost reduction

4. Conduct Regular Financial Audits

Conducting regular financial audits is another way to improve defense financial management. Financial audits provide a framework for evaluating the effectiveness and efficiency of financial management processes, enabling defense organizations to identify areas for improvement and implement corrective actions. By conducting regular financial audits, defense organizations can improve their ability to detect and prevent financial errors, improve financial reporting and transparency, and increase accountability in defense financial management.

Financial audits can also help defense organizations to improve their financial management processes. By identifying areas for improvement, financial audits enable defense organizations to implement corrective actions, improve financial controls, and reduce the risk of financial errors. This can help to increase transparency and accountability in defense financial management.

Benefits of Regular Financial Audits in Defense Financial Management

- Improved detection and prevention of financial errors

- Enhanced financial reporting and transparency

- Increased accountability in defense financial management

- Improved financial management processes

- Reduced risk of financial errors

5. Provide Training and Development Programs for Financial Managers

Providing training and development programs for financial managers is another way to improve defense financial management. Training and development programs provide financial managers with the skills and knowledge needed to manage defense programs effectively, enabling them to make informed decisions about resource allocation and improve financial management processes. By providing training and development programs, defense organizations can improve their ability to execute defense programs within budget and ensure that resources are utilized efficiently.

Training and development programs can also help financial managers to stay up-to-date with changing financial regulations and guidelines, improving their ability to manage defense programs effectively. By providing training and development programs, defense organizations can improve their financial management processes, increase transparency and accountability, and reduce the risk of financial errors.

Benefits of Training and Development Programs in Defense Financial Management

- Improved financial management processes

- Enhanced decision-making through skilled financial managers

- Increased transparency and accountability in financial reporting

- Better understanding of financial regulations and guidelines

- Improved ability to execute defense programs within budget

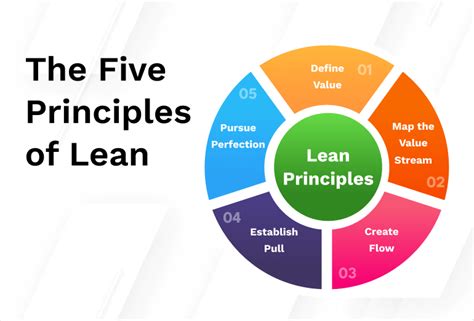

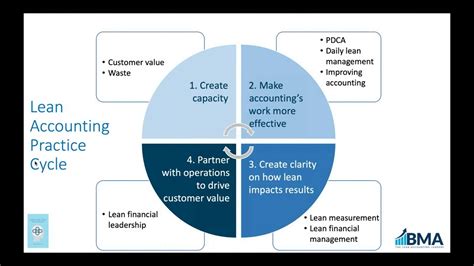

6. Adopt Lean Financial Management Principles

Adopting lean financial management principles is another way to improve defense financial management. Lean financial management principles provide a framework for eliminating waste and improving efficiency in financial management processes, enabling defense organizations to reduce costs, improve financial reporting, and increase transparency. By adopting lean financial management principles, defense organizations can improve their ability to execute defense programs within budget and ensure that resources are utilized efficiently.

Lean financial management principles can also help defense organizations to improve their financial management processes. By eliminating waste and improving efficiency, lean financial management principles enable defense organizations to reduce costs, improve financial reporting, and increase transparency. This can help to increase accountability in defense financial management.

Benefits of Lean Financial Management Principles in Defense Financial Management

- Improved efficiency in financial management processes

- Reduced costs and improved financial reporting

- Increased transparency and accountability in financial management

- Better understanding of financial regulations and guidelines

- Improved ability to execute defense programs within budget

Defense Financial Management Image Gallery

What is defense financial management?

+Defense financial management refers to the process of planning, budgeting, and executing defense programs to ensure that resources are utilized efficiently and effectively.

Why is defense financial management important?

+Defense financial management is important because it enables defense organizations to execute defense programs within budget and ensure that resources are utilized efficiently, which is critical for national security.

What are some best practices in defense financial management?

+Some best practices in defense financial management include implementing ERP systems, adopting ABC methodology, conducting regular financial audits, providing training and development programs for financial managers, and adopting lean financial management principles.

In conclusion, improving defense financial management is critical for ensuring that a country's military is equipped to respond to emerging threats and protect national interests. By adopting best practices in financial management, defense organizations can improve their ability to plan, budget, and execute defense programs, leading to more efficient and effective use of resources.